Company Background – IDFC First Bank is an Indian private sector bank. It was formed due to the merger of Erstwhile IDFC Bank and Erstwhile Capital First on December 18, 2018. The bank has successfully served customers over 60,000 villages, cities and towns across the country. It has expanded to 651 branches, 235 asset service centres, 807 ATMs and 602 rural business correspondent centres across the country.It provides the following facilities to the customers by providing quality technology-enabled corporate banking solutions, contemporary cash management solutions, fleet card and FASTag solutions and wealth management solutions.

Product Portfolio– The product portfolio includes Credit Card, Home Loan, Personal Loan Savings Account, Current Account, Fixed Deposit, Recurring Deposit, Loan against property, two wheeler loan, Pratham Savings loan and education loan.

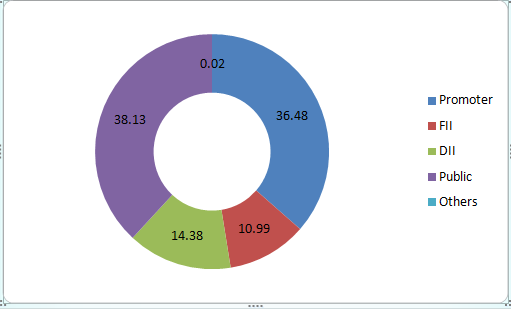

Shareholding Pattern in Percentage

Financial Snapshots– Core operating profit increased by 64% YoY and by 18% QoQ to Rs. 987 crores. Net Interest Margin improved to 5.89%. Fee and Other Income improved by 100% YoY to reach Rs. 899 crores. Core operating income improved by 39% YoY to Rs. 3,650 crore. NII grew by 26% YoY toRs. 2,751 crore. The net profit for Q1-FY23 grew to Rs. 474 crore and PAT grew by 38% QoQ. Fee and Other Income increased by 100% YoY to Rs. 899 crore. The operating expense grew 31% YoY to Rs. 2,663 crore. The TheRoA of the Bank improved to 0.97% in Q1-FY23. The RoE improved to 8.96% in Q1-FY23.

Digitization- The bank has successfully moved towards digitization. It is the First Bank to introduce FASTag recharge via WhatsApp. Till June 2022 the bank has undertaken 94% Retail Digital Transactions. It has launched UPI123 PAY for non-internet based UPI transactions & feature phone users. The bank has successfully issued 1 million credit cards since January 2021. It has also launched UFILL for fuel prepayment through UPI.

Funded Assets

| Gross Funded Assets (In Rs. Crore) | Jun-21 | Jun-22 |

| Home Loan | 9,511 | 15,352 |

| Loan Against Property | 16,217 | 18,631 |

| Wheels | 9,185 | 11,359 |

| Consumer Loans | 13,843 | 19,679 |

| Rural Finance | 10,909 | 14,127 |

| Digital, Gold Loan and Others | 4,116 | 9,166 |

| Credit Card | 819 | 2,315 |

| Commercial Finance | 9,435 | 10,679 |

| Wholesale Funded Asset | 39,759 | 36,354 |

The Funded assets increased by 21% to Rs. 1,37,663 crores. The Retail funded asset reached 90,630 crore driven by 61% growth in Housing loans book. The Commercial Loans reached Rs. 10,679 crore as on June 30, 2022. Corporate (non-Infrastructure) funded book increased by 12% YoY to Rs. 23,970 crore. Infrastructure book declined by 35% YoY to Rs. 6,739 crore.

Industry Analysis-In the current scenario the demands for banks have increased due to the increase in working populations and growing disposable income. The banks are inclined more towards digital innovation. Banks with lower NPA and High net interest margins are preferable in the Industry. The Indian banking system consists of 12 public sector banks, 22 private sector banks, 44 foreign banks, 43 regional rural banks, 1,484 urban cooperative banks and 96,000 rural cooperative banks. The Indian banking has moved to digital banking. The digital payments revolution has triggered a massive change in the entire lending/borrowing procedure.IDFC First enjoys a leading position in the retail asset segments. Presently the combined customer base is now 7.3 million and growing significantly in the Indian market. The mission of this bank is to touch the lives of millions of Indians in a positive way by providing affordable, high-quality banking products and services to them.The banking system in India has been affected by the pandemic. The government of India introduced the moratorium system during COVID-19. The RBI also decreased the repo rate and reverse repo rate. This hampered the overall revenue of the bank. Moreover Borrowers and businesses face job losses, slowed sales, and declining profits. Both the economic system and financial systems are hampered. The impact affected the GDP growth. After COVID-19 banks have moved toward digitization. The customers prefer online banking over in-person banking. The bank processes are now conducted with much more ease.The Banking system flaunts some user friendly apps for its customers. Digitization has brought cost effectiveness to the industry. It has enabled easy and super-quick cashless transactions. It provides a secure way of Cybersecurity, which is also important in banking.

Peer comparison

| Company Name | MCap(Cr) | TTM PE | P/B | ROE(%) |

| IDFC First Bank | 27,862.40 | 22.51 | 1.44 | 0.62 |

| HDFC Bank | 8,14,953.05 | 20.48 | 3.28 | 15.38 |

| ICICI | 5,90,636.00 | 20.14 | 3.82 | 13.79 |

| Kotak Mahindra | 3,63,044.78 | 27.85 | 3.76 | 12.5 |

As per peer comparison HDFC bank is in a better position based on the market cap and ROE. From an investor perspective the HDFC is providing a highest return on equity. IDFC has a good P/B ratio but ROE is very less so investors won’t be so much interested.

Inherent Strengths– This is a new segment in the banking sector.IDFC has a wide geographic presence.Large number of ATMs opened for smooth operations. The brand catering to different customer segments.The bank has high marginal profit compared to other banks.

Inherent Risks– Competitive pressure from other banks.Stagnation in the rural markets.An Increase of nonperforming assets increasing the risk of the bank.

Business Initiatives– The bank has successfully created awareness about financial products and services in 11 regional languages with an aim to provide good financial practices. It has introduced MSME loans with no collateral requirement and a doorstep collection policy.