Stock Data:

| Ticker | NSE: HEROMOTOCO |

| Exchange | NSE |

| Industry | AUTOMOBILES & AUTO COMPONENTS |

Price Performance:

| Last 5 Days | -2.25% |

| YTD | +13.36% |

| Last 12 Months | +10.24% |

Company Description:

Hero MotoCorp Ltd. is a leading two-wheeler manufacturing company headquartered in New Delhi, India. With a rich heritage spanning over three decades, Hero MotoCorp has emerged as the world’s largest two-wheeler manufacturer. The company is committed to providing efficient and reliable mobility solutions, empowering millions of people with their wide range of motorcycles and scooters. The company operates a vast network of dealerships, ensuring accessibility and customer satisfaction.

Critical Success Factors:

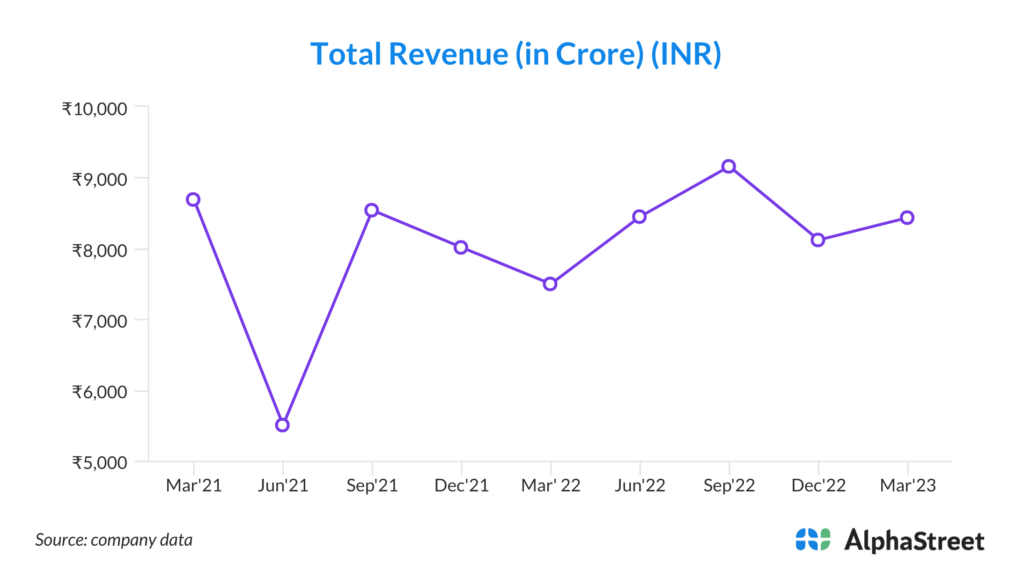

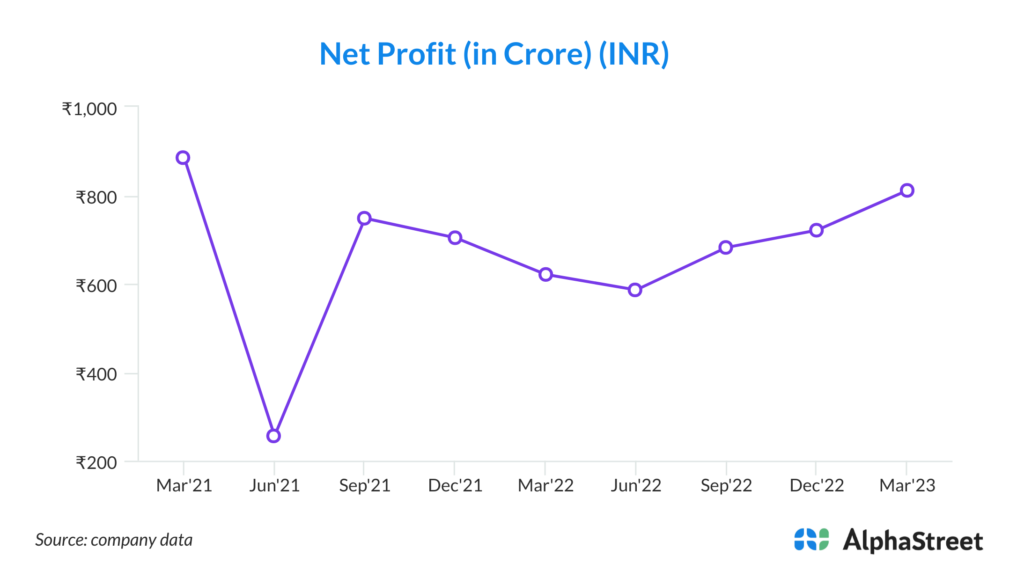

1. Strong Financial Performance: Hero MotoCorp has demonstrated impressive financial growth with revenues increasing by 12%, EBITDA by 31%, and profit after tax by 37%. The company’s focus on non-product revenue streams, such as the Parts, Accessories, and Merchandise (PAM) business, has resulted in high quarterly and full-year revenues.

2. Widest and Deepest Distribution Network: Hero MotoCorp boasts the widest and deepest distribution system in India. Leveraging this extensive network, the company aims to ensure maximum reach for its products, including its EV business, and capitalize on the demand in both urban and rural markets.

3. Market Share Recovery: The company has witnessed a market share recovery, with significant improvements in market share in various segments. Hero MotoCorp’s strong presence in the motorcycles segment, including the popular Splendor and HF Deluxe models, has helped the company regain its market share, particularly in the 125cc segment.

4. Focus on Product Innovation: Hero MotoCorp plans to launch new products every quarter in the fiscal year, targeting segment-wise growth and market share expansion. The company has introduced features and variants in its products, such as tubeless tires, USB chargers, LED headlamps, Bluetooth, and digital speedometers, to cater to evolving customer preferences.

5. Cost Reduction Initiatives: Hero MotoCorp is committed to cost reduction and efficiency enhancement through programs like LEAP and LEAD. The company focuses on driving cost efficiencies across the entire value chain, considering ideas from various stakeholders and regularly benchmarking against competition to maintain a competitive edge.

