Hindustan Construction Company Limited (NSE: HCC) is one of India’s largest private construction companies. The company is working on a number of projects, some of which should be completed this fiscal year. Additionally, the company evaluated a bid of about ₹4,000 crore and did find opportunities that should boost its order book. The company’s debt resolution plan is completed, which will now lower their quarterly interest costs by ₹100 crore, strengthening P&L. Strong demand exists in the construction sector, and if HCC can capitalize on it, both top and bottom line performance should surge.

Business Basics

Hindustan Construction Company Limited is a pioneer in India’s infrastructure industry and has defined the country’s progress since 1926. Seth Walchand Hirachand, who founded the business, is widely regarded as the founder of the Indian transportation industry. The company has built a number of well-known projects, including the Bandra Worli Sea link in Mumbai Bogibeel Bridge rail-cum-road bridge. In addition, HCC has built a total of 4,036 lane KM of highways, 365 KM of tunnels, as well as India’s installed nuclear and hydropower capacities of 60% and 26%, respectively.

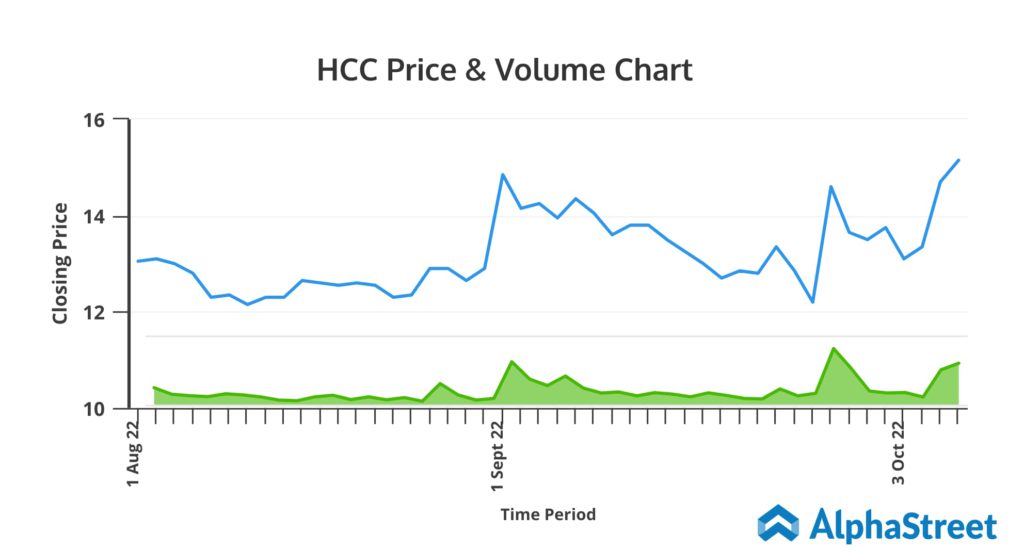

Recent Share Price Insights

- On October 10, 2022, the stock price closed at ₹15.1, reaching near to its 52-week high of ₹20.05.

- Interestingly, though over the last six months, the stock has dropped by almost 17%, meanwhile it has provided a one-year return of more than 43%.

Financial Snapshot

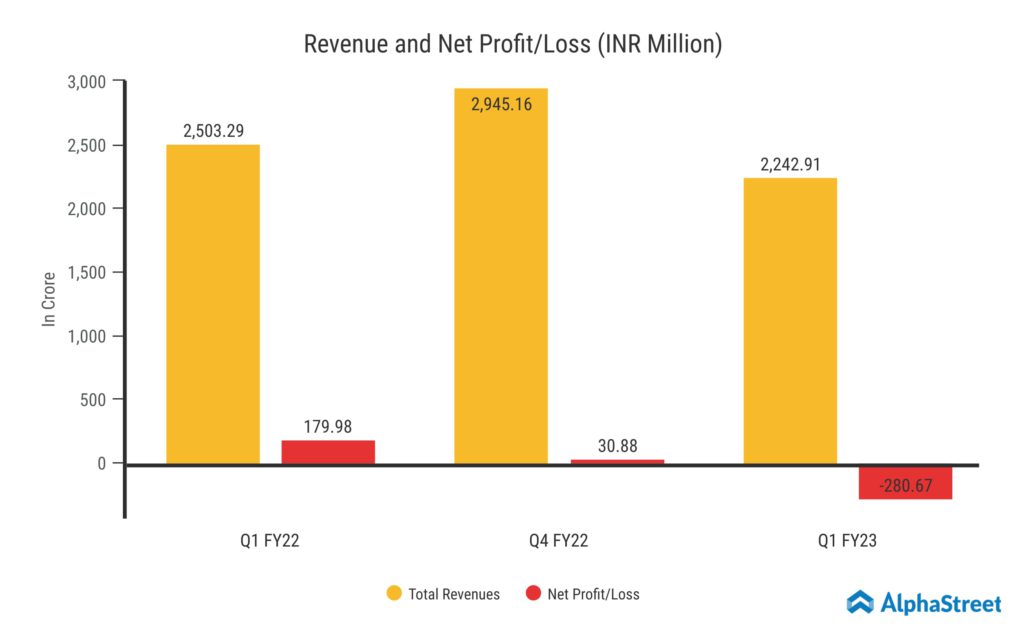

In Q1 FY23, Hindustan Construction Company reported a 9% year-over-year drop in revenue from operations, to ₹2,228.92 crore from ₹2453.94 crore. The company reported a loss of ₹280.67 crore, compared to a profit of ₹179.98 crore in Q1 FY22. The Mumbai projects’ lower-than-expected turnover rates had a significant negative impact on the quarter’s performance. This was largely due to protests by fishermen against the coastal road project, as well as a significant shortage of skilled labor for the two large projects in Mumbai.

