Executive Summary

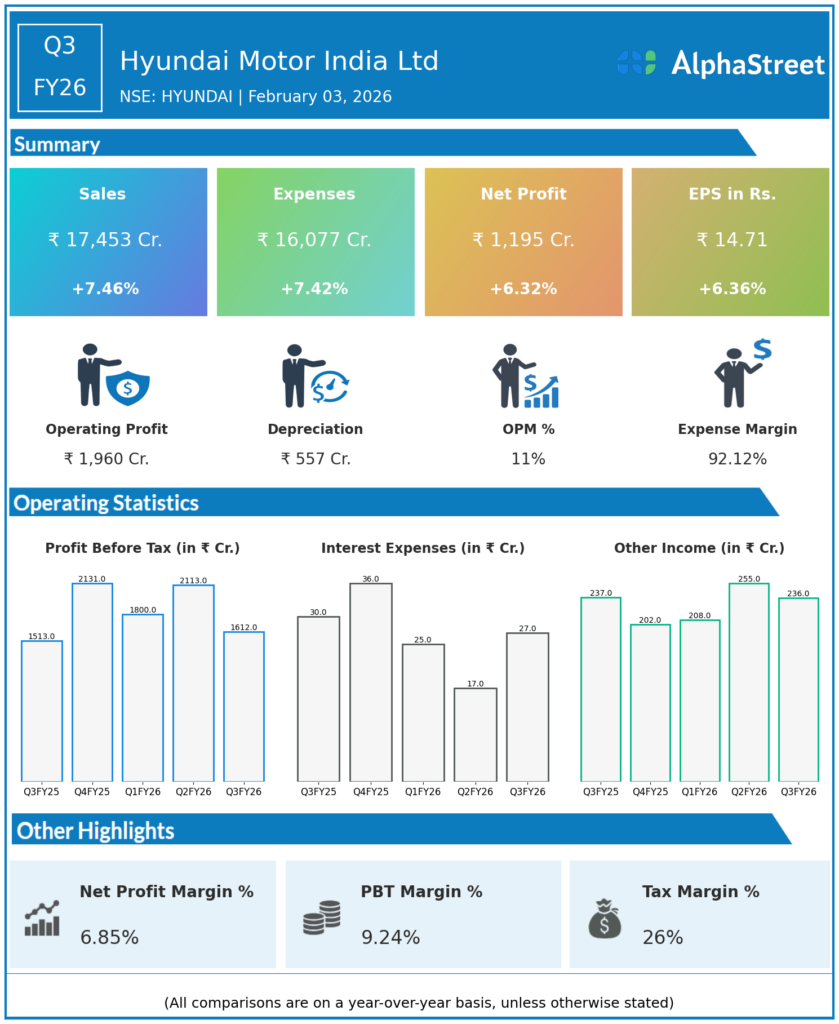

Hyundai Motor India Ltd reported Q3FY26 revenues of ₹17,453 crore, up 7.46% YoY, with consolidated net profit increasing 6.32% to ₹1,195 crore. Steady domestic SUV demand, 21% export growth, and festive sales supported performance despite rising input costs.

Revenue & Growth

Revenues grew to ₹17,453 crore in Q3FY26 from ₹16,242 crore YoY, driven by 5% sequential wholesale volume rise and Creta’s record sales. Total expenses increased 7.42% YoY to ₹16,077 crore, tracking revenue expansion in passenger vehicles.

Profitability & Margins

Consolidated net profit rose 6.32% YoY to ₹1,195 crore from ₹1,124 crore, with EBITDA up 7.6% to ₹2,018 crore at stable 11.2% margins. Basic EPS increased 6.36% to ₹14.71 from ₹13.83; 9M PAT reached ₹4,176 crore.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26. Capacity ramp-up at Talegaon plant noted amid expansion.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

EBITDA margin held at 11.2%; exports contributed 25% to sales mix with Venue bookings at 80,000 units. 9M revenue up to ₹518,472 Mn, margins expanded to 12.8% despite commodity pressures.