6. Optimistic Market Outlook: Hero MotoCorp is optimistic about the Indian economy’s resilience and expects double-digit revenue growth in the two-wheeler industry. The company anticipates continued growth in both rural and urban areas, driven by increased employment, income, and spending, along with favorable macroeconomic factors like government CapEx spending, GST collections, and stable forex rates.

Key Challenges:

1. Dependency on Economic Factors: Hero MotoCorp’s performance is closely linked to the overall economic conditions in India. Any adverse changes in the Indian economy, such as inflation, financial sector issues, or geopolitical challenges, could impact consumer purchasing power and demand for two-wheelers, affecting the company’s revenue and profitability.

2. Competitive Landscape: The two-wheeler industry in India is highly competitive, with several established players and new entrants vying for market share. Hero MotoCorp faces the risk of intensified competition, which could put pressure on pricing, market positioning, and profitability. The success of its product launches and ability to differentiate itself from competitors will be crucial.

3. Uncertainty in Rural-Urban Demand: The demand pattern in rural and urban areas can be unpredictable, as observed during festivals. Hero MotoCorp relies on a balanced demand from both segments, and any significant fluctuations or dampened demand in either segment could impact the company’s sales and revenue growth.

4. EV Market Penetration: While Hero MotoCorp is making efforts to expand its presence in the electric vehicle (EV) segment with the VIDA electric scooter, the success and rate of EV adoption remain uncertain. The ramp-up of EV operations could pose challenges, including higher initial costs, longer breakeven periods, and the need for continuous innovation and cost reduction to stay competitive in the evolving EV market.

5. Commodity Cost Volatility: Hero MotoCorp is susceptible to fluctuations in commodity prices, including those of key raw materials like steel and aluminum. Any significant increase in commodity costs could put pressure on the company’s margins unless adequately offset by pricing adjustments or cost reduction initiatives.

6. Regulatory Changes and Compliance: Hero MotoCorp operates in a highly regulated industry and must adhere to various safety, emission, and quality standards. Changes in government regulations, such as emission norms or import/export policies, could require significant investments in research and development, production processes, and compliance measures, potentially impacting the company’s costs and operations.