Hindalco is a subsidiary of Aditya Birla Group. It is an Indian aluminium and copper manufacturing company. It was incorporated in the year 1958. The headquarters is located in Mumbai, Maharashtra India. As per data Hindalco is one of the world’s largest aluminium rolling companies and one of the biggest producers of primary aluminium in Asia. Renukut unit was set up in 1962and the company began production of 20 thousand metric tons per year of aluminium metal and 40 thousand metric tons per year of alumina. In 1989 the company was restructured and renamed as Hindalco.

Today Hindalco ranks among the global aluminium producer. It has expanded its footprint in 9 countries outside India. It has been awarded by the Star Trading House status in India. The aluminium and copper are accepted by the London Metal Exchange (LME) with Grade Aaccreditation. Hindalco’s global footprint spans 50 manufacturing units across 10 countries.

Product Portfolio- The product portfolio consists of mainly aluminium and copper. Hindalco is the largest integrated primary producer of aluminium in Asia. The process includes bauxite mining, alumina refining, aluminium smelting to downstream rolling, extrusions and recycling. The final products include alumina, primary aluminium in the form of ingots, billets and wire rods, value-added products such as rolled products, extrusions and foils. Metallurgical alumina, Chemical alumina etc. Hindalco produces LME grade copper cathodes, continuous cast copper rods in various sizes.It also manufactures 19.6mm diameter copper rods, which is used for railway electrification. The co-products sulphuric acid, is used in the production of phosphoric acid and fertilisers like di-ammonium phosphate (DAP).

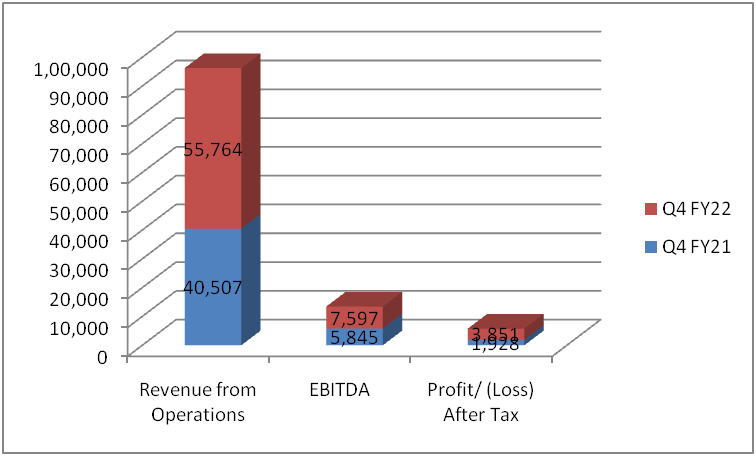

Financial Snapshots (Rs. crore)

For Q4 FY 2022, The consolidated PAT increased by 100% YoY to Rs.3,851 crore. Consolidated EBITDA increased 30% YoY to Rs.7,597 crore. For Aluminium India EBITDA stood at Rs.4,050 crore, increased 123% YoY; EBITDA margin is 41%. For FY 2022 the Consolidated EBITDA increased by 59% to Rs.30,056 crore. Consolidated PAT increased by 294% YoY to Rs.13,730 crore. Aluminium India Business EBITDA increased by 139% to Rs.13,025 crore, and margin is 41%. The Consolidated Net Debt to EBITDA stood at 1.36. The Board has recommended a dividend of Rs.4/share.

Industry Analysis-India is the fourth largest producer of aluminium in the world with a share of around 5.3% of the global aluminium output. The aluminium consumption in India is 2.7 kg per capita, which is much below the industry standards. However the government of India has taken initiatives to invest over US$ 1 billion in this sector. It is anticipated that the aluminium sector will be benefited by this. India’s annual aluminium consumption is expected to double to 7.2 MnT by 2023.

SWOT Analysis

Strength- Hindalco being recognized as the strong brand in the Indian market. The company has successfully obtained high profit margin. The product mix has helped cater to different customers. It is one of the producers of aluminium and copper, which are accepted by the London Metal Exchange.

Weakness- The companyshould focus more on the improvement of gross and net profit. Since Metal Mining industry is growing sector, Hindalco Industries needs to analyze the various trends within the Basic Materials sector and figure out how to drive the future growth. Increasing operation cost is impacting the profit percentage.

Opportunity-Hindalco should focus more on expansion in the International markets. It should concentrate more on technological innovations and advances and improve productivity, allowing suppliers to manufacture a vast array of products and services.

Threat- US and China trade war, Brexit is impacting European Union, and overall instability in the Middle East has impacted the business in local and international markets for Hindalco Industries. New competitors entering and dominating the market. Effect of global pandemic and economic slowdown impacted the business.

Comparative Study

| Companies | PE Ratio | PB Ratio | Dividend Yield |

| Hindalco Industries Ltd | 5.66 | 1.17 | 1.14% |

| National Aluminium Co Ltd | 4.51 | 1.25 | 6.90% |

| MMP Industries Ltd | 14.15 | 1.96 | 0.62% |

If we make a comparative study we will find that in terms of P/E ratio, P/B ratio and dividend yield National Aluminium Co will be better in terms of both business and potential investors.

Segment Analysis– The business segments can be classified into Novelis, Aluminium India and Copper. The EBITDA of Novelis business declined by 15% YoY to $431 million driven by cost inflation, semiconductor chip shortage in automotive and other short-term operational issues. Net Income from operations increased by 21% Y-o-Y to $217 million driven by lower interest expense in Q4 FY22. The Revenue increased by 34% YoY, driven by higher global aluminium prices. EBITDA from Aluminium India business stood at Rs.4,050 crore for Q4 FY22. The revenue is Rs.9,847 crore. The copper Continuous Cast Rod sales increased by 2% YoY, to 74 Kt. EBITDA increased by 20% to Rs.387 crore. The revenue of copper business stood at Rs.9,787 crore with an increase of 15% YoY due to higher global prices of copper and higher volumes.

Key Developments –Novelis announced a strategic capital investment of $3.4 billion towards transformational organic growth. It has invested $2.5 billion in the greenfield Rolling Mill in Alabama, US. An investment of $365 million was done for an advanced recycling centre with an annual recycling and sheet ingot casting capacity of 240 Kt in Guthrie, Kentucky in North America. It also invested $130 million in the Oswego, New York plant to debottleneck and increase hot mill rolling capacity and increase automotive sheet finishing capabilities. $375 million was invested in Zhenjiang, China to expand rolling and recycling capabilities. It also invested $50 million to expand recycling capabilities in Ulsan, South Korea.