Home First Finance Company India Ltd. (NSE: HOMEFIRST, BSE: 543259) shares ended higher on Friday after the housing finance lender detailed its December-quarter operating and financial performance during its Q3 FY26 earnings call. The stock closed at ₹1,052.30 on the National Stock Exchange, up 5.2% from the previous close, according to exchange data.

Market Capitalization

Home First Finance had a market capitalization of approximately ₹10,900 crore at the close of trading, based on prevailing share prices.

Latest Quarterly Results

For the quarter ended December 31, 2025, the company reported consolidated financial results showing continued expansion in its loan book and profitability.

- Total interest income stood at ₹429 crore, an increase of 20.5% year-on-year and 4.8% quarter-on-quarter.

- Profit after tax rose to ₹140 crore, up 44% year-on-year and 6.3% sequentially.

Segment Highlights

- Treasury: Cost of borrowing, excluding co-lending, declined by 10 basis points quarter-on-quarter to 8%, supporting a lending spread of 5.4%.

- Wholesale Banking: Direct assignment transactions during the quarter totaled ₹215 crore.

- Retail Banking: Quarterly disbursements reached ₹1,318 crore, up 10.5% year-on-year, with individual housing loans accounting for 83% of originations.

Chart — Financial Trends

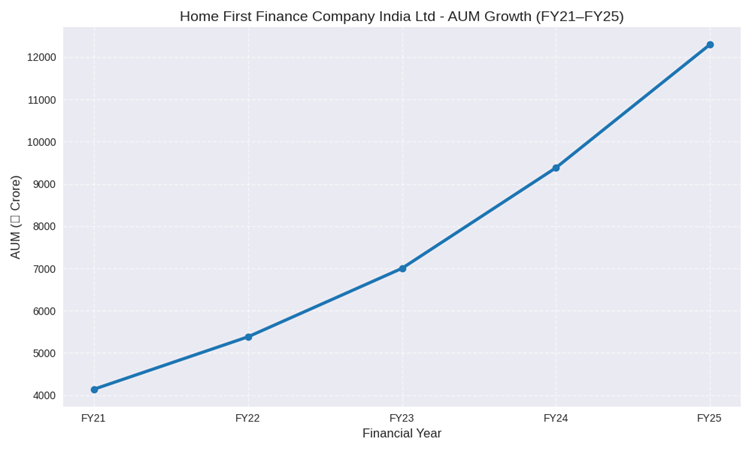

Operating Performance – AUM Growth

Business and Operations Update

Assets under management (AUM) rose to ₹14,925 crore, reflecting 24.9% year-on-year and 5.3% quarter-on-quarter growth. The company added two branches during the quarter, taking its network to 165 branches and 368 touchpoints across 13 states and union territories. Management said six to eight branches are in the pipeline, with at least six expected in Q4 FY26.

Digital adoption remained high, with 81% of approvals processed through the account aggregator framework and over 80% of loans fulfilled digitally using e-agreements and e-NACH mandates. The company said 96% of customers are registered on its mobile application.

Asset Quality and Risk Metrics

Early delinquency indicators showed improvement. Accounts with 1+ days past due declined by 20 basis points quarter-on-quarter to 5.3%, while 30+ DPD remained unchanged at 3.7%. Gross Stage 3 assets stood at 2.0%, up 10 basis points sequentially. Total provision coverage increased to 40.4%, with Stage 3 provisioning at 22%.

Capital and Funding Position

Capital adequacy ratio rose to 49% as of December 2025, compared with 48.4% in the prior quarter. Net worth increased to ₹4,180 crore, up 73.6% year-on-year. Funding remained diversified, with 57% sourced from banks, 16% from the National Housing Bank, and the remainder from assignments, co-lending, and market instruments.

Guidance and What to Watch

Management reiterated its focus on distribution expansion, technology-led origination, and calibrated growth across states. The company cited traction under the Pradhan Mantri Awas Yojana 2 scheme, with over 4,500 applications received as of date.

Performance Summary

Home First Finance shares rose following disclosures from its Q3 FY26 earnings call. The company reported higher quarterly income, increased disbursements, and expanding AUM, while asset quality indicators remained broadly stable. The stock’s move reflected investor response to the reported operational and financial metrics.