The global chemical industry, valued at approximately $4.7 trillion, is undergoing a significant geopolitical and strategic realignment. Driven by the “China+1” supply chain diversification strategy, environmental pressures, and robust domestic demand, India is emerging as a formidable global competitor in the high value specialty chemicals segment. This analysis examines the catalysts for this growth, the key players and their strategies, and the outlook for India’s chemical sector as it targets a $1 trillion market by 2040.

1. The Global Chemical Landscape: A Sector in Transition

The chemical industry is the foundational bedrock of modern manufacturing, enabling over 96% of all produced goods. The global market, historically dominated by the European Union and the United States, has seen a dramatic shift in dominance towards Asia. China now commands a leading 43% share of global chemical sales, a significant increase from its ~9% share in 2003.

This dominance, however, is being challenged. Stringent environmental regulations in China post 2015, the US-China trade war, and pandemic-induced supply chain disruptions have exposed the risks of concentrated manufacturing. In response, global corporations are actively diversifying their supply chains through the “China+1” strategy, creating a historic opportunity for alternative manufacturing hubs.

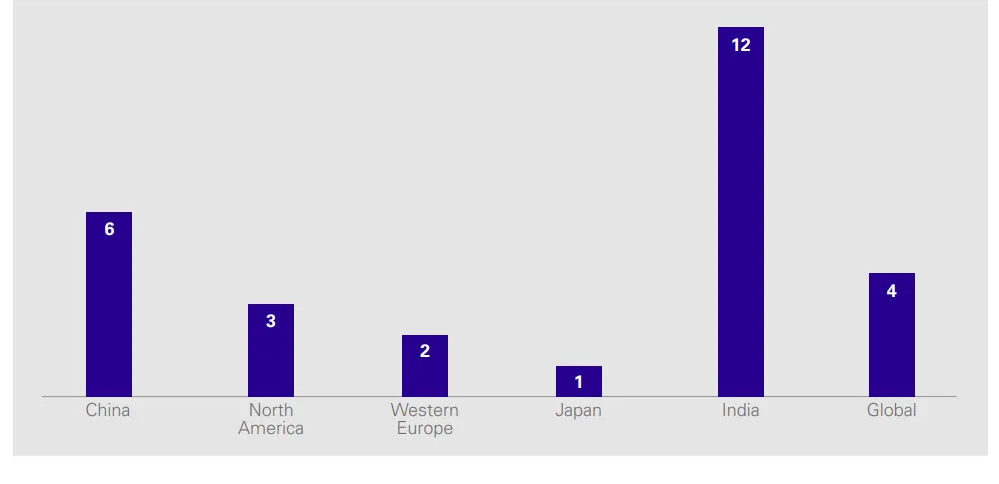

Specialty Chemicals market CAGR among selected regions from FY20 – FY24

2. Defining the Opportunity: Specialty vs. Commodity Chemicals

A critical distinction within the sector is between commodity chemicals and specialty chemicals.

- Commodity Chemicals: These are bulk produced, undifferentiated industrial chemicals (e.g., sulfuric acid, caustic soda). They are characterized by high volume, low margins, and pricing that fluctuates as a global commodity.

- Specialty Chemicals: These are high value, performance-oriented compounds designed for specific applications. While they represent only 20% of global chemical volumes, they command significantly higher margins due to their customized nature, intellectual property, and deep customer integration. Examples include agrochemicals, polymer additives, surfactants, and aroma chemicals.

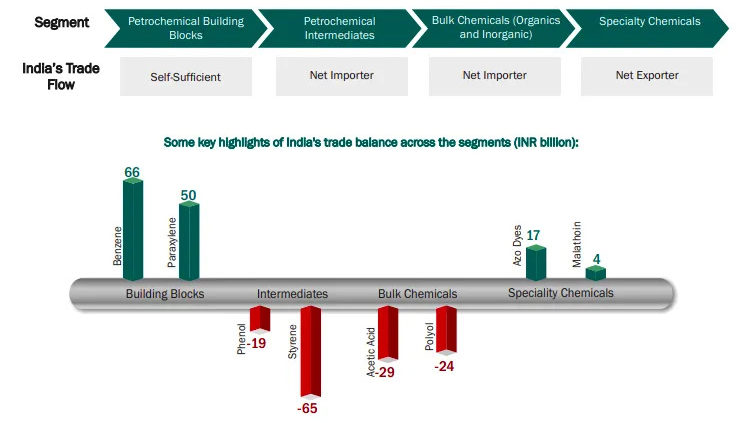

India’s trade position across the specialty chemicals value chain

The specialty segment is where India holds a competitive advantage, offering a combination of technical skill, cost efficiency, and a growing commitment to sustainable (bio-based) production.

3. India’s Strategic Position and Catalysts for Growth

India’s chemical industry is currently valued at $220 billion and is projected to reach $300 billion by 2028 (Source: NITI Aayog). The specialty chemicals segment, valued at $36 billion, is its fastest-growing component, expanding at a CAGR of 11-12%.

