ICICI Prudential Life Insurance Company Limited is an Indian Life Insurance Company. It is located in Mumbai, India. It was founded in 2000. The company was incorporated in joint ventures with ICICI Bank. The company offers a wide range of protection and savings products to individuals and group customers.

Product Portfolio- It offers insurance plans for term life, health, retirement, group life and rural. It also offers traditional savings/ money back plans, child education insurance plans, critical illness insurance plans, and unit linked insurance plan. ICICI Prudential distributes products and services through proprietary sales force, individual and corporate agents, brokers, banks and online channels in India.

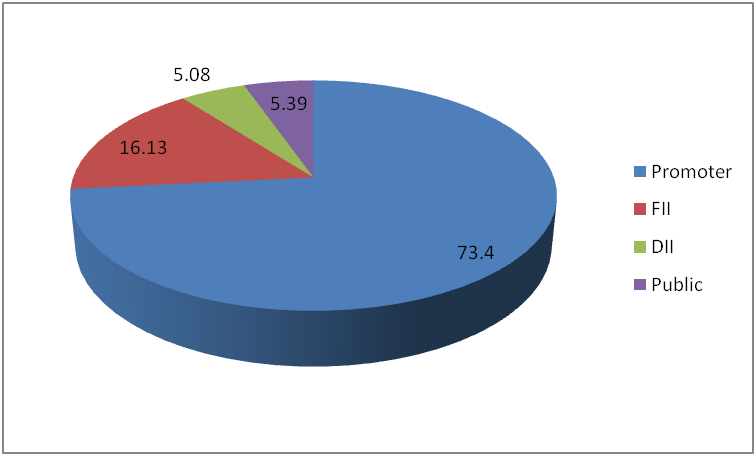

Shareholding Pattern

Financial Snapshot-

| (Rs in billion) | Q1 FY 23 | Q1 FY 22 |

| Premium earned | 72.65 | 68.7 |

| Net premium earned | 68.84 | 66.02 |

| Total income | -15.78 | 162.36 |

| Profit/(Loss) before tax | 1.56 | -2.16 |

| Profit/(Loss) after tax | 1.56 | -1.86 |

Net premium increased by 4.3% to Rs 68.84 billion in Q1-FY2023. Income under other than unit-linked decreased to Rs 13.92 billion. Other income increased to Rs 0.34 billion Q1-FY2023. Total expenses (including commission) increased by 16.1% to Rs 14.11 billion. Commission expense (including rewards) increased by 12.9% to Rs 3.06 billion. Profit after tax for the quarter stood at Rs 1.56 billion. Operating expense increased by 17.4% to Rs 10.85 billion. Claims and benefit payouts (net of reinsurance) decreased by 2.8% to Rs 55.12 billion. Annualized Premium Equivalent (APE) grew by 25% in Q1-FY2023 to Rs 15.20 billion.

Business Strategies- ICICI Prudential has 800 partnerships including 30 banks and 200,000 advisors. It has recruited 6,821 agents during Q1-FY2023. The company has targeted on diversified product mix. It has moved towards digitization. It has tied up with wallets, payment banks, fin-tech companies.

Digitization-ICICI prudential has moved towards digitization. It covers 3.1 million digital service interactions every month. This software supported 1.1 million+ app downloads. This is the highest rated app in the life insurance industry. The customers can access 45 types of policy transactions. It has successfully created 96% digital logins. The software has fitness tracker to monitor health statistics.

Business Outlook- The company expects changes to the regulatory framework in the coming months. It further anticipates that solvency to substantially improve under a risk-based capital regime. The regulators expect that by leveraging data and technology it will improve the awareness, serve the underserved, secure data security among other things.

Major Drivers- The major drivers which have helped the business succeed include deeper penetration in customer segment. It has prioritized on a new distribution channel that is focused on online channels. Increased focus on Pension and Annuity.

Industry Analysis– The Indian Insurance Sector is basically divided into two categories – Life Insurance and Non-life Insurance. In India both Life Insurance and Non-life Insurance governed by the IRDAI (Insurance Regulatory and Development Authority of India).

India Insurance market stands at $131 billion as of FY22. In this last two decades, the Indian insurance industry grew at a CAGR of 17%. In the Global Insurance market, India ranked the 11th position. The life insurance industry is expected to increase at a CAGR of 5.3% between 2019 and 2023. It is expected that Premiums from India’s life insurance industry is expected to reach Rs. 24 lakh crore (US$ 317.98 billion) by FY31.

For Insurance Sector the most dominant player was LIC, but with the change of time people inclined towards other insurance. Today insurance comes at a pocket friendly price which can be availed by each and every customer. Moreover the demographic factors also contributed in the growth of the insurance sectors like awareness among people, retirement planning.

The collaboration with foreign markets has made the Insurance Sector in India grow tremendously with a high current market share. For further growth insurance sector has introduced emerging trends like product innovation, multi-distribution, better claims management and regulatory trends in the Indian market.

Strength, Weakness, Opportunity & Threat

Strength- ICICI Prudential Life Insurance products have strong brand recognition in the Insurance industry. It has a wide geographic presence. The company enjoys a high profit margin. The company has a good network and diverse products and services.

Weakness- The company failed to create brand image like LIC. Products like ULIPs of ICICI Prudential is also a major threat.

Opportunities- It should expand its global reach. Grabbing the market by diversifying portfolios for customers. It is expanding in new emerging markets. The company should expand more on acquisitions and Joint Ventures. ICICI prudential should tie up with new banks for selling and marketing its Life Insurance Policies.

Threats- It has strong competition in the market. The reputation has been affected due to insurance fraud. Violation of IRDA rules can create serious problems for this company. Other companies providing competitive price for premium.

ESG Initiative- It is the only Indian insurance company that has been featured in the list as the ‘Most Sustainable Companies’ by BW Businessworld and and Sustain Labs Paris. FTSE Russell has improved the ESG rating score from 3.3 to 3.7.

The company has also focused on human capital. It has introduced Mental wellness campaigns which will remove stigma, encourage practice of restorative breaks for employees. Introduced physical wellness campaign Anti tobacco, heart care, critical illness and health-focused policies. To increase the productivity the company has introduced differentiated rewards based on performance and potential. It has introduced diverse workforce for employees. Introduced 3i framework to align employees to strategy, to enhance connect & belongingness to the Company. Introduced grievance redressal framework in the company and introduced employee survey.