However, the Baharampore-Farakka Highways, one of the Built Operate Transfer assets, has performed admirably, registering an impressive growth of 31% in the quarter.

Recent Highlights

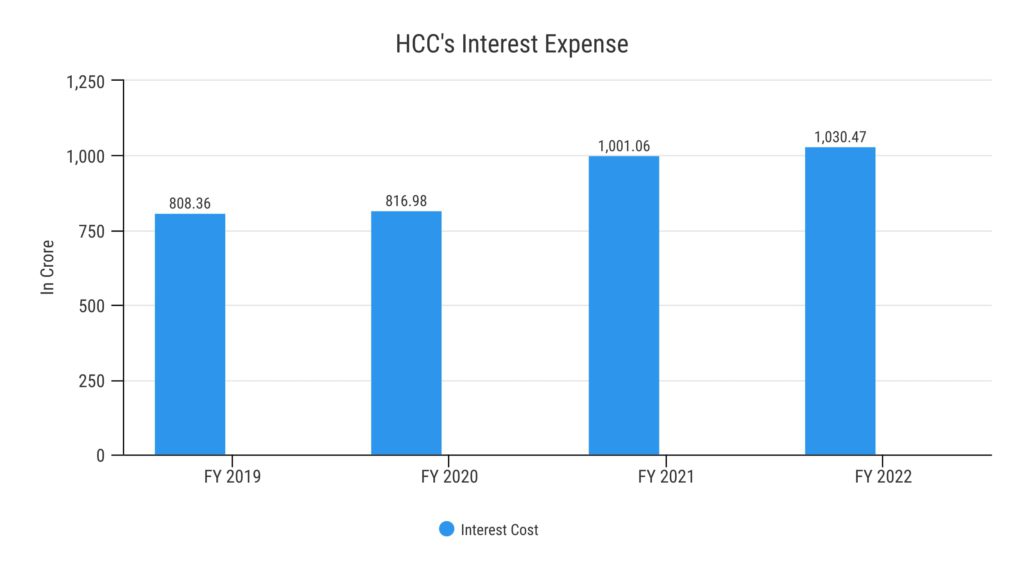

With the support of 23 banks, Hindustan Construction Company finished its debt resolution plan. An important portion of HCC’s debt as well as corresponding assets have been removed from its balance sheet as part of the resolution plan. On a quarterly basis, this would save approximately ₹100 crore in interest costs.

Arjun Dhawan, Vice Chairman, HCC, said, “This milestone gives us the freedom to focus on building our business with renewed confidence, by addressing a fundamental legacy issue relating to delayed arbitration payments.”

Hindustan Construction Company’s Undergoing Projects

The company has a few projects which are under construction. The DC06 – Delhi Metro is currently about 54% complete, and work on laying the metro’s tracks is likely to commence. Both the Imphal Road project and the Anjikhad Cable-stayed bridge plan are 61% and 54% completed, respectively. Moreover, in J&K, along with Anjikhad Cable-stayed bridge, T49 Tunnel project is completed around 76%, with the lining works in progress for the main and escape tunnels. Notably, this is one of the longest tunnels for the railways.

Uttarakhand has few hydropower projects, which includes Vishnugad Pipalkoti Hydropower, Tapovan Vishnugad. Also, another project with NTPC & Tehri PSP project has just started. Some of the projects have been near to completion such as the Nikachhu project in Bhutan, which has been completed at 85%, and the dam concreting, which is around 96% complete . Also, the Rajasthan Atomic Power Project (Unit 7 & 8) is now almost 97% completed. All the units of this project including Unit 1 to 6 have been built by HCC. The BARC, Tarapur complex is 70% complete in Maharashtra as well. The overall progress on the Mumbai Metro project is 67%, while the completion rate for the Coastal road project is 42%. Along with project completions, the company has assessed the bid of about ₹4,000 crore and has found a few significant opportunities where the company has the necessary strength to pursue them. If the bid is accepted, this opportunity should grow the company’s order book.

Hindustan Construction Company’s Backlog Orders

As of the Q1 of current fiscal year, the company had an order backlog worth approximately ₹14,875 crore. Once more, transportation has the majority of the backlog of orders, followed by hydro, nuclear, and special projects. The two states with the highest concentration of the company’s project bases are still Maharashtra and Uttarakhand. The Steiner AG, a subsidiary of HCC in Switzerland, has a backlog of orders totaling about ₹7,400 crore. The order intake is almost down to ₹804 crore this quarter compared to ₹1,881 crore in Q1 FY22.

Industry Analysis

Around 7% of the world’s workforce is employed by the construction industry, which contributes more than 10% of the global GDP. According to Goldstein Market Research, India’s construction sector contributes only 8% of the country’s GDP. However, this sector is a key engine of economic expansion for India, and its GDP contribution should rise. Currently, the market is being driven by important infrastructure projects, including the Gati Shakti Yojna, Sagarmala, and Bharatmala Pariyojana. The National Highway network will be increased by 25,000 KM in 2022–2023 for ₹20,000 crore. The construction of additional stretches of national highways, as well as the approval and completion of numerous projects and fundraising efforts, will result in significant growth for India’s road sector in 2022, making it a better year than before.