Indian Oil Corporation Limited (IOCL), a Maharatna company under the Government of India, operates across the entire hydrocarbon value chain, including refining, pipeline transportation, petroleum product marketing, research and development, exploration and production, natural gas marketing, and petrochemicals. It holds a leadership position in India’s oil refining and petroleum marketing sectors. Presenting below are its Q1 FY26 Earnings Results.

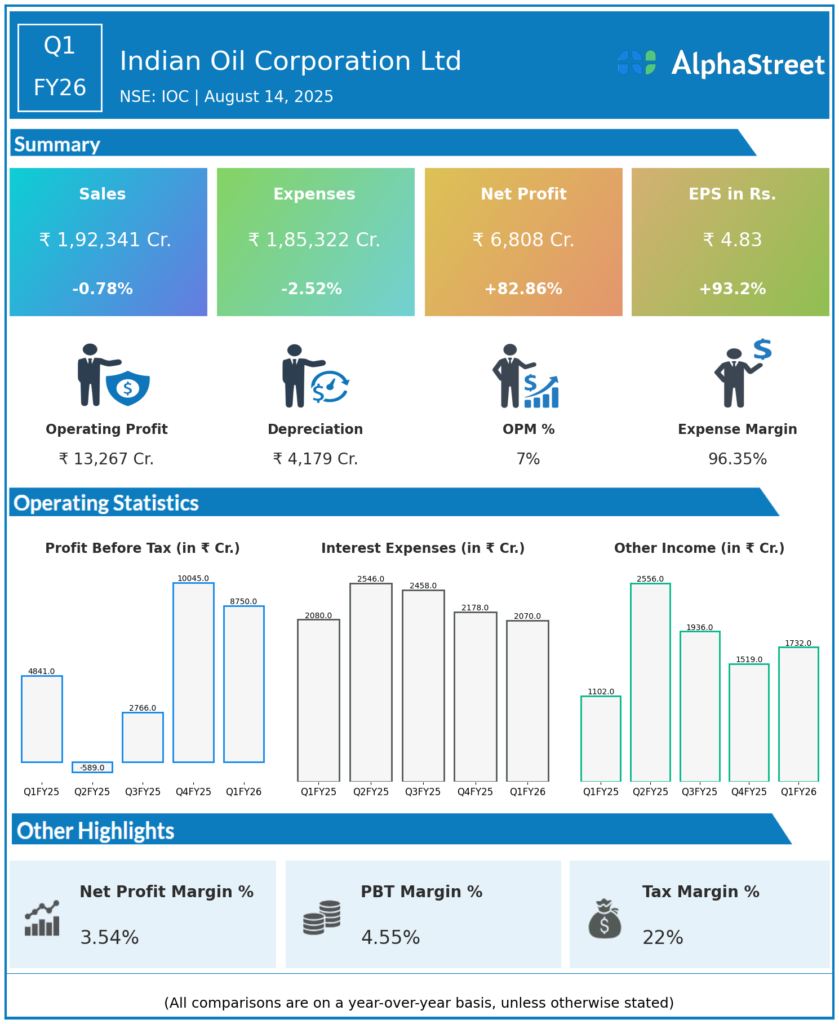

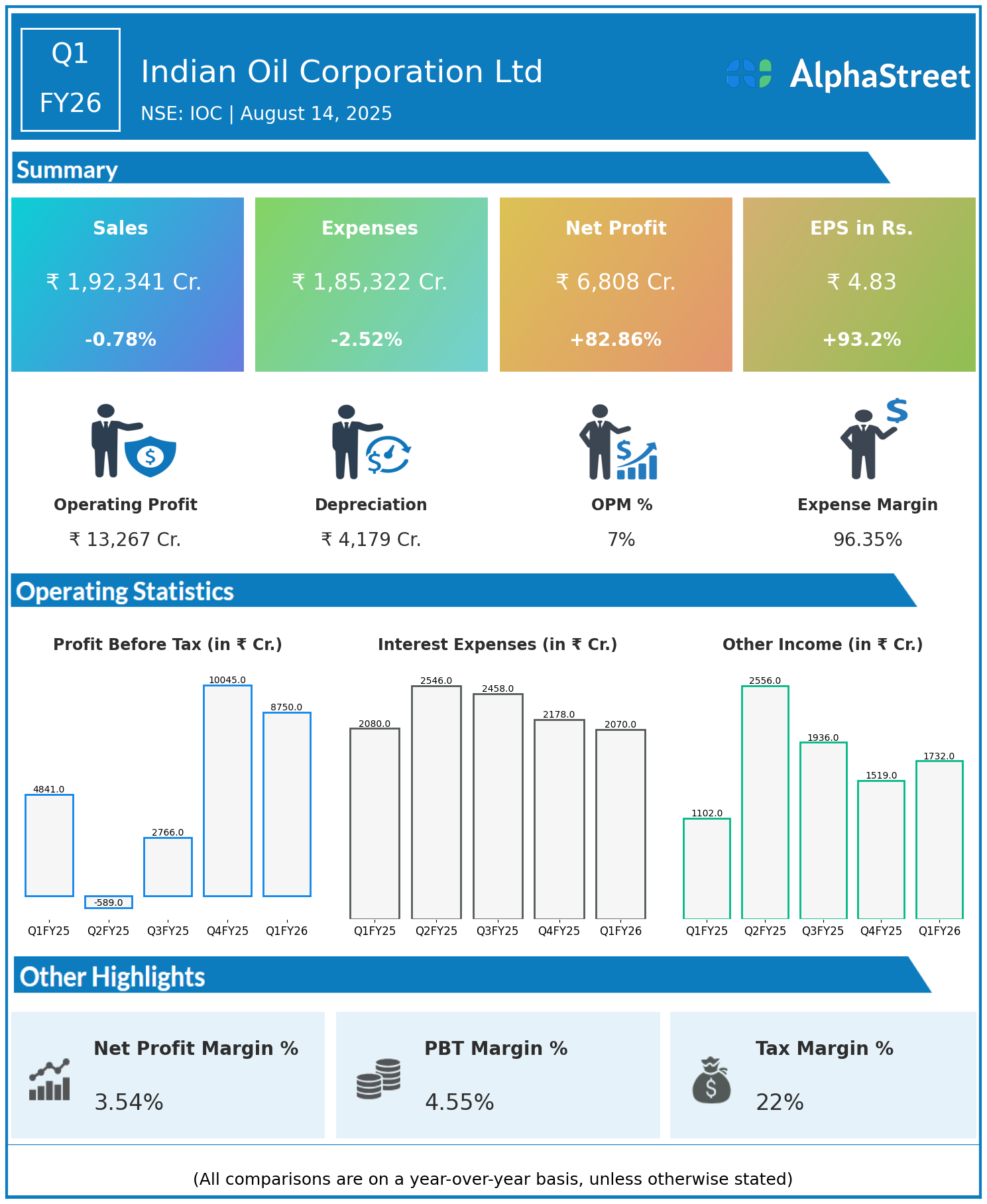

Q1 FY26 Earnings Results

- Revenue: ₹1,92,341 crore, down 0.78% year-on-year (YoY) from ₹1,93,845 crore in Q1 FY25.

- Total Expenses: ₹1,85,322 crore, down 2.52% YoY from ₹1,90,106 crore.

- Consolidated Net Profit (PAT): ₹6,808 crore, up 82.86% from ₹3,723 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹4.83, up 93.20% from ₹2.50 YoY.

Operational & Strategic Update

- Stable Revenue Trend: Revenue marginally declined by 0.78%, primarily due to softer crude oil prices and product realizations, despite steady sales volumes across refining and marketing operations.

- Cost Optimization: Total expenses decreased by 2.52%, driven by lower crude procurement costs, enhanced operational efficiencies, and improved supply chain management.

- Robust Profit Growth: Net profit surged by over 82%, supported by favorable refining margins, disciplined cost control, and stronger performance in petrochemical and natural gas marketing segments.

- Integrated Business Strength: IOCL’s diversified operations across refining, pipelines, fuel retail, and petrochemicals provide resilience and steady cash flows.

- Strategic Initiatives: The company is focusing on refinery capacity expansion, petrochemical capacity enhancement, renewable energy investments, and scaling of city gas distribution in line with energy transition goals.

Corporate Developments in Q1 FY26 Earnings

The quarter exhibited IOCL’s ability to deliver strong profitability growth amid flat revenue, driven by operational discipline, margin improvement, and business diversification.

Looking Ahead

Indian Oil Corporation Ltd plans to sustain growth by optimizing refining operations, expanding petrochemical output, enhancing pipeline and fuel retail infrastructure, and investing in clean energy and renewable projects. These initiatives are expected to foster long-term profitability and shareholder value creation through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.