HT Media Ltd (NSE: HTMEDIA) reported a marginal increase in consolidated total income for the third quarter of FY26 while navigating significant one-time regulatory costs. The company confirmed a major leadership change with the appointment of a new Managing Director and CEO effective March 2026.

The company recorded a consolidated total income of INR 53,227 Lakhs for the quarter ended December 31, 2025, compared to INR 53,044 Lakhs in the corresponding quarter of the previous year. The company reported a net loss of INR 2,370 Lakhs for the period.

Quarterly Results and Financial Highlights

Consolidated revenue from operations for the quarter was INR 49,661 Lakhs, representing a year-over-year increase from INR 48,980 Lakhs. Total expenses for the quarter rose to INR 51,894 Lakhs, up from INR 52,405 Lakhs in the prior year. Employee benefits expense stood at INR 11,004 Lakhs, while finance costs were INR 1,537 Lakhs. The company recorded a consolidated net loss of INR 3,941 Lakhs for the nine months ended December 31, 2025.

Regulatory Milestones and Segment Updates

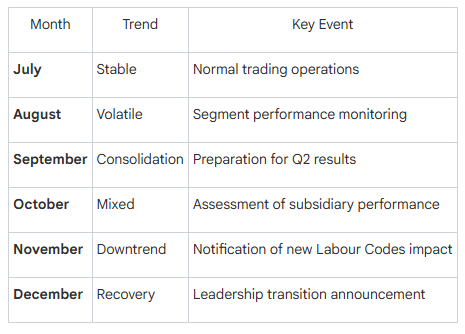

The company’s financial performance was impacted by the notification of four new Labour Codes by the Government of India. HT Media recognized a non-recurring exceptional impact of INR 3,991 Lakhs for gratuity and INR 153 Lakhs for long-term compensated absences.

Segment Revenue Performance (Q3 FY26)

• Printing & Publishing: INR 39,484 Lakhs.

• Digital: INR 6,667 Lakhs.

• Radio Broadcast & Entertainment: INR 3,370 Lakhs.

In the radio segment, the company realized an exceptional gain of INR 109 Lakhs following the surrender of a radio license by its subsidiary, Next Radio Limited.

Business Model and Market Situation

HT Media operates as a multi-media entity with a presence in traditional print, digital news, and radio entertainment. The Printing and Publishing segment remains the core business, contributing approximately 79% of total segment revenue this quarter. The Digital segment showed growth, rising to INR 6,667 Lakhs from INR 5,145 Lakhs in the same period last year.

Growth Trajectory and Shareholder Value

The company’s growth is increasingly driven by its Digital segment, which saw an approximate 29.5% year-over-year revenue increase for the quarter. To optimize its international structure, the company’s wholly-owned subsidiary, HT Overseas Pte Ltd (HTOS), carried out a buyback of 2.64 Lakhs equity shares, representing 20% of its total equity capital. Paid-up equity share capital remained constant at INR 4,655 Lakhs.

Management Commentary and Leadership Transition

The Board of Directors approved the appointment of Shri Sameer Singh as Managing Director and Chief Executive Officer for a five-year term beginning March 1, 2026. Mr. Singh, an alumnus of IIM Calcutta, previously held leadership roles at TikTok/ByteDance, Google, and GroupM. Management is focused on digital innovation and brand transformation as part of the long-term strategy.

Where Does HT Media Ltd Stand Today?

HT Media is currently navigating a period of regulatory adjustment and leadership transition while maintaining a strong capital base. The core printing business continues to provide scale, while the digital division serves as the primary growth engine.