Hitachi Energy India Ltd (formerly known as ABB Power Products and Systems India Ltd.) was created in 2019 as a Joint Venture between Hitachi and ABB’s Power Grids. The company serves utility and industry customers, with a complete range of engineering, products, solutions, and services in areas of Power technology. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

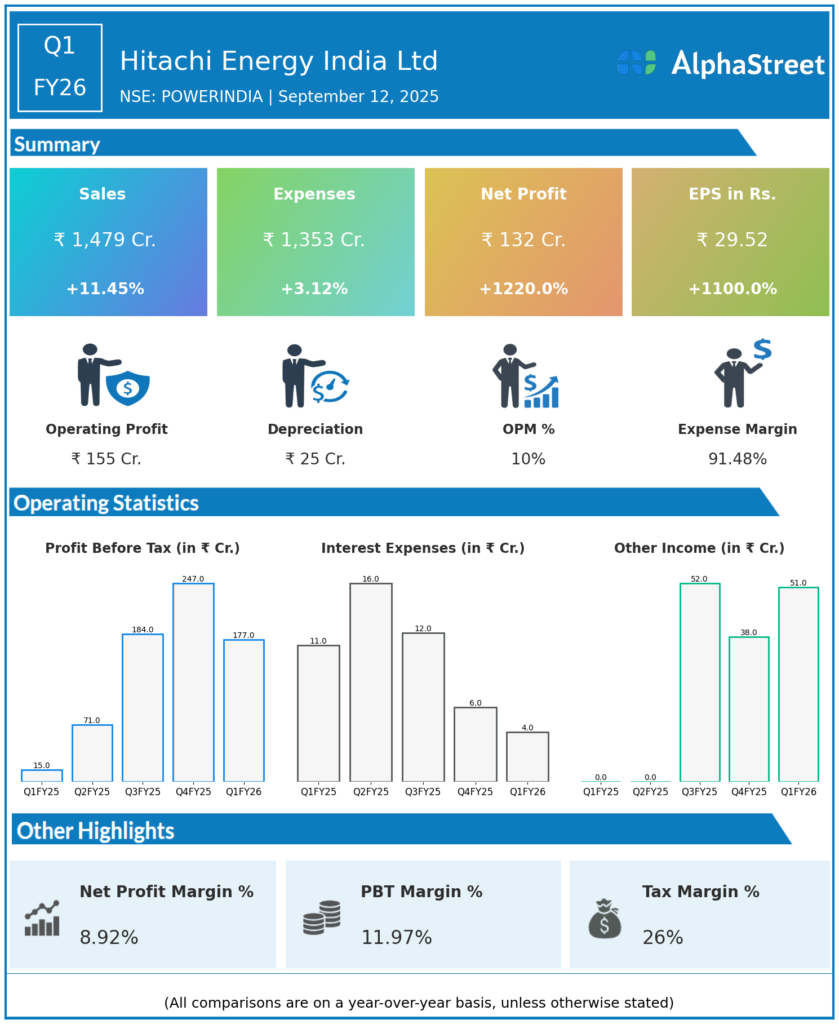

Revenue: ₹1,479 crores, up 11.4% YoY (Q1 FY25: ₹1,327.3 crores).

-

Profit Before Tax (PBT): ₹176.9 crores, up significantly from Q1 FY25 (₹15.1 crores), aided by high-margin orders.

-

Profit After Tax (PAT): ₹131.6 crores, up 1,220% YoY (Q1 FY25: ₹10.4 crores).

-

EBITDA: ₹170.2 crores, up 176.6% YoY (Q1 FY25: ₹61.5 crores).

-

EBITDA Margin: 11.1%, up 650 bps YoY (Q1 FY25: 4.6%).

-

Gross Margin: 44%.

-

Order Flow: ₹11,339 crores, up 365% YoY, driven by a landmark Bhadla-Fatehpur HVDC project and major Powergrid orders.

-

Order Backlog: ₹29,135 crores, at an all-time high, ensuring strong visibility for future quarters.

-

Other Financials: Net finance cost ₹4 crores (reduced YoY), depreciation ₹25 crores (up due to capex capitalization).

-

Export Share: Exports (excluding HVDC) made up ~25% of the order book, with strong momentum from Europe, Americas, and Asia.

-

Service Business: Service order intake up 90% YoY, now accounting for a high single-digit share of order book.

Key Management Commentary & Strategic Highlights

-

Management cited robust execution and order wins (notably the HVDC win and Powergrid bulk transformer contract) as key drivers of revenue and margins.

-

CEO N Venu emphasized continued support for India’s renewables grid integration, data center growth, railway expansion, and electrification across industries.

-

The company remains committed to maintaining double-digit margin performance and strong operating cash flow through efficiency gains and capacity expansion.

-

Ongoing capex of ₹2,000 crores focused on growing transmission, digital & industrial offerings, and export-oriented production.

-

Growth priorities include sustaining core segment leadership, leveraging export momentum, expanding services, and capitalizing on India’s evolving energy infrastructure needs.

Q4 FY25 Earnings Results

-

Revenue: ₹1,884 crores.

-

PAT: ₹184 crores.

-

Order Backlog: ₹23,964 crores (Q4 FY25; now a record ₹29,135 crores).

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.