Hindustan Unilever Ltd is a leading FMCG company operating primarily in Home Care, Beauty & Personal Care, and Foods & Refreshment segments with manufacturing facilities across India.

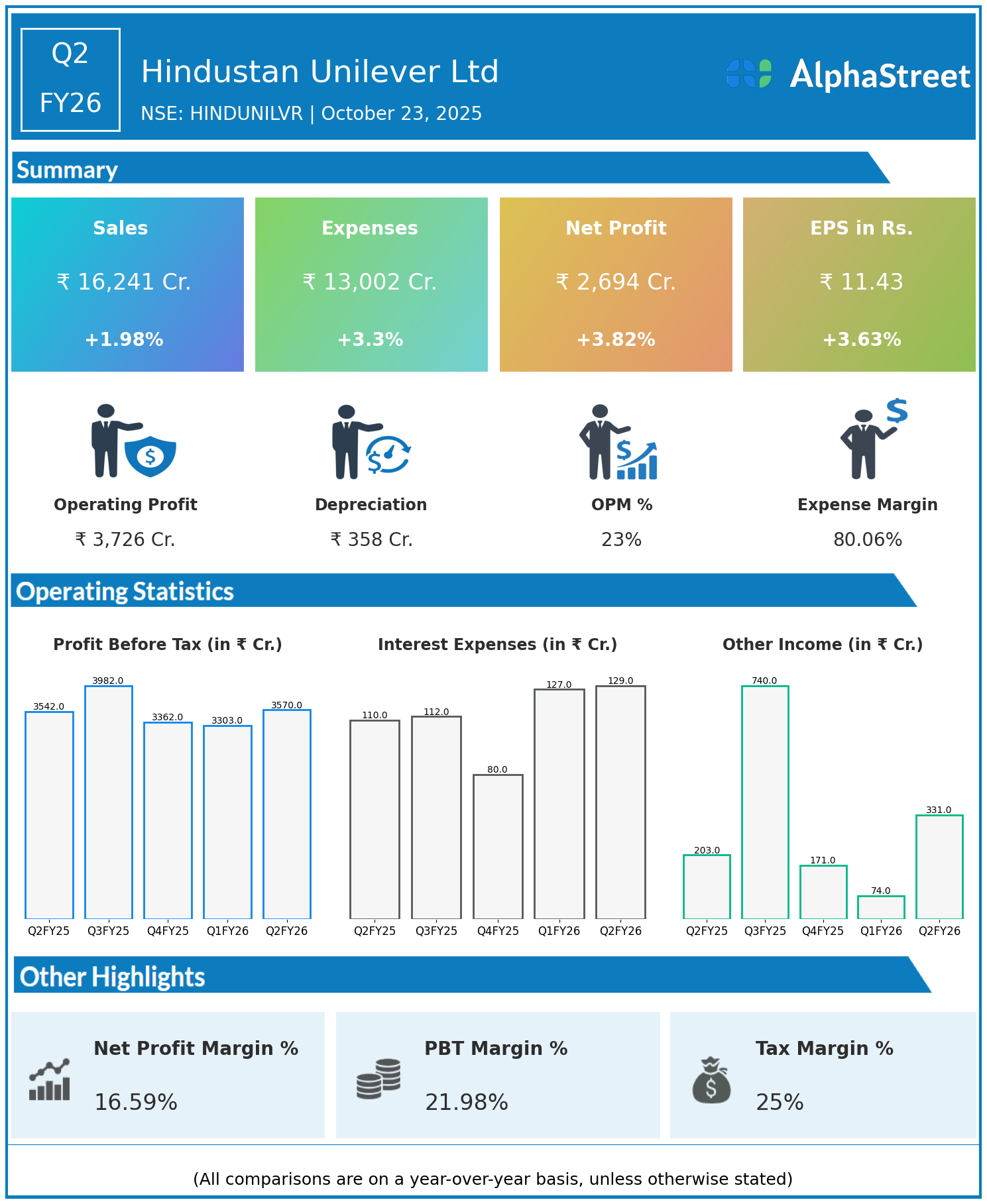

Q2 FY26 Earnings Summary

- Consolidated revenue rose 1.98% year on year to ₹16,241 crore from ₹15,926 crore.

