India Cements Ltd, headquartered in Chennai, is one of India’s leading cement manufacturers. Incorporated in 1946 by Shri S. N. N. Sankaralinga Iyer and Sri T. S. Narayanaswami, the company has diversified into shipping, captive power, and coal mining—offering synergies to its core cement operations. It is also known for sponsoring the IPL franchise Chennai Super Kings.

Q2 FY26 Earnings Summary

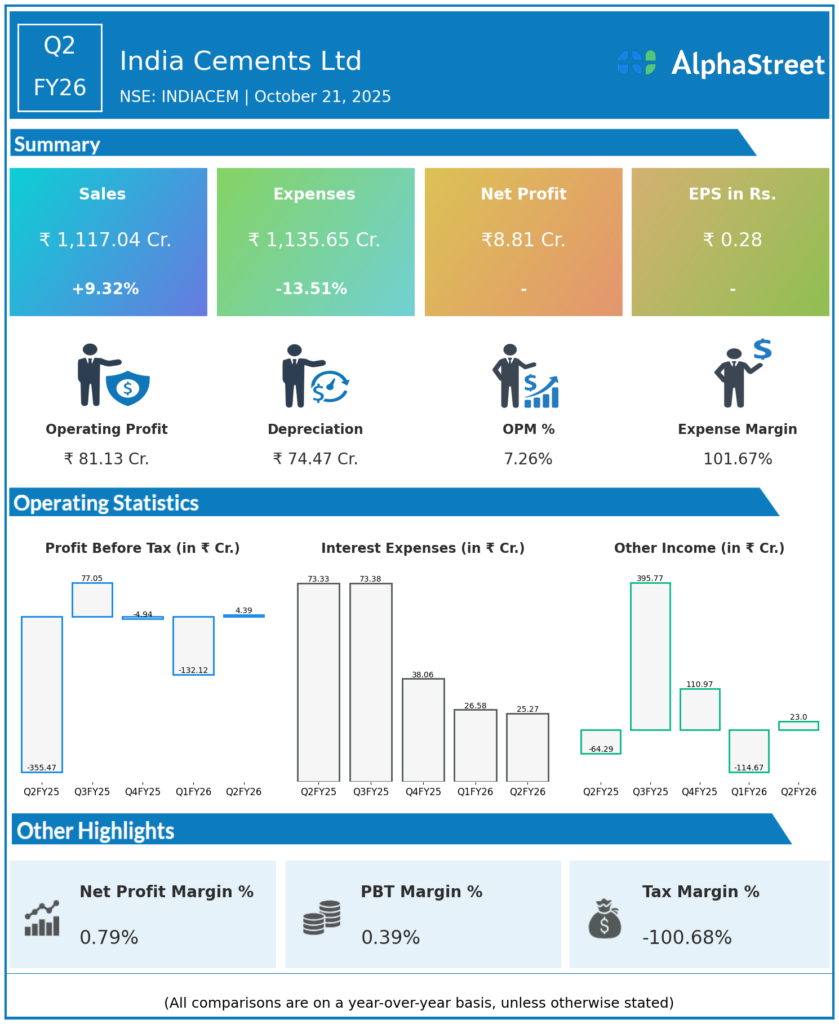

Consolidated revenue stood at ₹1,117.04 crore, up 9.32% year on year from ₹1,021.84 crore.

Total expenses declined 13.51% to ₹1,135.65 crore from ₹1,313.02 crore last year, driven by better cost management.

Consolidated Net Profit stood at ₹8.81 crore, a significant turnaround from a net loss of ₹338.72 crore in the same quarter a year ago.

Earnings Per Share (EPS) improved to ₹0.28 from a loss per share of ₹10.94 in Q2 FY25.

Operational and Business Highlights

The company achieved an 11.9% increase in domestic cement sales volume, reaching 2.44 million tonnes with 65% capacity utilization for the quarter. Cost optimization in fuel, logistics, and raw material procurement contributed to operating margin improvement to 7.26% from a loss position of -15.93% in the prior year.

Operating EBITDA rebounded sharply to ₹95 crore compared to a loss of ₹162 crore in the previous year. The company’s turnaround reflects disciplined operational improvements and a stable demand environment in southern India.

Financial Position and Outlook

India Cements’ board approved a major investment plan of ₹2,014 crore, including ₹1,574 crore for modernization and ₹440 crore for a 2.8 million tonne capacity expansion. This capex will enhance process efficiency, sustainability, and competitiveness under its new ownership structure following its acquisition by UltraTech Cement.

With improved operating performance, positive cash generation, and strategic expansion plans, India Cements is poised for long-term growth in the Indian cement industry. The company aims to sustain profitability momentum in H2 FY26, supported by stable demand, cost efficiency, and modernization initiatives.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.