Hindustan Petroleum Corporation Ltd (HPCL) is a major Indian company engaged in refining crude oil, marketing petroleum products, producing hydrocarbons, and providing services for management of E&P (Exploration & Production) Blocks. Presenting below are its Q1 FY26 Earnings Results.

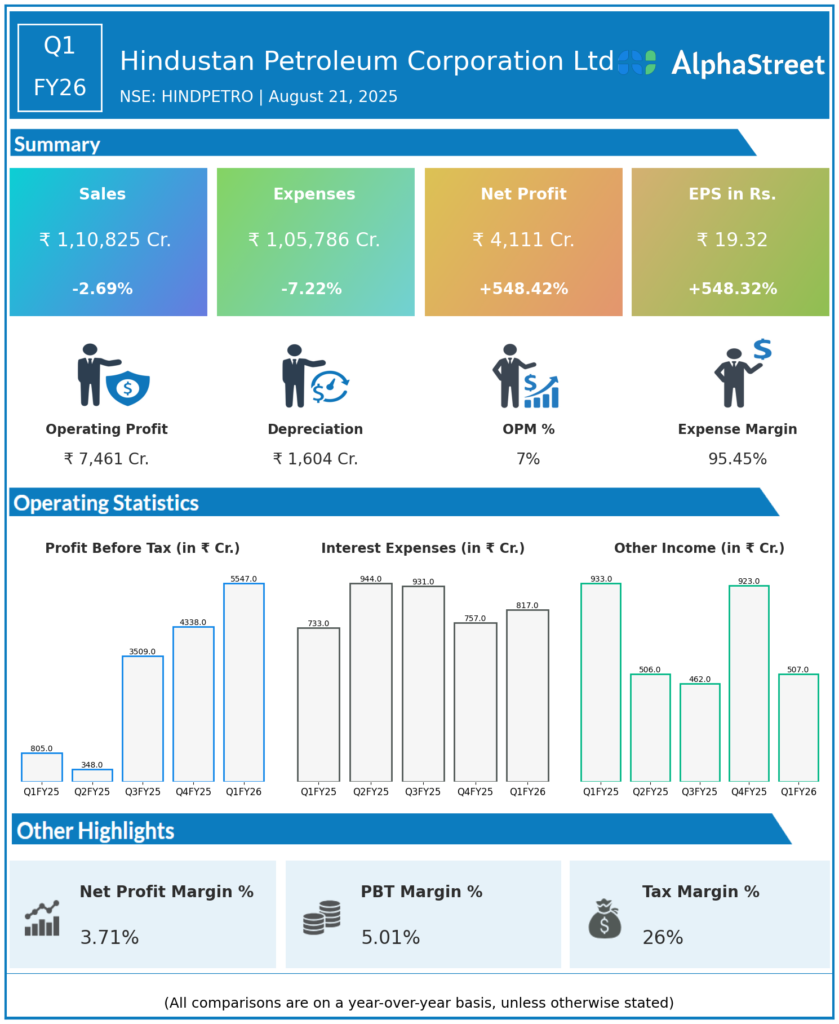

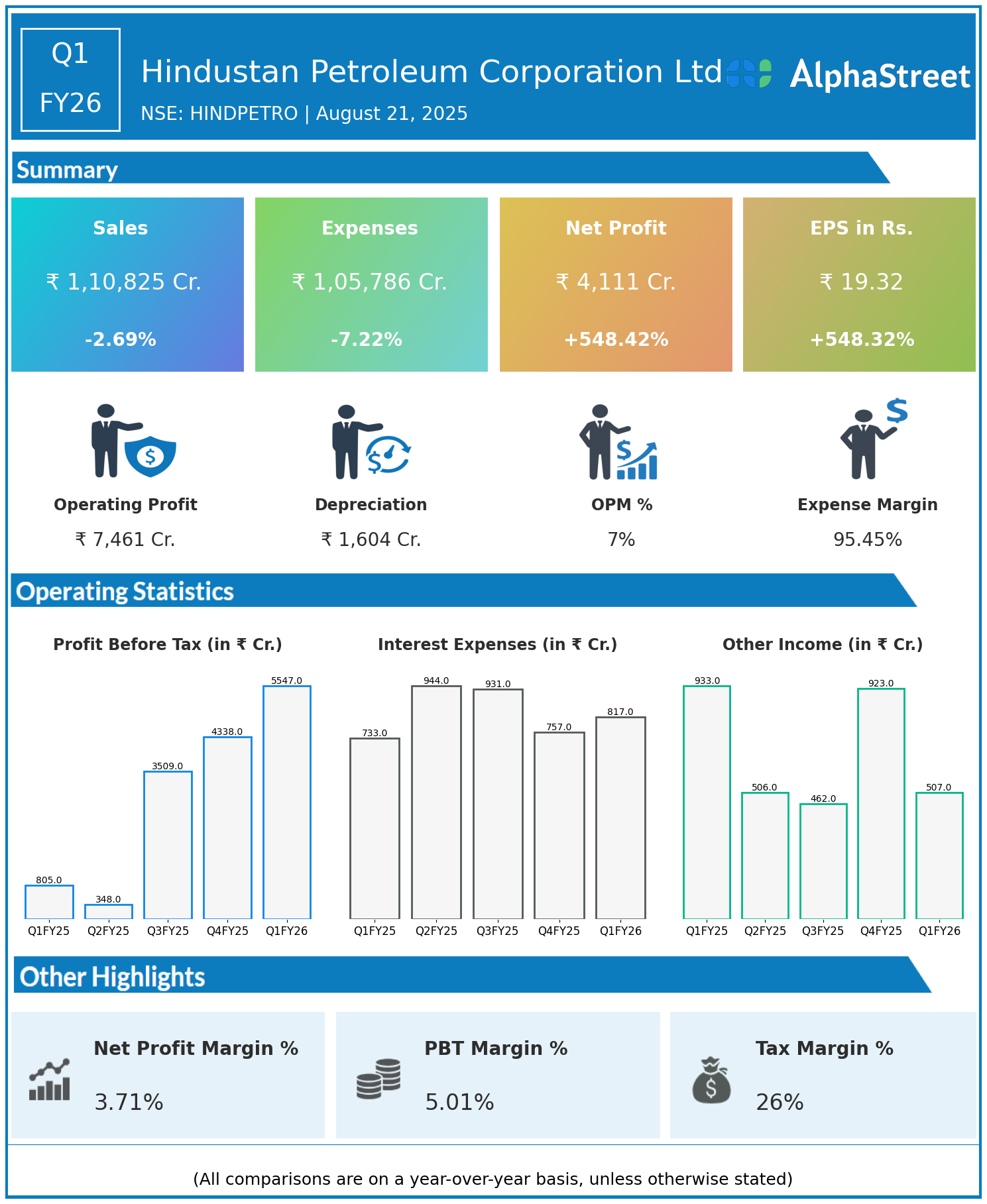

Q1 FY26 Earnings Results

- Revenue: ₹1,10,825 crore, down 2.69% year-on-year (YoY) from ₹1,13,888 crore in Q1 FY25.

- Total Expenses: ₹1,05,786 crore, down 7.22% YoY from ₹1,14,017 crore.

- Consolidated Net Profit (PAT): ₹4,111 crore, up 548.42% from ₹634 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹19.32, up 548.32% from ₹2.98 YoY.

Operational & Strategic Update

- Revenue Trend: Revenue saw a marginal decline reflecting lower product realization or volumes, typical of the complex petroleum market environment.

- Expense Rationalization: A notable drop in expenses by 7.22% was achieved through operational efficiency, reduction in input costs, and effective management of inventory.

- Exceptional Profit Performance: Net profit and EPS saw a 5.5x jump, driven by strong improvement in refining margins, lower costs, and operational excellence.

- Market & Strategy: HPCL retains a significant role in India’s refining and petroleum product market with a broad footprint, strategic investments, and continued focus on value-added business segments.

- Outlook: The company continues to invest in capacity expansion, technology upgrades, and streamlining operations to drive future growth and enhance shareholder value.

Corporate Developments in Q1 FY26 Earnings

The remarkable profit growth this quarter Q1 FY26 reflects HPCL’s success in maximizing operating margins and capitalizing on cost reductions despite softer revenues.

Looking Ahead

Hindustan Petroleum Corporation Ltd prioritizes further operational optimization, strategic expansion, and market leadership to build on its record performance and deliver sustained value through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.