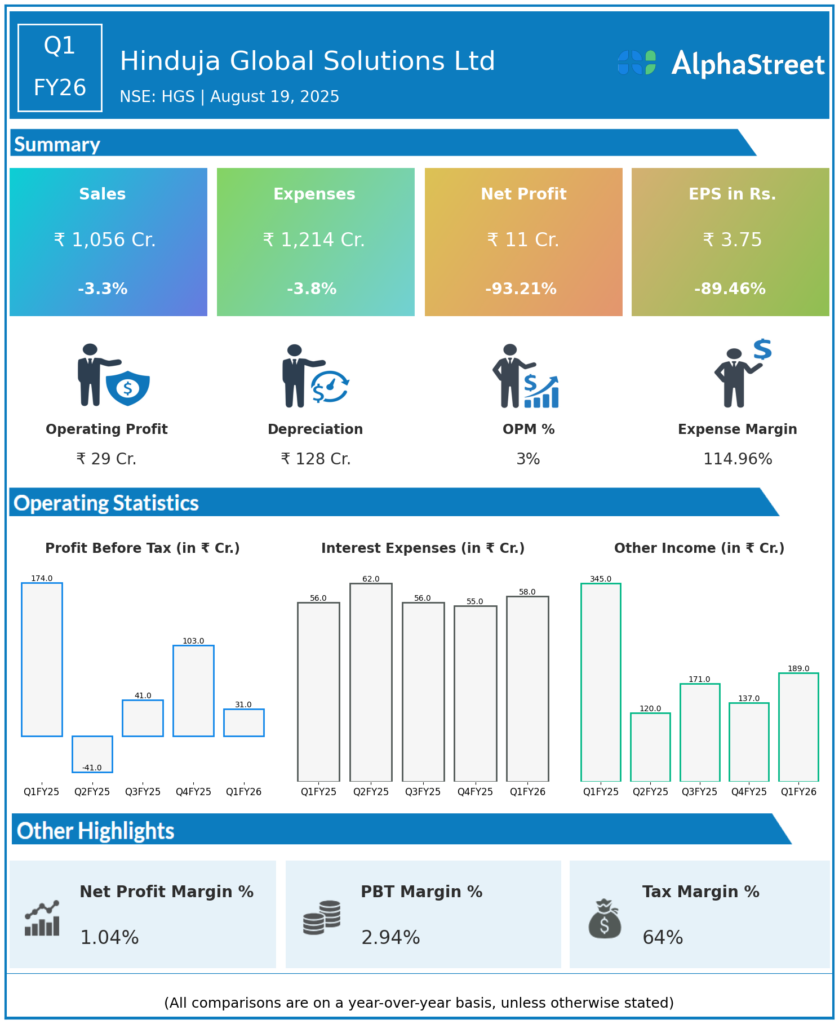

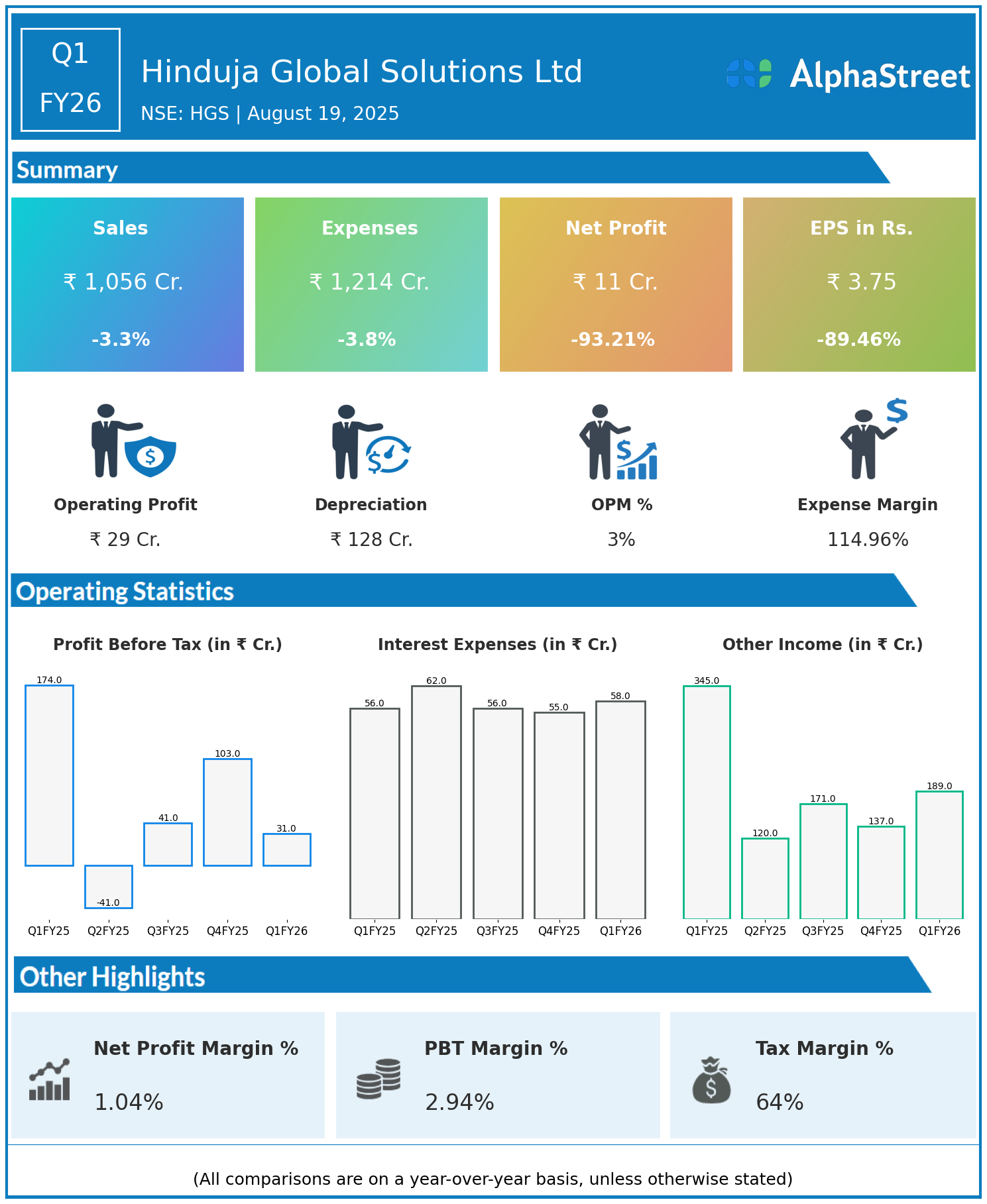

Hinduja Global Solutions Ltd (HGS) is engaged in the business of business process management (BPM), providing voice and non-voice services like contact center solutions and back office transaction processing across the globe. The company operates in sectors including healthcare, telecom, consumer electronics, and banking. Presenting below are its Q1 FY26 Earnings Results

Q1 FY26 Earnings Results

- Revenue from Operations: ₹1,056 crore, down 3.3% year-on-year (YoY) from ₹1,092 crore in Q1 FY25.

- Total Income: ₹1,187.3 crore, down 2.6% YoY from ₹1,218.6 crore.

- Total Expenses: ₹1,213.7 crore, down 3.9% YoY from ₹1,262.8 crore.

- Consolidated Net Profit (PAT): ₹11.2 crore, down 93.1% from ₹161.5 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹12.40, down 73.6% from ₹47 YoY.

- EBITDA: ₹159.7 crore; EBITDA margin: 13.5% (up 169bps YoY).

Operational & Strategic Update

- Revenue Moderation: Revenue declined by 3.3% YoY, mainly due to macroeconomic volatility, extended client sales cycles, seasonality, and a significant client ramp-down.

- Expense Control: Total expenses fell almost 4%, with the company maintaining cost discipline amidst lower business volumes.

- Profitability Decline: Net profit plunged over 93% on a YoY basis, mostly due to the absence of large one-off gains recorded in Q1 FY25 and ongoing sectoral challenges. EPS also dropped sharply.

- Margin Improvement: Despite profit pressure, EBITDA margin improved to 13.5%, driven by a higher share of digital and offshore services and enhanced cost management.

- Strategic Initiatives: HGS is accelerating its focus on digital services, AI-driven solutions, and optimizing its sales pipeline, especially in the Americas, where digital operations now constitute over 55% of new business.

Corporate Developments in Q1 FY26 Earnings

Hinduja Global Solutions’ Q1 FY26 performance illustrates the impact of a tough macro environment and client-specific headwinds on topline and bottom-line outcomes. However, ongoing investments in digital transformation and improving the quality of revenue are yielding stronger margins.

Looking Ahead

HGS plans to sustain margin improvements by deepening its digital and AI-enabled offerings, pursuing cost-efficient business models, and capitalizing on growth opportunities in its key markets. The company remains committed to long-term operational optimization and technology-driven solutions to support profitability.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.