“As I’ve been guiding that we will, on a longer-term basis look forward to 8,000 plus customer addition per quarter, which is about 33,000 – 32,000 in a year. And this particular quarter, it was a one-off because there was Dussehra, Diwali in the same month. So, there was so many less number of working days, otherwise, I’m still confident that we’ll still do more than 8,000 in March quarter for sure.”

-Dinesh Chandra Agarwal, Chief Executive Officer

Stock Data

| Ticker | INDIAMART |

| Exchange | NSE & BSE |

| Industry | E-Commerce |

Share Price

| Last 1 Month | 0.6% |

| Last 6 Months | 11.4% |

| Last 12 Months | 15.2% |

Business Basics

IndiaMART InterMESH Limited is a leading online B2B marketplace in India that connects buyers and suppliers in various industries. The company operates on a commission-based model and earns revenue through commissions on successful transactions and advertising revenue. Indiamart has a diverse customer base that includes small and medium-sized businesses, large enterprises, and individuals across various industries. The platform offers a variety of features to its users, including a searchable database of suppliers and products, RFQ functionality, and a messaging system for communication between buyers and suppliers. Indiamart faces competition from other online B2B marketplaces and uses various marketing strategies to reach its target audience.

In addition to its core business of connecting buyers and suppliers, Indiamart also provides various value-added services such as payment protection, logistics, and financing. These services help buyers and suppliers to complete transactions smoothly and securely, thereby increasing trust and confidence in the platform.

Q3 FY23 Financial Performance

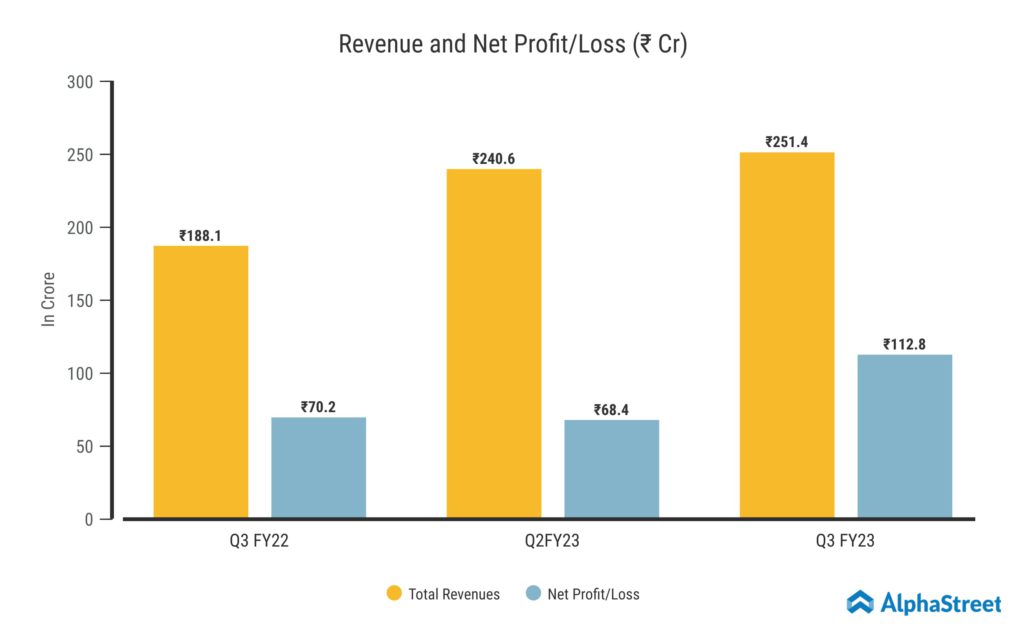

Indiamart Intermesh Limited reported Revenue from Operations for Q3 FY23 of ₹251.4 Crore up from ₹188.1 Crore year on year, a growth of 34%. The Revenue was driven by Web & Related Services segment which surged by 28% up to ₹241 Crore. For the quarter, Other income was ₹102 crores. The gain was primarily caused by a one-time realised and unrealized gain of ₹67 crores from the sale of investments in other companies, primarily ProcMart. The investee company obtained its initial funding from institutional investors.

Consolidated Net Profit of ₹112.8 Crore, up 61% from ₹70.2 Crore in the same quarter of the previous year. The number of paying subscription suppliers that Indiamart acquired in the first quarter of this fiscal year increased by 24%, which was a major contributor to the growth. The Earnings per Share is ₹36.90 for this quarter. The Cashflow generated from operations during this quarter was ₹115 crores.

Indiamart’s Busy Infotech, which is an accounting software company, posted a billing of ₹12.4 crores, with Revenue from Operations of ₹10.4 crores this quarter. The EBITDA of this company for Q3 FY23 stood at ₹1.6 crores with margins of 16%. The Net Profit of the company was approximately ₹2 crores.

