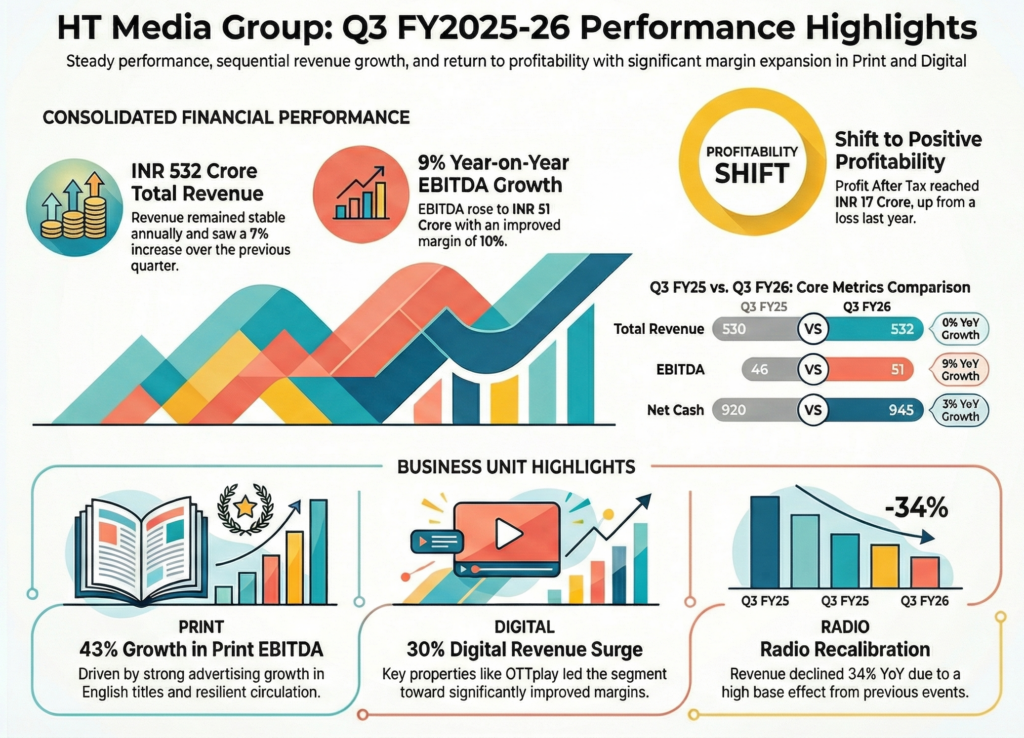

HT Media Ltd (NSE: HTMEDIA) achieved a consolidated total revenue of INR 532 Crore for the third quarter of FY26, representing stable year-over-year performance. The company recorded a significant improvement in profitability, reporting a Profit After Tax (PAT) of INR 17 Crore compared to a loss in the prior year period.

HT Media is a leading Indian media house with a presence in print, radio, and digital platforms. For the quarter ended December 31, 2025, the company reported a consolidated total revenue of INR 532 Crore, up from INR 530 Crore in Q3 FY25.

Key Segment Developments

The English Print titles demonstrated a strong sequential advertising revenue uptick of 16%. Hindi Print ad revenue saw a marginal 4% annual decline, attributed to a shift in festive timing. The Radio business is currently undergoing operational recalibration to align with changing industry dynamics. The Digital segment’s growth was driven by the performance of key properties, including OTTplay.

Performance by Business Vertical

HT Media operates three primary segments: Print, Radio, and Digital.

• Print: The segment reported an operating revenue of INR 395 Crore, a 2% increase year-over-year. Operating EBITDA for the segment grew by 43% to reach INR 60 Crore, with margins expanding to 15%.

• Radio: Revenue declined by 34% year-over-year to INR 34 Crore, primarily due to a high base effect from event-led business in the previous year. The segment reported an operating EBITDA loss of INR 5 Crore.

• Digital: Revenue rose 30% year-over-year to INR 67 Crore. While the segment remains in a loss, operating EBITDA improved by 10% to a loss of INR 23 Crore.

Performance and Quarterly Results

Consolidated revenue from operations for the quarter stood at INR 49,661 Lakhs, reflecting a year-over-year increase from INR 48,980 Lakhs. The company reported a consolidated net loss of INR 2,370 Lakhs for the quarter, which includes a significant exceptional loss. For the nine-month period ended December 31, 2025, the total consolidated loss was INR 3,941 Lakhs. The loss was primarily driven by exceptional items totaling INR 4,035 Lakhs for the quarter.

Core Growth Strategies

The company’s strategy focuses on leveraging the enduring strength of its established Print mastheads while scaling digital-first offerings. Management aims to maintain a clear path toward profitability in the Digital segment through disciplined cost management and scaling new-age platforms. The group continues to maintain a robust cash position, with Net Cash standing at INR 945 Crore as of December 31, 2025.

Strategic Expansion and Regulatory Context

HT Media is expanding its footprint in the digital ecosystem through platforms like Shine.com, Mosaic Digital, and OTTplay. As noted in the conversation history, the company is also managing a transition in leadership with the appointment of Shri Sameer Singh as Managing Director and CEO effective March 2026. Additionally, the company is accounting for the non-recurring impact of new Government Labour Codes, which affected previous financial periods.

Operational Scale and Market Leadership

HT Media operates across three primary reportable segments: Printing & Publishing, Radio Broadcast & Entertainment, and Digital.

• Printing & Publishing: This segment remains the largest contributor, with Q3 revenue of INR 39,484 Lakhs.

• Digital: The segment showed a growth trajectory, with revenue increasing to INR 6,667 Lakhs from INR 5,145 Lakhs in the prior-year quarter.

• Radio Broadcast: Revenue for this segment was INR 3,370 Lakhs for the quarter.

Robust Capital Strength

As of December 31, 2025, HT Media maintains a consolidated net worth of INR 1,61,557 Lakhs. The group’s debt-equity ratio is 0.35, and the total debt to total assets ratio is 0.18. The company has outstanding commercial papers with a face value of INR 15,000 Lakhs. The current ratio stands at 1.08, indicating a stable liquidity position to meet short-term obligations.