IndiaMART, India’s largest B2B digital marketplace, continues to be a key enabler in integrating small and medium businesses (SMEs) into the digital ecosystem. Focused on innovation, IndiaMART aims to simplify discoverability and engagement between buyers and suppliers, driving business efficiency across industries.

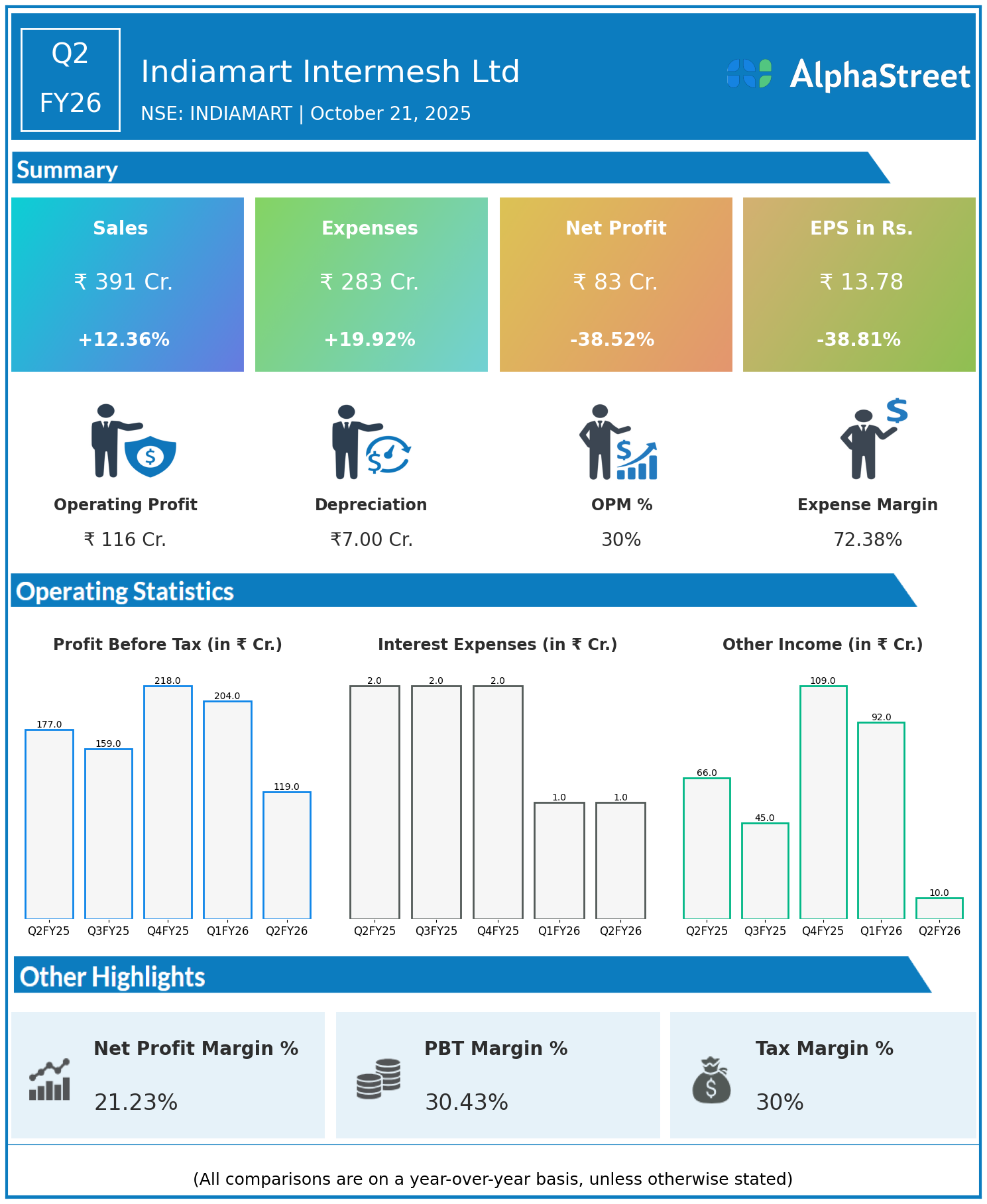

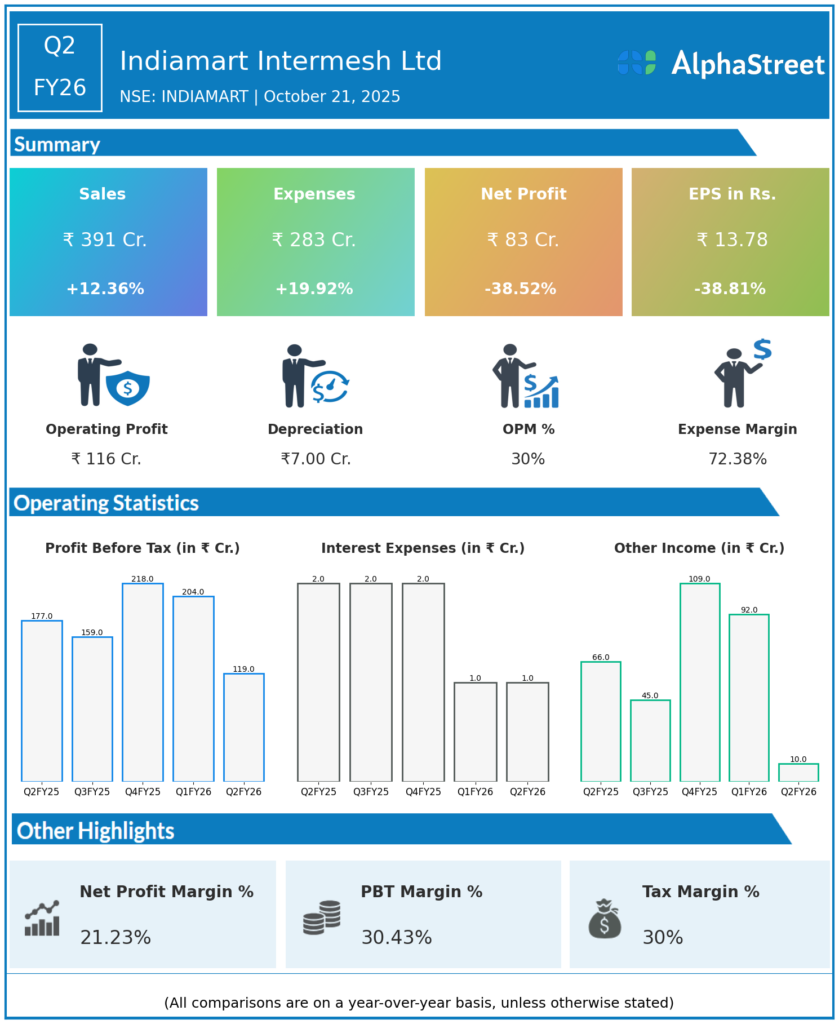

Q2 FY26 Earnings Summary

Consolidated revenue stood at ₹391 crore, up 12.36% year on year from ₹348 crore.

Total expenses increased 19.92% to ₹283 crore, compared to ₹236 crore in the same period last year.

Consolidated Net Profit declined 38.52% year on year to ₹83 crore, from ₹135 crore in Q2 FY25.

Earnings Per Share (EPS) fell 38.81% to ₹13.78 from ₹22.52 in the previous year’s quarter.

The EBITDA margin contracted to 33% from 38.7% due to higher investments in product development and technology enhancements.

Operational and Business Highlights

Customer collections grew 14% year on year to ₹406 crore, supported by a rising base of paying suppliers and higher renewals. Deferred revenue strengthened by 18% to ₹1,750 crore, indicating robust subscription momentum and business visibility.

The quarter saw unique business enquiries rise 12% to 31 million, while supplier storefronts expanded 6% year on year to 8.6 million. Paying suppliers reached 2.22 lakh, reflecting a net addition of 4,000 during the quarter.

The company’s continued focus on product innovation, platform reliability, and enhanced digital tools helped maintain engagement levels despite rising operational expenses.

Financial Position and Outlook

IndiaMART maintained a strong balance sheet with cash and investments of ₹2,874 crore and cash flow from operations of ₹114 crore. The company remains debt-free, emphasizing operational sustainability and long-term growth investments.

Management remains committed to leveraging technology and AI-driven tools to improve user engagement, increase conversions, and create value for both buyers and suppliers.

Despite short-term margin pressures, IndiaMART’s healthy subscriber base, recurring revenue streams, and expansion into SaaS and accounting software solutions position it for consistent growth and profitability in FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.