ICICI Lombard General Insurance Company Limited is an Indian General Insurance Company. It was founded in the year 2000. The company has its headquarters in Mumbai, Maharashtra, India. It has a diversified product range which includes motor, health, crop, fire, personal accident, marine, engineering, and liability insurance. The company has issued over 29.3 million policies, settled 2.3 million claims and has a Gross Written Premium (GWP) of ₹185.62 billion. It has 283 branches and 11,085 employees as on March 31, 2022.

Digitization- The company solely moved towards digitization. The technology on which ICICI Lombard General Insurance Company Limited works is based on Cloud. Several technologies have been implemented which include first Face Scan and Cal Scan on its signature insurance and wellness App. The company is focusing more on digital innovation. 61.6% of group cashless claims were approved through AI in June 2022. 85.2% STP of motor break approved from Self Inspection app in June 2022. It is Leveraging on Artificial Intelligence, Machine Learning, IoT etc. throughout the customer life cycle. Introduced Dedicated “digital arm” to improve speed of delivery for D2C business.

Product Portfolio- The product portfolio comprises of Travel Insurance, Motor Insurance, Health Insurance & Other products. The other products include Fire Insurance, Business Insurance, Crop Insurance, NRI Insurance, Cyber Insurance and ICICI Bharat Griha Raksha policy.

Health Insurance- ICICI Lombard provides medical insurance policy which covers health insurance, medical expenses for illnesses and injuries. The policy covers all OPD requirements that include teleconsultation with the doctor, pharmacy, and routine diagnostics on a cashless basis. It covers pre and post hospitalisation costs. It assists the patient with cashless treatment. Deduction in tax on health insurance under section 80D can also be claimed. They provide 6500+ healthcare providers for a hassle free service. 24*7 customer support with a quick settlement procedure.

Motor Insurance- ICICI provides motor insurance to cars, two wheelers and other road vehicles. This policy protects the insured vehicle against the damages. Along with it the policy provides coverage for third-party liabilities. ICICI Lombard provides Comprehensive motor insurance, standalone Own Damage (OD) cover policies and Third-party motor insurance. It provides network for 10800+ garages. The process claims settlement can also be accessed through the app. They provide cashless policies and 24*7 customer support for its policyholders.

Travel Insurance- This policy is designed mainly for the travellers. They can get coverage for medical and non-medical emergencies, for a trip. This policy has been designed for frequent flyers. ICICI Lombard’s international travel policy does not include countries like China, Antarctica, Belarus, Cuba, Democratic Republic of the Congo, Iran, Iraq, Ivory Coast, Liberia, Myanmar, North Korea, Sudan, Syria and Zimbabwe.

Fire Insurance- The Fire Insurance covers the property against the damage and losses caused by fire. It is mostly availed by an organisation/firm/institution/individual who wishes to save their business from an unforeseen event in case of fire.

Marine Insurance-ICICI Lombard provides Marine Insurance to protect the goods against the losses or damages of cargo during transportation between the points of origin to the final destination. The insured can choose any policy based on specific business requirements.

Crop Insurance- Crop Insurance has been introduced to cover the post-harvest losses and aims at adoption of technology for the purpose of yield estimation.

Other Insurance- The other Insurance includes NRI Insurance and Business Insurance, Cyber Insurance. The NRI insurance helps to Insure Family & Assets in India while the policyholder is Overseas. Business insurance protects business owners from unexpected losses. Since we are moving more digitally the demand for Cyber insurance has increased. It provides cyber security coverage against theft, unauthorized transactions, and more.

Comprehensive Product Portfolio

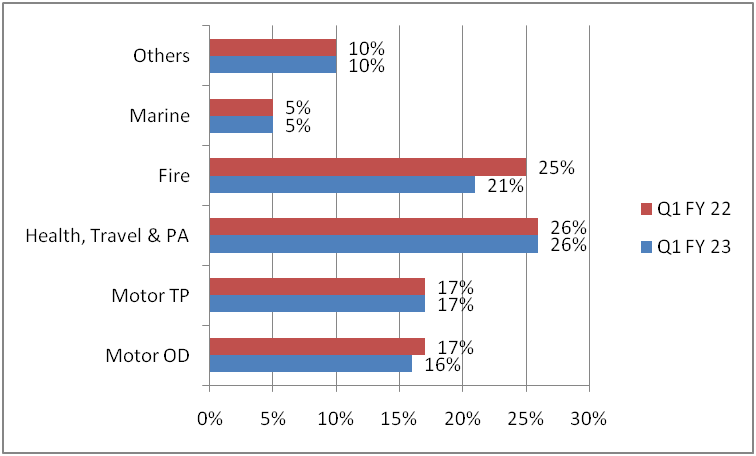

ICICI Lombard has a Market leadership in the Motor segment with a market share of 11.3%. There has been a revision in the base premium for Motor TP effective June 1st 2022. TheAdvance premium collected is ₹ 34.71 billion. In retail, health business headcount stood at 1,101. The premium grew by 18.3% for Q12023.In Property & Casualty, the Fire Insurance has achieved a market share of 13.4%. The marine cargo achieved a market share of 19.7%. The crop insurance constitutes 2.6% of the product mix for Q12023.

Financial Snapshots

Gross Direct Premium Income (GDPI) of the Company increased by 28.2% to ₹ 53.70 billion. Profit before tax (PBT) increased by 80.1% to ₹ 4.65 billion. Profit after tax (PAT) improved by 79.6% to ₹ 3.49 billion. Profit after tax (PAT) grew by 79.6% to ₹ 3.49 billion. GDPI of the Motor segment was at ₹ 17.82 billion in Q1 FY2023.

Growth of Insurance Sector in India

For Insurance Sector the most dominant player was LIC, but with the change of time people inclined towards general insurance. Today general insurance comes at a pocket friendly price which can be availed by each and every customer. Moreover the demographic factors also contributed in the growth of the insurance sectors like awareness among people, retirement planning.

The collaboration with foreign markets has made the Insurance Sector in India grow tremendously with a high current market share. For further growth insurance sector has introduced emerging trends like product innovation, multi-distribution, better claims management and regulatory trends in the Indian market.

Impact of COVID-19 in insurance market

COVID-19 has directly impacted the Insurance sector. While people were losing their jobs, cutting business the insurance sector was emphasizing to introduce more and more to stimulate and recover activity in these industries. COVID-19 specific health insurance plans have been introduced in the regular health insurance plans for the policyholders. Thehealth insurance and travel insurance sector was totally digitized. Customers can purchase and renew using the official website of the insurer. Many health insurance providers made change in their health policy. Another new policy has been introduced travel insurance for COVID-19.

Strength, Weakness, Opportunity & Threat

Strength- ICICI Lombard is leading the private sector, non life insurer market since 2004. The company has a diverse product portfolio. It has 94,559 Individual Agents. ICICI Lombard has successfully moved towards digitization.

Weakness-The company has less visibility in the rural area. The company has more visibility in Indian market. No international exposure is visible.

Opportunities- The company should concentrate more on product diversification and try to expand itself in the global markets. It has high market shares compared to other players.

Threats- Competition from other players. Different rules imposed by IRDA creating hindrance to Insurance Business.

ESG Initiatives- ICICI Lombard has taken ESG initiatives to reduce the carbon emissions. The company is inclined towards reducing the carbon footprint by integrating digital tools. The company is emphasizing to reduce, reuse and recycle. It is adopting green measures for communication across organisation. It has introduced a reduction in the use of paper and effective disposal of E-wastes.