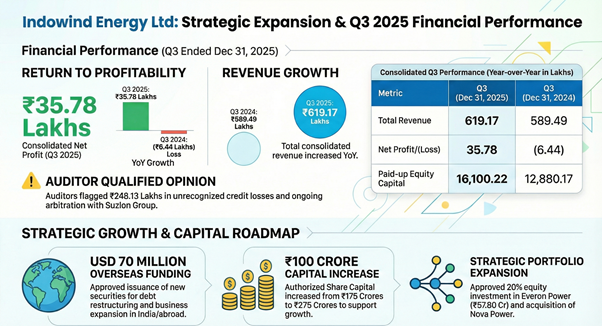

Indowind Energy Limited (NSE: INDOWIND) reported consolidated revenue of ₹619.17 lakhs for the quarter ended December 31, 2025, up 5.03% from ₹589.49 lakhs in the corresponding period a year earlier. Consolidated profit after minority interest rose to ₹42.14 lakhs for the quarter, compared with ₹2.24 lakhs in the year-ago period.

For the nine months ended December 2025, consolidated revenue increased to ₹3,548.65 lakhs from ₹2,918.04 lakhs in the prior year. Profit before tax for the December quarter stood at ₹22.90 lakhs, after factoring in an exceptional loss of ₹167.24 lakhs. Basic earnings per share for the quarter was ₹0.03. Depreciation continued to be provided in line with power generation levels.

Capital Expansion

The Board of Directors approved an increase in the authorized share capital from ₹175 crores to ₹275 crores. This change remains subject to shareholder approval through a postal ballot. Additionally, the company is seeking to increase its borrowing powers to ₹1,500 crores. The board also cleared a proposal to raise up to $70 million via overseas new securities. These funds are primarily intended for the restructuring of outstanding bonds and business expansion in India and abroad.

Strategic Investments

Indowind Energy is diversifying its portfolio through several new investments. The company will invest up to ₹57.80 crores to acquire a 20% equity stake in Everon Power Limited, making it an associate company. It also plans to invest ₹10 lakhs each into Nova Power Private Limited and a new subsidiary dedicated to service connections. These entities operate within the renewable power generation sector.

Audit Qualifications

Indowind Energy Limited continues to have an outstanding arbitration claim of ₹9,083.39 lakhs against the Suzlon Group, filed in prior years. The statutory auditors have issued a qualified opinion citing accounting treatment related to components of the claim. An advance payment of ₹1,320.44 lakhs made to Suzlon Global Services Ltd. continues to be carried as an advance. Auditors noted the absence of adequate audit evidence and stated that the amount was not expensed in earlier periods as required.

The company has also recognized ₹845.59 lakhs as compensation receivable from Suzlon Energy Ltd. without counterparty confirmation or measurement in accordance with Ind AS 109. The remaining portion of the arbitration claim has not been recognized in the financial statements.

Auditors stated that these treatments depart from Indian Accounting Standards. Had the advance been expensed and the receivable appropriately amortized, reserves and surplus would be lower by ₹2,166.03 lakhs.

Legal Proceedings

An ongoing legal case in the Honorable Bombay High Court (Case No. 05/2007) concerns a ₹102 lakhs bank guarantee issued in 2002. The company holds an Ombudsman order directing the bank to honor the guarantee with interest, but the matter remains sub judice. The realizability of this amount remains uncertain.

Operational Expansion

The company is moving toward a more verticalized operating structure through the incorporation of new subsidiaries. It has outlined plans for a $70 million fundraise, intended to support deleveraging of bond liabilities and fund business expansion. The board has also approved a proposal to modify the utilization of proceeds from the Rights Issue completed in November 2025, subject to shareholder approval.

SWOT Analysis

Strengths:

- Nine-month revenue growth of 21.6% year-over-year.

- Significant increase in consolidated net profit for the quarter compared to the previous year.

- Successful expansion of paid-up equity share capital to ₹16,100.22 lakhs.

Weaknesses:

- High finance costs amounting to ₹283.03 lakhs for the nine-month period.

- Auditor concerns regarding overstatement of trade receivables and reserves by ₹248.13 lakhs.

- Lack of confirmation for compensation receivables from Suzlon Energy Ltd.

Opportunities:

- Planned acquisition of a 20% stake in Everon Power Limited to expand the IPP footprint.

- New vertical for service connections via a dedicated subsidiary.

- Raising $70 million for international and domestic business expansion.

Threats:

- Long-standing litigation in Bombay High Court regarding bank guarantees.

- Risk of impairment of goodwill in the wholly owned subsidiary Indeco Ventures Limited.

- Uncertainty regarding the recovery of ₹9,083.39 lakhs in claims against Suzlon Group.