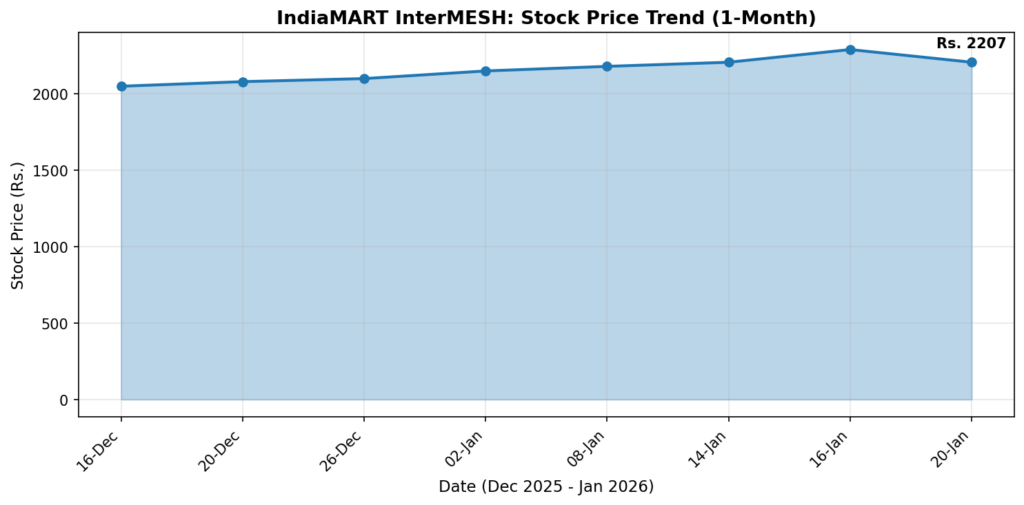

IndiaMART InterMESH Limited (NSE: INDIAMART, BSE: 542726), India’s largest online B2B marketplace, reported its Third Quarter Results for the period ending December 31, 2025. The stock moved in line with broader market trends on January 20, 2026, amid a session where the Sensex declined 1.28% and Nifty50 fell 1.38%.

Market Capitalization

As of January 20, 2026, IndiaMART InterMESH had a market capitalization of approximately ₹13,750 Crore. The company has 6.01 crore equity shares outstanding.

Latest Quarterly Results

Q3 FY26 Consolidated Financial Highlights:

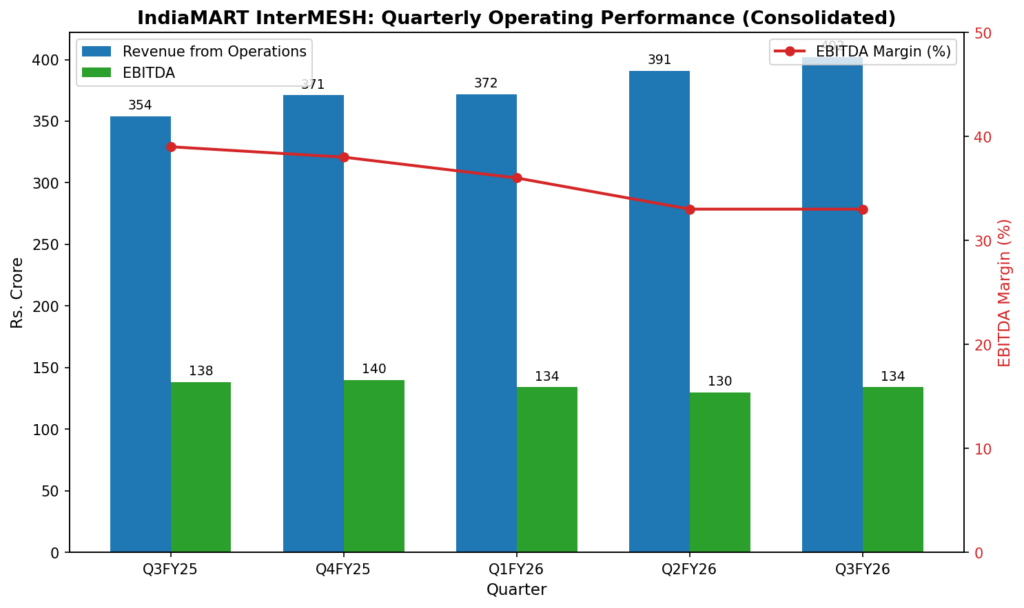

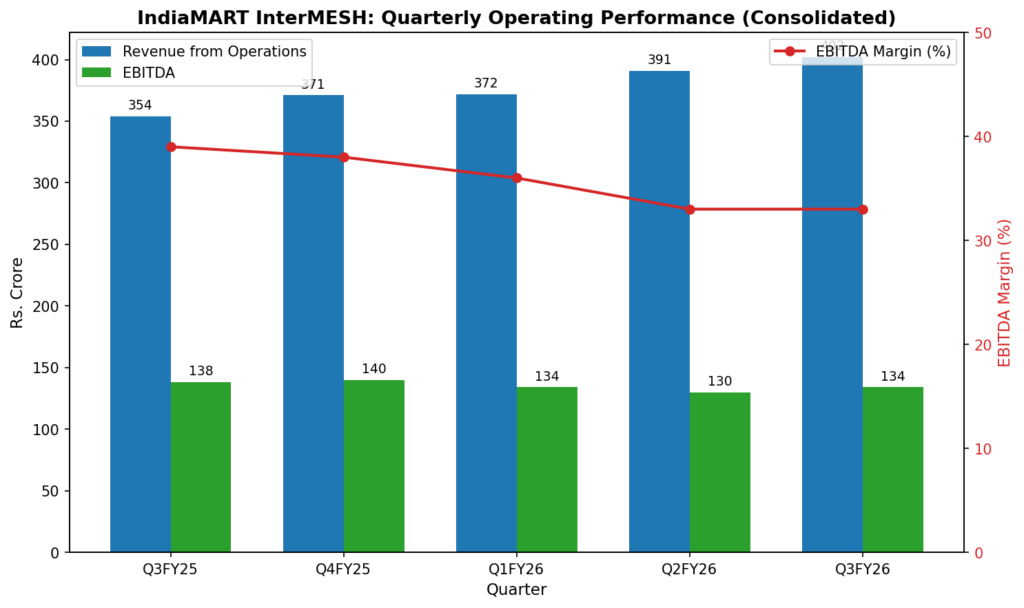

Revenue from Operations: ₹402 Crore, up 13% year-over-year from ₹354 Crore in Q3 FY25.

Net Profit: ₹188 Crore, representing a 56% increase year-over-year and a net profit margin of 35%.

EBITDA: ₹134 Crore with an EBITDA margin of 33%.

Collections from Customers: ₹426 Crore, up 17% year-over-year.

Cash Flow from Operations: ₹129 Crore, up 13% year-over-year.

Deferred Revenue: ₹1,775 Crore as of December 31, 2025, up 19% year-over-year.

Cash and Investments: ₹3,051 Crore as of quarter end.

Segment Performance

IndiaMART Standalone: Revenue of ₹368 Crore (9% YoY growth), EBITDA of ₹136 Crore (37% margin), Net Profit of ₹206 Crore (65% YoY growth).

Busy Infotech (Subsidiary): Revenue of ₹32 Crore (50% YoY growth adjusted for reclassification), with deferred revenue of ₹112 Crore (56% YoY growth).

Financial Trends

Chart 1: Quarterly Operating Performance

Chart 2: Stock Price Trend (1-Month)

Full-Year Context

For the nine months ended December 31, 2025 (9M FY26), IndiaMART has demonstrated continued revenue growth trajectory. FY25 full-year consolidated revenue was ₹1,388 Crore with net profit of ₹551 Crore. The company has maintained consistent cash flow generation with ₹623 Crore from operations in FY25.

Business and Operations Update

Operational metrics for Q3 FY26 (Standalone):

– Paying Suppliers: 221,000 (3% YoY growth)

– Supplier Storefronts: 8.7 million (6% YoY growth)

– Active Buyers (Last 12 Months): 42 million

– Unique Business Enquiries: 28 million in Q3 FY26 (4% YoY growth)

– Live Product Listings: 128 million (11% YoY growth)

– Annualized Revenue Per Paying Supplier: ₹67,000 (6% YoY growth)

The company reported a net decline of 1,000 paying suppliers during the quarter.

The company continues adoption of AI-enabled technologies across its platform for matchmaking and user experience enhancement.

Strategic Investments

IndiaMART holds strategic investments in multiple companies aligned with its business enablement strategy:

– Busy Infotech (100% subsidiary): Business accounting software

– Livekeeping Technologies (100% subsidiary): Tally integration services

– Investment of ₹9 Crore in Livekeeping Technologies concluded in January 2026

– Acquisition of 1.2% additional stake in Mobisy Technologies (Bizom) for ₹5 Crore concluded in January 2026

Total investment in accounting space stands at approximately ₹725 Crore.

Institutional Coverage

IndiaMART InterMESH is covered by institutional research. Major institutional shareholders include ICICI Prudential Mutual Fund, UTI Mutual Fund, SBI Mutual Fund, Vanguard Group, Capital Group, and Pictet Asset Management. Promoter and promoter group holds 49% of outstanding shares.

Guidance and Outlook

The company has not issued specific forward guidance. Management commentary from CEO Dinesh Agarwal indicated focus on platform strengthening, quality enhancement, and improving buyer-supplier engagement, supported by AI-enabled technology adoption.

Key metrics to monitor: Paying supplier growth trajectory, ARPU expansion, collections growth, and subsidiary performance.

Performance Summary

IndiaMART InterMESH reported Q3 FY26 consolidated revenue of ₹402 Crore (13% YoY) and net profit of ₹188 Crore (56% YoY). Collections grew 17% YoY to ₹426 Crore. Standalone operations contributed approximately 90% of revenue and 100% of EBITDA. Paying suppliers stood at 221,000 with ARPU of ₹67,000. The company maintains a cash and investments position of ₹3,051 Crore.