HFCL Ltd (Himachal Futuristic Communications Limited) is a diversified telecom infrastructure company engaged in the development of telecom networks, system integration, and manufacturing of high-end telecom equipment, optical fiber, and optical fiber cables (OFC). It also operates in defence electronics, contributing to India’s strategic and digital connectivity goals.

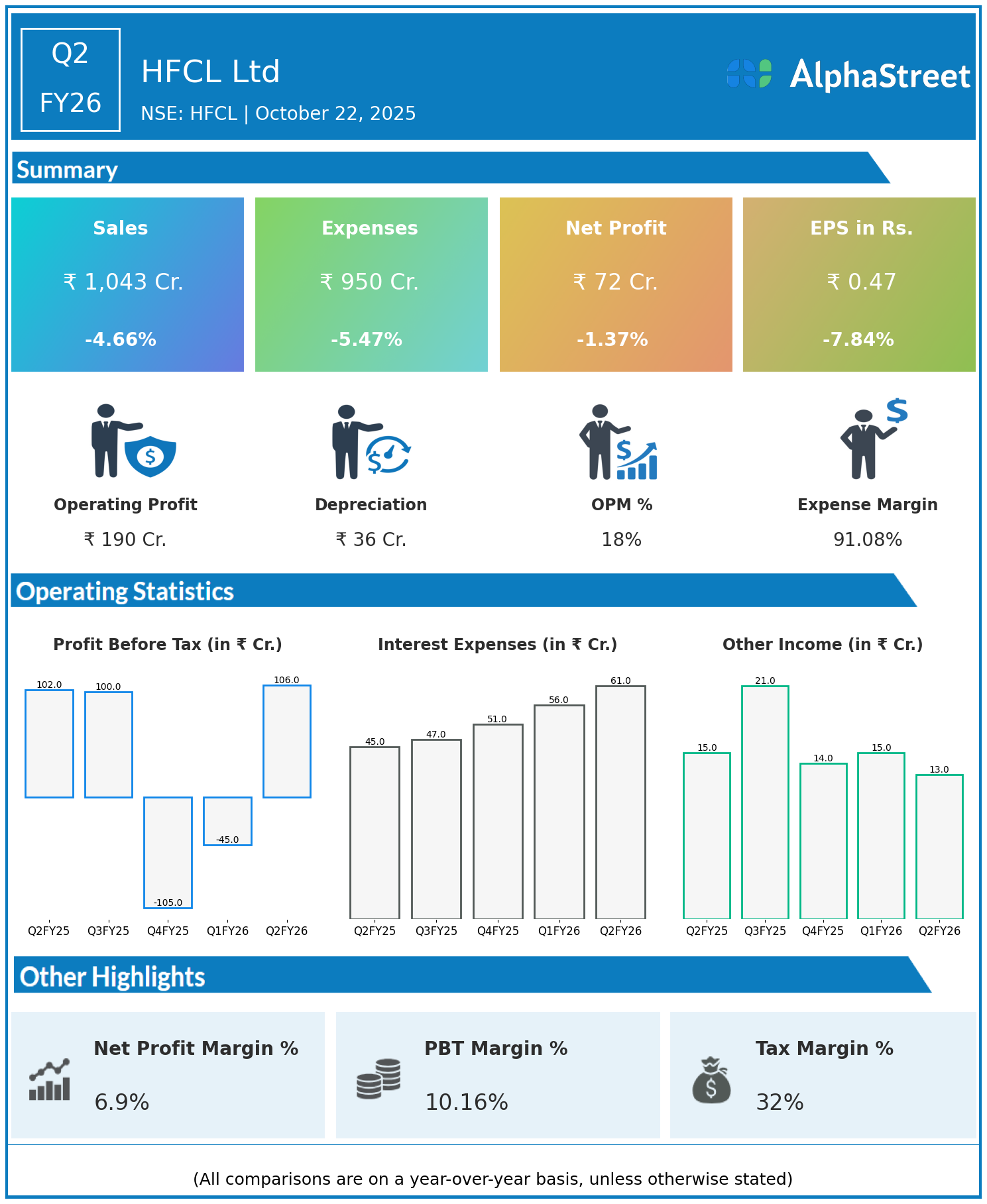

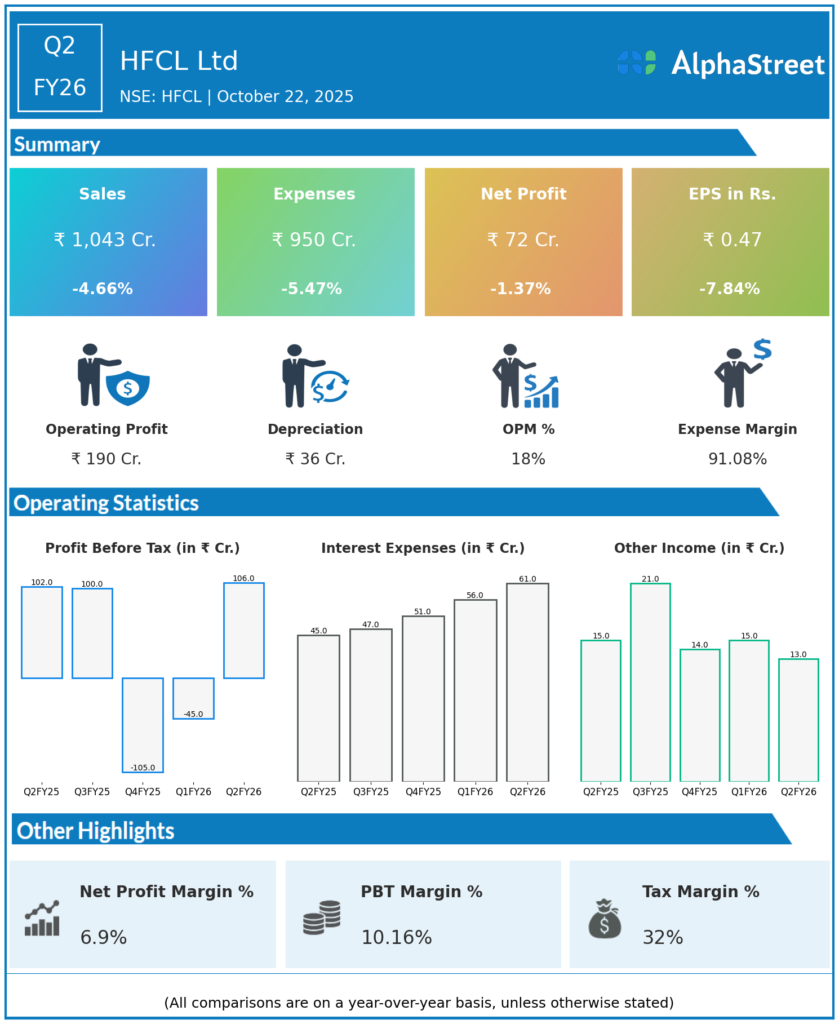

Q2 FY26 Earnings Summary

Consolidated revenue stood at ₹1,043 crore, down 4.66% year on year from ₹1,094 crore.

Total expenses declined 5.47% to ₹950 crore from ₹1,005 crore year on year.

Consolidated Net Profit marginally declined by 1.37% to ₹72 crore from ₹73 crore in the same quarter last year.

Earnings Per Share (EPS) decreased to ₹0.47, down 7.84% from ₹0.51 in Q2 FY25.

EBITDA surged almost fivefold quarter-on-quarter to ₹203 crore, with an improved EBITDA margin of 19.49% compared to 15.71% in the same period last year.

Operational and Business Highlights

The company reported solid operational recovery driven by strong execution in its telecom and defence segments.

Telecom product sales contributed ₹537 crore, while turnkey contracts and services added ₹507 crore during the quarter.

Exports accounted for 28% of the company’s total revenue, supported by growing international demand for optical fiber cables and telecom equipment.

HFCL secured new domestic and overseas orders worth over ₹281 crore, including contracts for BharatNet and defence projects such as thermal weapon sights.

The total order book remained robust at ₹9,981 crore as of September 30, 2025.

Financial Position and Outlook

HFCL continues to maintain a strong balance sheet with total consolidated assets of ₹7,959 crore and equity of ₹4,178 crore.

The company’s ongoing expansion in optical fiber manufacturing will increase capacity to 42.36 million fiber kilometers by June 2026, positioning HFCL among the top global producers.

Management reaffirmed a revenue growth target of 20% for FY26 with stable EBITDA margins, citing strong demand from telecom, defence, and data center markets.

HFCL Ltd remains well-positioned to capitalize on growth opportunities in India’s digital infrastructure and defence sectors, supported by robust order visibility, operational efficiency, and expanding global reach.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.