Stock Data

Ticker: HEROMOTOCO

Exchange :NSE and BSE

Industry: Automobile

Price Performance

Last 7 days -1.68%

YTD 12.53%

Last 12 months -1.71%

The stock has picked up from Apr’22 due to EV transition. On last Friday the shares jumped over 6% after the company announced a 4% hike in the vehicle price.

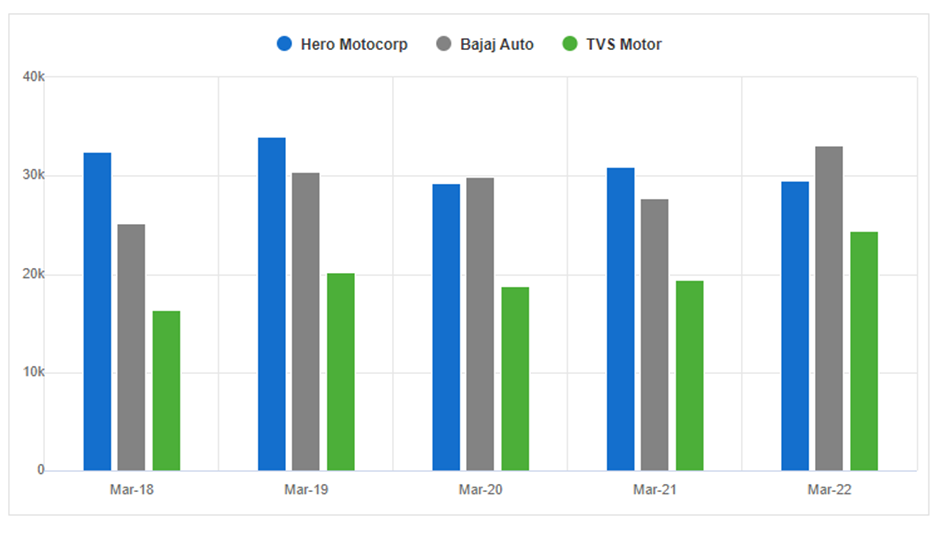

The stock fell last year owing to supply chain disruptions, chip shortage and rising input prices. Hero Motocorp has given much less return compared to TVS Motor in last year. The stock has underperformed.

Events to watch out for:

First quarter results on Aug. 12, 2022

Earnings conference call on Aug. 13, 2022

Company Description

Motorcycle manufacturer Hero MotoCorp was founded in 1984. Hero Moto Corp was earlier known as “Hero Honda”. The name was changed, as Honda entered in a partnership with Hero. Hero Honda Motors Ltd received a fresh copy of Certificate of Incorporation and the name changed to Hero MotoCorp Limited on 29th July 2011.

The company has its headquarters in New Delhi, India. Hero Motocorp has taken rapid strides to expand its presence to 40 countries across Asia, Africa, and South & Central America.It holds 50% share in the domestic motorcycle market.The product range comprises of CDDeluxe,Pleasure,Splendor +,SplendorNXG,PassionPRO,PassionPlus,SuperSplendor.

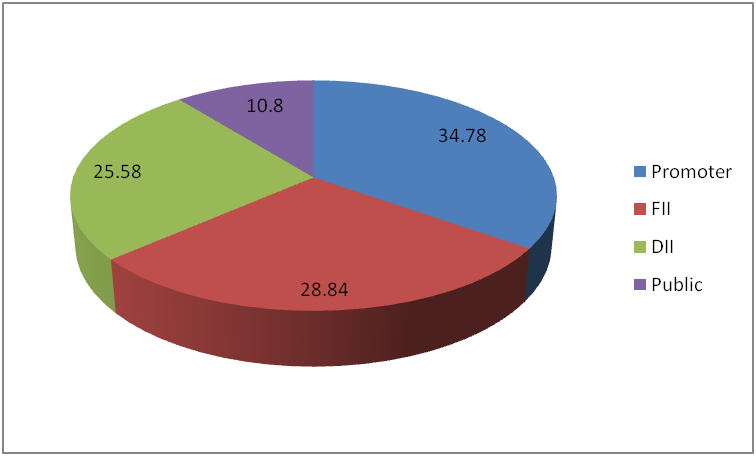

Share holding Pattern in Percentage

As on July 2022, Hero MotoCorp reported sales of 445,580 units, up 19% Y-O-Y. It has exported 14,896 units in July 2022 as compared to 25,190 units shipped in the same month last year. The company aims to strengthen its footprint in the used two-wheeler segment. It has announced the facility of exchange of existing two-wheelers of any brand in the best resale value. Customers can avail this facility even from their smartphones.

The company has partnered with Accenture to scale up and enhance its future-ready supply chain. Accenture will use its zero-based supply chain approach to facilitate Hero MotoCorp’s cost optimization.

New Launches

Hero MotoCorp has launched Euro-5 compliant versions in Turkey to further strengthen its commitment and operations in the Turkey market.

The company has launched Splendor +XTEC. The model comes with five years of warranty and at a price of Rs 72,900. It has the following features like digital meter with bluetooth connectivity, call and SMS Alert, Real time mileage indicator, high intensity LED lamp and USB Chargers. It comes with i3S technology.

Hero Motocorp also launched the Canvas Black Edition of the iconic Super Splendor. It comes with few new features like fuel efficiency, mileage of 60-68 kmpl, new Digi Analog Cluster, an Integrated USB Charger, Side-Stand Engine Cut-off, and a refreshed look.

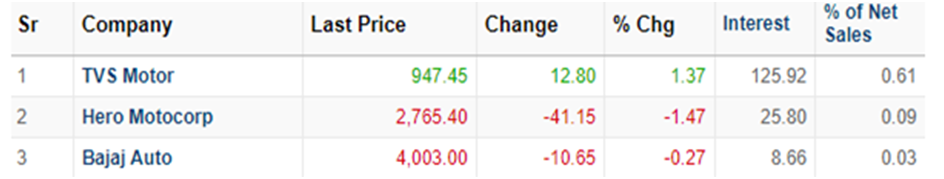

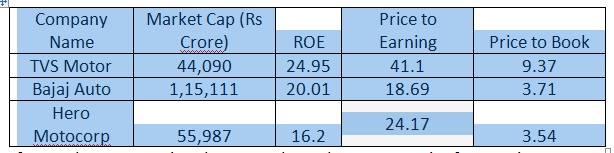

Peer Comparison

If we make a comparison between these three companies from an investor perspective, Bajaj auto is in a better positioned based on the P/E ratio and Market Cap followed by Hero Motocorp and TVS Motors.

The image of the company was greatly impacted due to the Income tax raid, which took place on 23-24 March. The income tax department has collected evidences that Hero MotoCorp has booked bogus purchases, made huge unaccounted cash expenditures of more than Rs 1,000 crore. The department also found over Rs 100-crore cash transactions for a farmhouse in Chhattarpur, Delhi. The Central Board of Direct Taxes confirmed that HeroMotocorp has siphoned off money by way of layering. This impacted the share market,the share dropped over 6% to Rs 2,150.

Our View- TheCompany has launched several new products in the market The company has concentrated on technological advancement in its new launches. It is expected that the sales momentum for the two wheeler industry will increase in the coming months in both the urban and rural sectors. Hero MotoCorp led the segment in sales with 4.6 lakhs units. It is also in a better position due to tie-ups with Ather Energy and other several brands on EV transition.