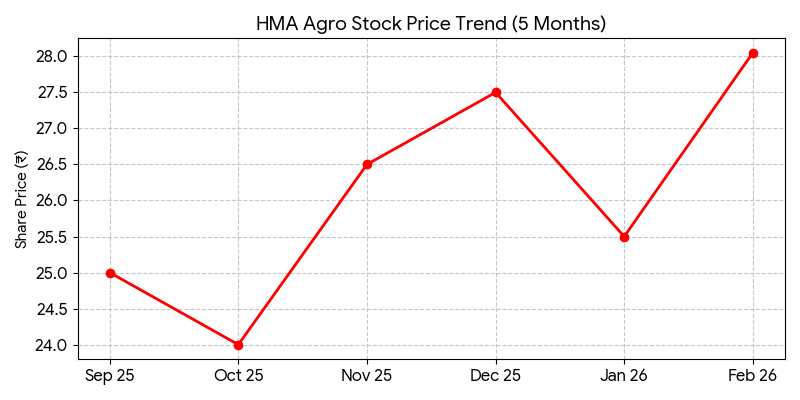

HMA Agro Industries Limited (NSE: HMAAGRO; BSE: 543929) shares declined 6.87% on Friday, closing at ₹28.05 on the National Stock Exchange. The company, a leading Indian exporter of frozen buffalo meat, reported its financial results for the quarter ended December 31, 2025.

Market Capitalization

The market capitalization of HMA Agro Industries Limited stands at ₹1,503 crore as of the current market close.

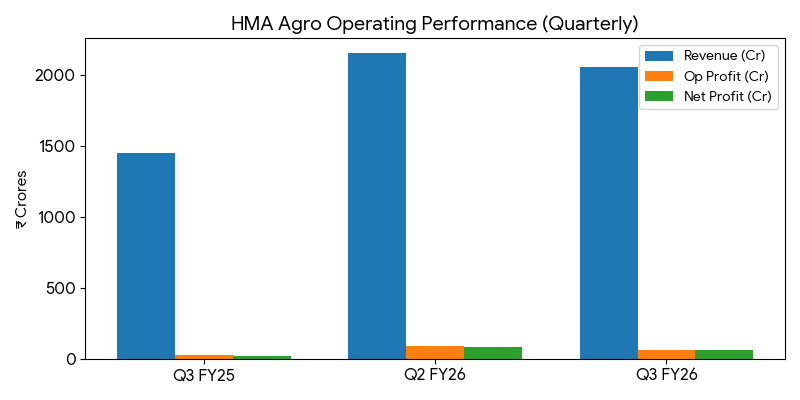

Quarterly Financial Performance (Q3 FY26)

HMA Agro reported consolidated revenue from operations of ₹2,059.45 crore for the third quarter of fiscal 2026. This represents a 41.54% increase compared to ₹1,455.00 crore in the same period last year. Net profit for the quarter rose to ₹66.23 crore, up 226.42% from ₹20.29 crore in the corresponding quarter of the previous fiscal.

Nine-Month Performance (9M FY26)

For the nine months ended December 31, 2025, cumulative revenue reached ₹5,337.40 crore, reflecting a 46.89% year-on-year growth. Total comprehensive income for the nine-month period was reported at ₹156.79 crore.

Segment Highlights

The company operates primarily in the meat processing and export segment. Key product categories include:

- Buffalo Meat: Comprising approximately 90% of total sales revenue.

- Diversified Products: Expansion into seafood, pet food, rice, and finished leather.

- Geographic Reach: Export markets including Southeast Asia, Middle East, and Africa account for over 95% of revenue.

Operational Infrastructure

HMA Agro operates five integrated meat processing plants located in Aligarh, Mohali, Agra, Haryana, and Parbhani. Additionally, the company maintains two secondary processing units in Jaipur and Manesar. The commissioning of Asia’s largest meat processing facility in Nuh, Haryana, has contributed to increased production capacity.

Financial Trends

Performance Summary Table

| Metric | Q3 FY26 | YoY Change |

| Revenue (₹ Cr) | 2,059.45 | +41.54% |

| Net Profit (₹ Cr) | 66.23 | +226.42% |

| Market Cap (₹ Cr) | 1,503 | N/A |

| EPS (₹) | 1.32 | +221.95% |

Strategic Updates

The Board of Directors approved an enhancement of export packing credit limits by ₹300 crores to support working capital requirements. The company maintains its status as a “Five Star Export House” recognized by the Government of India.

Outlook

The company projects steady demand in global markets for processed meat products. Management remains focused on operational efficiency and market diversification to mitigate international trade risks.