“Our financial performance has improved as some of our underutilized factories have ramped up. Our cash flow from operations also improved to nearly INR 100 Crores (erroneously spoken as INR300 crores), a near 3x increase over last year. Our EPS for FY ’23 stood at INR6.31 versus INR3.96 in FY’22. As we continue to invest in our capacities, our Gross Block is now at INR835 crores, which have been funded with the judicial mix of debt and equity. And thus, our net debt-to-equity ratio is around 1.18x to equity. As the Soaps and Bar lines, and ice cream factory start ramping up, we expect that the coming year to be better than the past.”

-Mayank Samdani, Group CFO

Stock Data

| Ticker | HNDFDS |

| Industry | FMCG |

| Exchange | NSE & BSE |

Share Price

| Last 1 Month | -7.3% |

| Last 6 Months | -22.1% |

| Last 12 Months | 52.3% |

Business Basics

Hindustan Foods Limited is a leading contract manufacturer and packaging solutions provider in India. The company specializes in offering a wide range of services to the food and beverage industry, catering to both domestic and international clients. The company’s core business revolves around contract manufacturing, where it collaborates with renowned food and beverage brands to produce a diverse range of products. The company operates state-of-the-art manufacturing facilities equipped with advanced technology and adheres to stringent quality control measures to ensure the highest standards of production. HFL’s manufacturing capabilities span various categories, including snacks, confectionery, ready-to-eat meals, sauces, and beverages.

In addition to contract manufacturing, HFL provides comprehensive packaging solutions to its clients. The company offers end-to-end packaging services, including design, sourcing, and supply of packaging materials, as well as labeling and artwork solutions. HFL’s expertise in packaging enables brands to enhance their product presentation, ensure regulatory compliance, and improve overall brand image. Hindustan Foods’s commitment to quality and customer satisfaction is reflected in its robust quality management systems and certifications. Furthermore, it places significant emphasis on research and development (R&D) to stay ahead of market trends and meet evolving consumer preferences. The company invests in innovation and works closely with clients to develop new products, reformulate existing ones, and improve manufacturing processes. This focus on R&D enables HFL to deliver customized solutions that cater to specific client requirements and market demands.

HFL’s client base includes prominent national and international brands across various segments of the food and beverage industry. The company’s strong reputation, manufacturing capabilities, and commitment to quality have positioned it as a preferred partner for leading brands seeking reliable contract manufacturing and packaging solutions.

Q4 FY23 Financial Performance

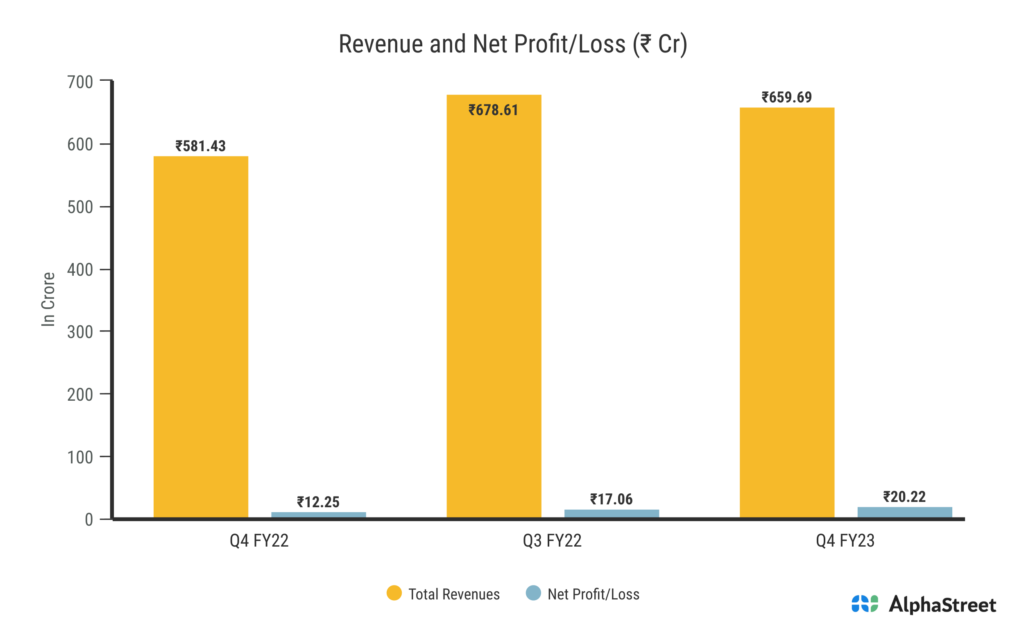

Hindustan Foods Limited reported Total Income for Q4 FY23 of ₹659.69 Crore up from ₹581.43 Crore year on year, a growth of 13.4%. The consolidated Net Profit of ₹20.22 Crore, up 65% from ₹12.25 Crore in the same quarter of the previous year. The Earnings per Share is ₹1.79 for this quarter.

Developments In Company’s Beverage Segment

The company currently operates one factory in Mysuru where it produces both juices and carbonated beverages and has contracted with a few new brands. In addition, HFL is establishing a juice line in Guwahati, which will serve only juice and not carbonated drinks. The management anticipates continued success for the beverage segment over the next couple of years. However, there is a capacity constraint, and the company is making changes in terms of manufacturing capacities and divestments with some of the industry’s larger players. New players have entered this market, which, if they can get their pricing right, should definitely increase per capita consumption. As a result, management has high hopes for the beverage segment.

Analysis of FMCG Industry in India

The Fast-Moving Consumer Goods (FMCG) industry in India is a vital sector that encompasses a wide range of products, including food and beverages, personal care items, household goods, and packaged goods. The FMCG industry in India has experienced remarkable growth over the years and continues to be a significant contributor to the country’s economy. It is the fourth-largest sector in the Indian economy. It is broken down into three main categories: household and personal care, which makes up 50% of the sector, healthcare, which makes up 31% of the sector, and food and beverages, which accounts for 19% of the sector. About 55% of the revenue share comes from the urban market, while 45% comes from the rural sector. By 2025, the market for processed foods in India is expected to grow from $263 billion to $470 billion. According to CRISIL Ratings, the FMCG sector’s revenue growth will double from 5-6% in FY21 to 10-12% in FY22.

One of the key drivers of the FMCG industry in India is the country’s large population, which provides a vast consumer base. With a growing middle class and rising disposable incomes, there has been an increase in consumer spending on FMCG products. Additionally, changing lifestyles, urbanization, and the influence of Western culture have led to a shift in consumer preferences, with a greater demand for convenience, quality, and branded products. The rural market in India also plays a crucial role in the FMCG sector. With a substantial rural population, FMCG companies have been focusing on penetrating rural areas by offering affordable and value-for-money products. Rural consumers are becoming more aspirational and are willing to spend on FMCG goods, creating immense growth potential in these regions.

The FMCG industry in India has witnessed significant competition among both domestic and multinational companies. Established Indian brands, as well as international players, have been vying for market share by introducing new products, innovative marketing strategies, and distribution networks. This competition has resulted in a wider variety of choices for consumers and continuous product innovations.