Several powerful catalysts are fueling this growth:

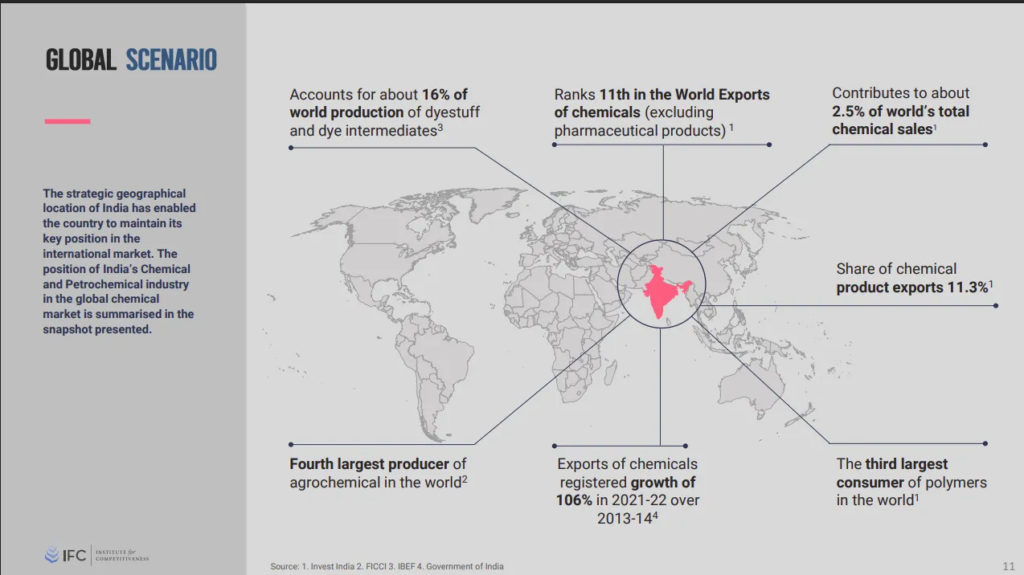

1. Supply Chain Diversification (“China+1”): As global buyers seek to de risk, India’s political stability, skilled workforce, and established manufacturing base make it a prime beneficiary. India is already a top global exporter in segments like dyes (2nd largest) and agrochemicals (4th largest).

2. Robust Domestic Demand: Nearly 70% of India’s chemical production is consumed domestically. With per capita consumption at just 10% of the global average, sustained growth in user industries (pharmaceuticals, automotive, textiles, FMCG) ensures strong underlying demand.

3. Government Policy Support: Initiatives like the Production Linked Incentive (PLI) scheme, the development of Petroleum, Chemicals and Petrochemical Investment Regions (PCPIRs), and the Plastic Parks scheme provide critical infrastructure and financial incentives. The government has also implemented anti-dumping duties to protect domestic manufacturers.

4. Sustainability Trends: The global shift towards bio-based and sustainable products aligns with the capabilities of Indian companies specializing in oleochemicals and green technologies.

4. Analysis of Key Market Segments and Players

The Indian specialty chemical industry is fragmented, with players dominating specific niches.

- Aarti Industries: The core specialty of the company is: Benzene & Toluene derivatives (Intermediates). Meanwhile the company remains vertically integrated across value chains. Its facing near-term margin pressure from Chinese overcapacity but responding with volume growth (+14% QoQ) and significant CAPEX (₹1,370 Cr in FY25) for future high-margin products.

- Fine Organics: The core specialty of the company is: Oleochemical-based Additives. The company derives additives from natural oils. Its “green” moat is a key advantage. Navigating high raw material (palm, castor oil) costs. Future growth hinges on a new SEZ plant and a strategic foray into US manufacturing to reduce lead times.

- Privi Speciality: The core specialty of the company is: Aroma Chemicals. The company is a backward integrated player using pine-based raw materials (CST, GTO). Excels at process innovation, converting side-streams into high-margin products. Posted record performance in Q4 FY25 (Revenue: ₹628 Cr, +28% YoY; PAT: ₹64 Cr, +100% YoY). Its joint venture with Givaudan (PRIGIV) ensures future demand visibility.

5. Market Outlook, Investments, and Challenges

The long-term outlook for India’s chemical sector is profoundly positive. A McKinsey report estimates the industry will grow by 11-12% from 2021-27, potentially tripling its global market share by 2040 to reach a $1 trillion valuation.

This is supported by significant capital flows:

- FDI Inflows (April 2000 – March 2024): $22.146 billion (excluding fertilizers).

- Projected Investments: ₹8 lakh crore (~$100 billion) by 2025.

However, the sector must navigate several challenges:

- Persistent Chinese Overcapacity: Leading to global price pressure and dumping concerns.

- Infrastructure Gaps: Need for dedicated chemical clusters with integrated logistics.

- Skill Development: Requiring a higher number of process chemists and R&D experts.

- Regulatory Efficiency: Requiring faster environmental and project clearances.

6. Conclusion: A Foundation for Future Growth

India is strategically positioned to become a global hub for specialty chemicals. The convergence of geopolitical trends, supportive government policy, strong domestic demand, and corporate innovation creates a powerful growth narrative. While cyclical headwinds and competition persist, the sector’s fundamental strengths are clear.

The journey from a $220 billion to a $1 trillion industry will be driven by continuous investment in R&D, a focus on high-value, sustainable products, and the ability of Indian companies to deepen their integration into the global value chain. The chemical sector is poised to be a primary engine of India’s manufacturing-led economic expansion in the coming decades.