Indiamart’s Traffic Growth Post Covid

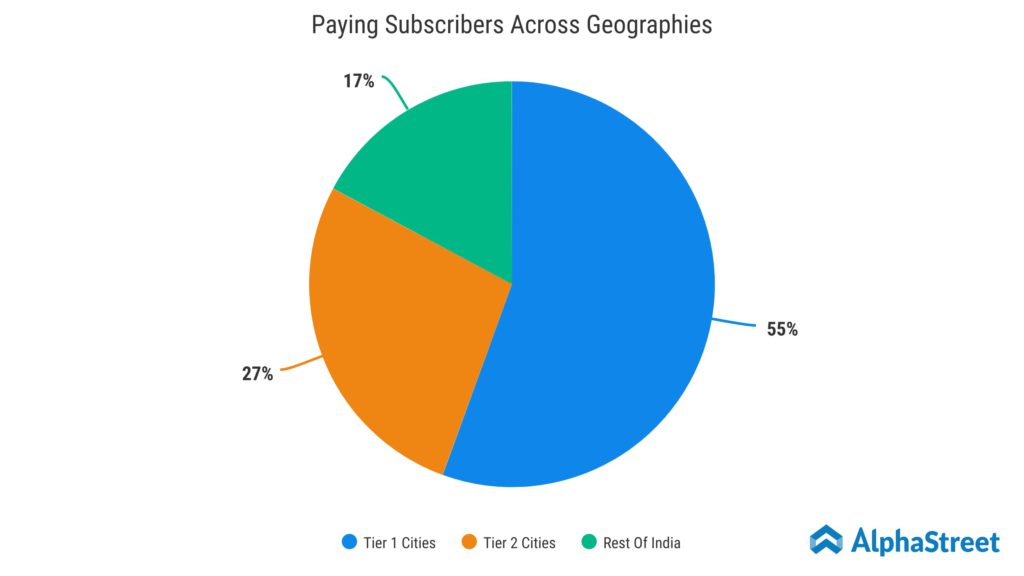

The website’s traffic has significantly increased from before COVID by 30% to 40%. That was largely brought on by shortages that occurred during that COVID period, mostly they were from the medical field. In addition, the volume of traffic, which is coming from other areas, is still kept it at a high level. The recovery across industries and demand for the digital transformation as a result of India’s accelerated internet adoption over these last two to three years are the main drivers of the paying subscriber market’s ongoing growth momentum. Tier 1 cities account for the majority of paying subscribers, followed by Tier 2 cities.

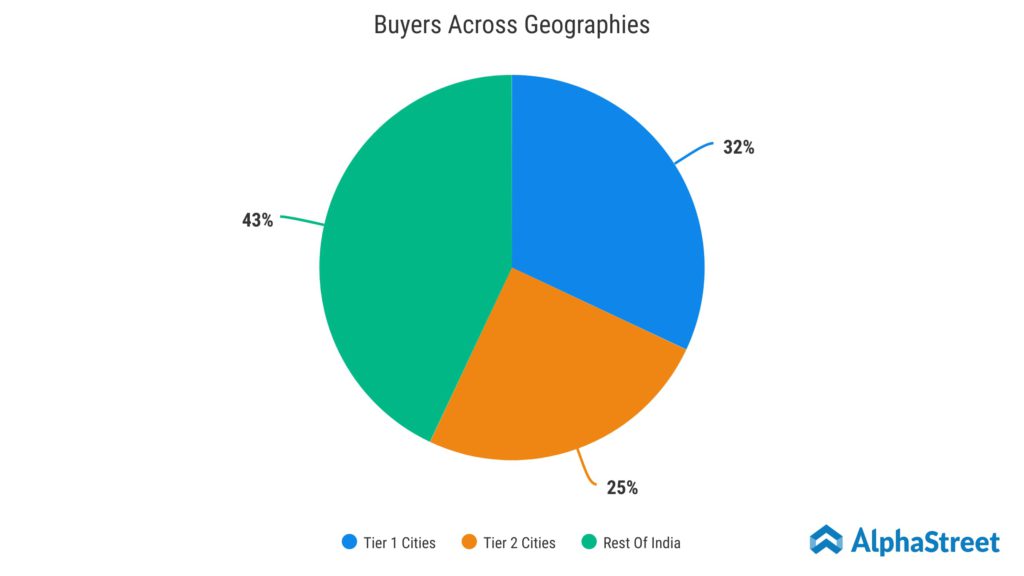

The platform’s overall traffic and the unique business enquiries it generated stayed constant at Rs. 250 million and Rs. 22 million, respectively. Indiamart typically serves the domestic B2B market, where domestic sales account for 90% to 95% of total sales. However, international traffic accounts for less than 10% of total traffic. On the buyers side, Tier 1 & Tier 2 cities account for more than 50% share. Tier 1 cities includes metro cities like Delhi NCR, Mumbai, Bengaluru, Hyderabad, Kolkata, Ahmedabad, Pune and Chennai. Meanwhile, Tier 2 cities are the one with population more than 5 lakh.

Indiamart’s Organizational Development Efforts

In this quarter, Indiamart added about 325 employees across sales, service, product, and technology and also continued its organisational strengthening efforts. With the addition of these new workers, there are now 4,413 workers overall. The business is almost finished hiring its Indian sales team. During this quarter, the company also sold 5,000 new licenses which takes the overall licenses sold to 3,23,000 till date. Moreover, Indiamart anticipates that future growth in the employee base will roughly correspond to that of the number of customers.

On the operational front, Indiamart has recently begun focusing on expanding the partner network, particularly to increase its penetration in the underpenetrated regions of India. The company’s overall business performance meets management’s expectations. Furthermore, they are optimistic to achieve the objective of doubling the growth rate of the business in this financial year.

As per the management, “Overall, we ended the quarter on an optimistic note and expect to continue to build upon the growth momentum. The growth reflects customers’ confidence in our value proposition. We will continue to invest in further strengthening the value proposition in line with our strategy.”