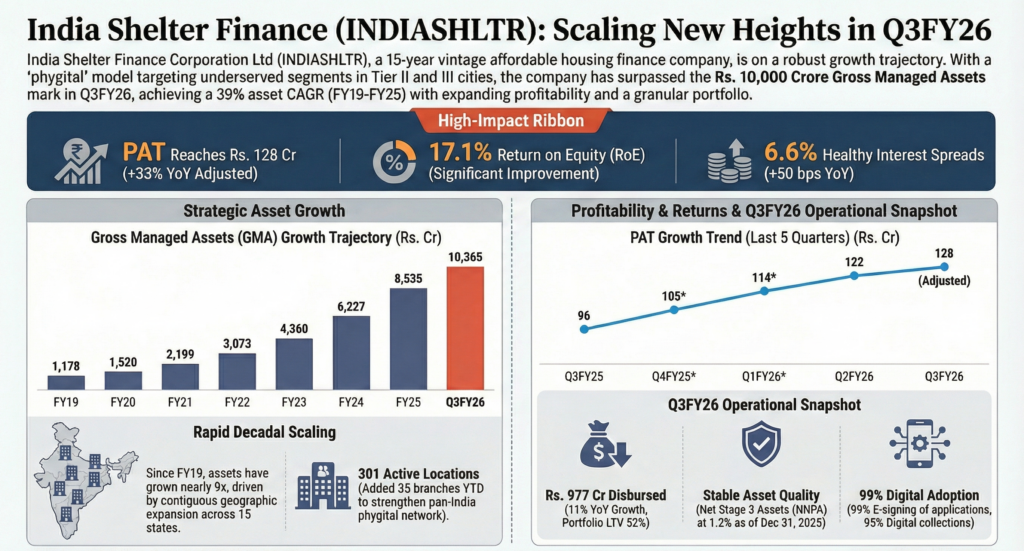

India Shelter Finance Corporation Ltd (NSE: INDIASHLTR) Gross Managed Assets reached Rs 10,365 crore, marking a 31% year-over-year increase driven by branch expansion and digital adoption. Expanding spreads to 6.6% and a robust 17.1% Return on Equity highlight the company’s strengthening position in the affordable housing segment.

Company Profile and Business Model

India Shelter Finance Corporation Ltd provides affordable home loans and loans against property, primarily targeting low- and middle-income (LIG and MIG) segments. The company has operated for 15 years, focusing on customers in Tier 2 and Tier 3 geographies who are building or buying their first homes. Its business model utilizes a “phygital” distribution network, combining 301 physical branches with a technology-driven scalable operating model.

Latest Quarterly Results and Highlights

For the quarter ended December 31, 2025, the company reported an adjusted Profit After Tax (PAT) of Rs 128 crore, representing 33% year-over-year (YoY) growth. Gross Managed Assets (GMA) grew 31% YoY to reach Rs 10,365 crore. Quarterly disbursements totaled Rs 977 crore, an 11% increase over the previous year. The company maintained an annualized adjusted Return on Equity (RoE) of 17.1% and an adjusted Return on Assets (RoA) of 5.8%.

Performance by Business Vertical and Key Segment Developments

The company’s product mix for Q3 FY26 consisted of 57% Home Loans and 43% Loans Against Property. Based on the borrower profile, 76% of customers are self-employed, while 24% are salaried. Approximately 91% of the business is concentrated in Tier 2 and Tier 3 cities, with 99% of applications including a woman applicant. The average ticket size for loans remains stable at Rs 10 lakhs.

Strategic Expansion and Operational Scale

India Shelter has established a pan-India presence across 15 states. The company added 35 new branches year-to-date, bringing its total geographic presence to 301 locations. To support this scale, the total employee base reached 4,669 as of December 2025. Operations are heavily digitized, with 95% digital collections and 99% e-signing of applications.

Robust Capital Strength and Regulatory Milestones

The company maintains a strong balance sheet with a Networth of Rs 3,048 crore. Its Capital Adequacy Ratio (CRAR) stood at 56.9% with a leverage of 2.9. Total available liquidity was Rs 1,818 crore as of December 31, 2025. Regulatory milestones include the disclosure of the Business Responsibility & Sustainability Report (BRSR) for FY25, which detailed Scope 1, 2, and 3 emissions for the first time. The company is also collaborating with the IFC for Green Housing Certification.

Asset Quality and Liability Management

Gross Stage 3 assets were reported at 1.5%, compared to 1.2% in the previous year. The Net Stage 3 ratio was 1.2%. On the liability side, the Cost of Funds (COF) improved to 8.3%, a 50bps YoY reduction. This led to an expansion in spreads to 6.6%. The company has a diversified funding profile including term loans from 32 lenders, National Housing Bank (NHB) refinancing, and direct assignments.

Management Commentary and Outlook

Management noted that annual growth remains robust and profit metrics have sustained momentum. The core growth strategy involves deepening branch penetration in adjacent markets and scaling co-lending opportunities. Guidance indicates a commitment to keeping Direct Assignments (DA) below 18% of GMA, with the current level at 16%. The company aims to continue leveraging technology to improve lead sourcing and internal data models for risk identification.