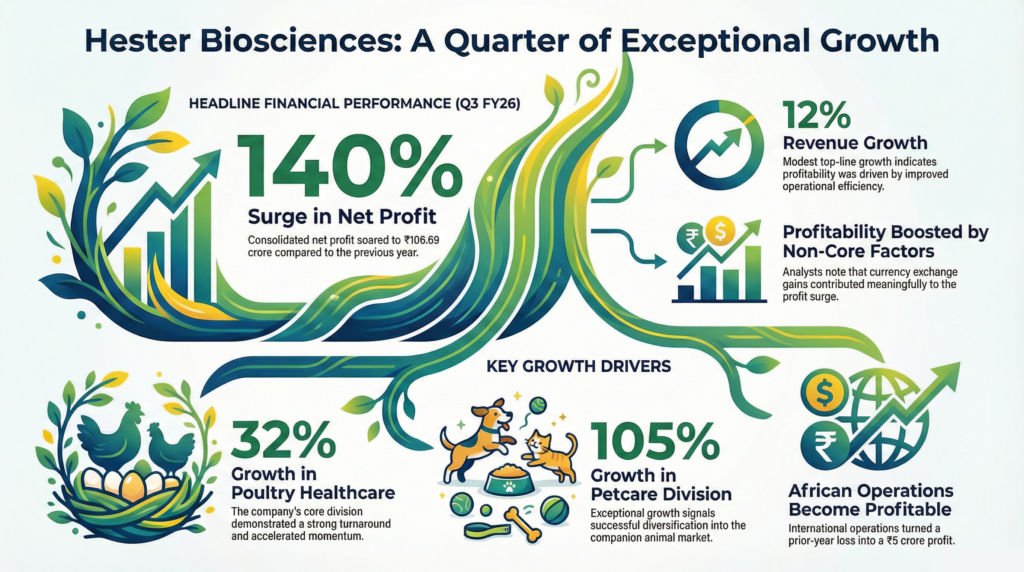

Hester Biosciences Limited (HESTERBIO:NSE), India’s second-largest poultry vaccine manufacturer, announced exceptional third-quarter results today with consolidated net profit climbing 140% year-over-year to ₹106.69 crore. The stock closed at ₹1,483 as of January 30, 2026, valuing the company at ₹1,222 crore market capitalization.

Quarterly Results

Hester Biosciences announced a consolidated net profit of ₹106.69 crore for the quarter ended December 2025, representing a 140% increase year-over-year. Standalone revenue for the period reached ₹84 crore, while consolidated revenue rose 12% to approximately ₹90.40 crore. The Poultry Healthcare Division recorded a 32% increase in sales, while vaccine sales specifically grew by 20%. The Petcare Division achieved growth of 105% during the quarter. These results indicate a profit turnaround driven by operational efficiency and margin expansion despite relatively modest topline growth. This indicates a significant profit turnaround.

Annual Performance Context

For the nine-month period ending December 2025, Poultry Healthcare revenues increased 20% and vaccine sales expanded 27%. The Petcare Division grew 38% over the same period. During the full fiscal year 2025, the company generated ₹286.32 crore in revenue and a net profit of ₹31.84 crore, reflecting 17.24% annual profitability growth. Earnings per share for FY25 were ₹37.43, and an equity dividend of ₹7 per share was maintained. Growth exceeded historical single-quarter profit levels. Cumulative nine-month performance reinforced underlying business momentum through manufacturing efficiency gains.

Business and Operations Update

Animal Healthcare performance normalized in Q3 following delays in government immunization programs during the first half of the fiscal year. Hester maintains a 75% domestic market share in PPR vaccines. International operations in the African markets transitioned to a profit of ₹5 crore on revenue of ₹17 crore, a turnaround from previous losses. Profitability was impacted by material currency gains from exchange rate fluctuations, including ₹7.83 crore in unrealized foreign exchange gains. In the poultry sector, management noted the stabilization of feed costs and bird placement cycles that historically pressured industry margins. Management focused on internal cost structures.

Forward Outlook

Management plans to launch an Avian Influenza vaccine during FY26, targeting both retail availability and export opportunities. This rollout represents the first major product launch in this segment in recent years. The company is prioritizing the execution of government tenders for PPR and Lumpy Skin Disease. While no formal forward earnings guidance was provided for the remainder of FY26, management expects normalized institutional demand and contributions from new product entries. Continued tracking of gross margins and operating expense ratios is required to assess the sustainability of recent efficiency gains.

Performance Summary

Hester Biosciences’ market capitalization stood at ₹1,225 crore with a closing stock price of ₹1,440. This price reflects a 39% decline from the 52-week high of ₹2,350. The surge in profitability is attributed to cost control measures and manufacturing leverage rather than volume acceleration. The company’s diversification into companion animal products and the turnaround in African markets provide additional growth channels. Investors continue to monitor the execution timelines of government programs and the impact of currency fluctuations. The company maintains strategic presence in thirty countries.