- Total expenses increased 3.3% to ₹13,002 crore from ₹12,587 crore.

- Consolidated Net Profit increased 3.82% to ₹2,694 crore from ₹2,595 crore in the year-ago period.

- Earnings Per Share (EPS) rose 3.63% to ₹11.43 from ₹11.03.

Operational and Business Highlights

- The quarter reflected the transitory impact of GST reforms and monsoon disruptions but price discounts taken earlier affected volumes, resulting in flat underlying volume growth.

- Home Care and Foods segments delivered competitive volume growth, supported by innovations such as Comfort Perfume Deluxe in fabric conditioners, and Horlicks PRO Fitness and Bru Gold Edition in beverages.

- Lower EBITDA margin by 90 basis points to 23.2% was due to higher business investments.

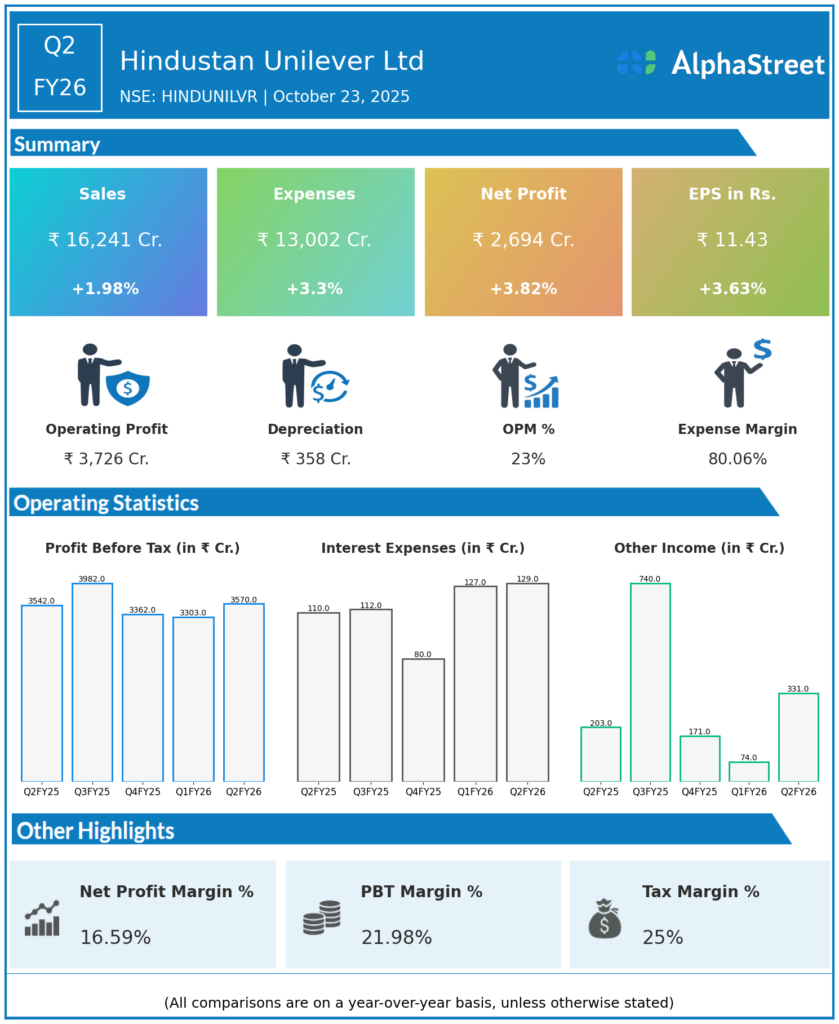

- One-off gains related to tax resolution contributed positively to net profit growth despite a 4% decline in profit before exceptional items.

Financial Position and Outlook

- The company declared an interim dividend of ₹19 per share, reflecting strong cash generation and shareholder returns.

- Management is confident of normalized trading conditions post GST transition and expects sustained volume-led growth over the mid-to-long term driven by portfolio transformation and digital capabilities enhancement.

Hindustan Unilever Ltd remains focused on innovation, marketing transformation, and portfolio injection of high-growth demand spaces to accelerate growth and profitability through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.