Hitachi Energy India Ltd showcased robust Q3 FY26 performance with revenue acceleration and margin expansion in power technology solutions. Profits surged amid strong order execution.

Executive Summary

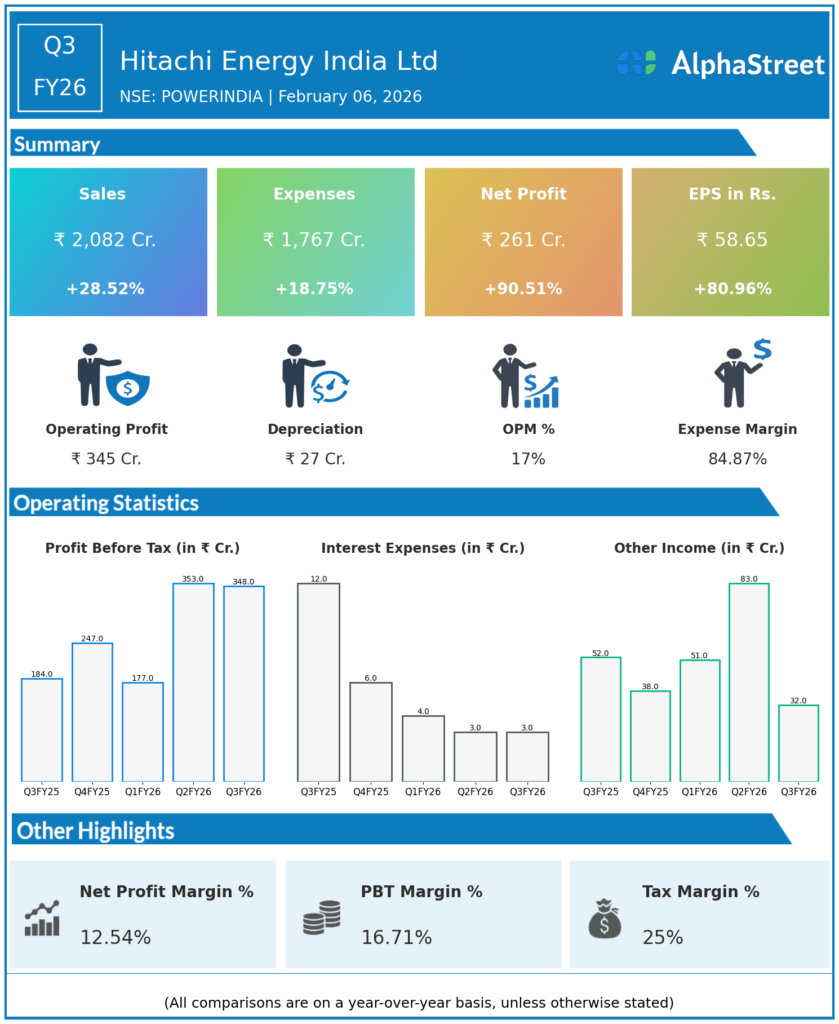

Hitachi Energy India Ltd reported consolidated revenues of ₹2,082 crore for Q3 FY26, up 28.52% YoY from ₹1,620 crore. Net profit rose 90.51% YoY to ₹261 crore from ₹137 crore, with EPS at ₹58.65, reflecting an 80.96% YoY increase. Expense growth lagged revenue, boosting profitability.

Revenue & Growth

Revenues expanded 28.52% YoY to ₹2,082 crore from ₹1,620 crore, driven by higher deliveries in power grids and engineering solutions. Total expenses increased 18.75% YoY to ₹1,767 crore from ₹1,488 crore. QoQ data not available from provided figures.

Profitability & Margins

Consolidated net profit grew 90.51% YoY to ₹261 crore. EPS advanced 80.96% YoY to ₹58.65 from ₹32.41. PAT margin improved to 12.54% from 8.46% YoY; EBITDA and gross margin specifics unavailable in dataset.

Balance-sheet Highlights

Balance sheet details including net debt, current assets, or liabilities not disclosed in input data. Operations span power technology products and services for utilities and industries. Net debt/EBITDA and current ratio unavailable.

Cash Flow / Liquidity

Cash flow metrics such as operating cash flow and free cash flow absent from dataset. Liquidity position reflected through steady working capital management in project executions. Current ratio not reported.