HealthCare Global Enterprises Limited (NSE: HCG; BSE: 539787) India’s largest specialized cancer care provider, reported 13% revenue growth and 20% adjusted EBITDA expansion for the third quarter ended December 31, 2025. On the reporting day, the stock price reached ₹564.20, a 0.78% decrease, implying a capitalization of ₹7,955.65 crore.

Quarterly Results

Total revenue reached ₹6,331 million for the quarter, compared to ₹5,586 million year-ago. Adjusted EBITDA grew 20% to ₹1,108 million, resulting in a margin expansion of 98 basis points to 17.5%. The Board of Directors approved these unaudited standalone and consolidated financial results for the quarter. Adjusted profit after tax was ₹6 million, a decline from ₹70 million year-over-year.

This decline was attributed to higher depreciation and interest costs totaling ₹1,055 million related to growth investments. A reported loss of ₹94 million included a ₹127 million exceptional charge for new Labor code impacts. Excluding fertility services, volume grew 8% while Average Revenue Per Occupied Bed (ARPP) increased 5%.

Annual Performance Context

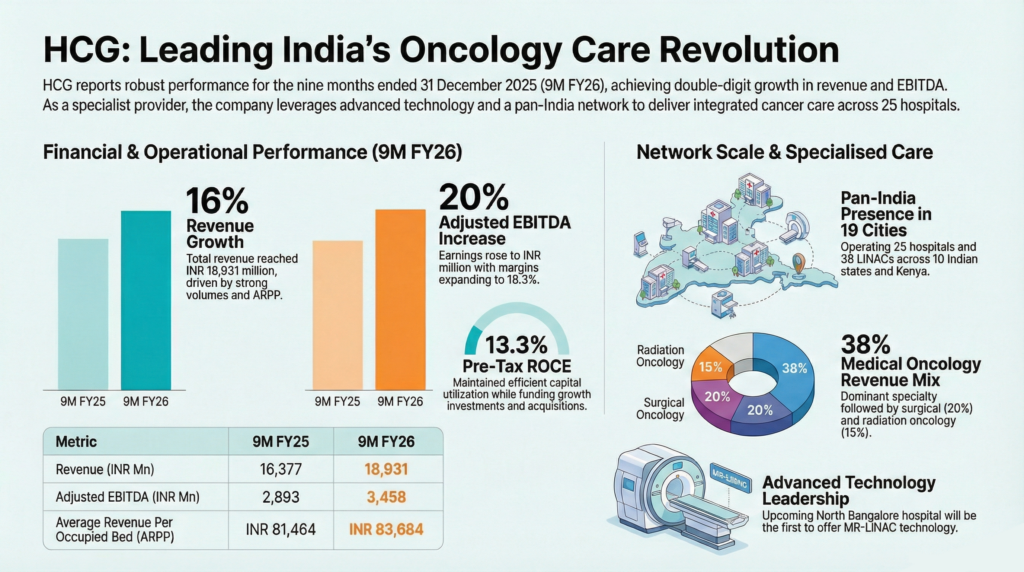

In the first nine months of fiscal year 2026, revenue totaled ₹18,931 million, a 16% increase. Adjusted EBITDA rose 20% to ₹3,458 million, with margins at 18.3%. Nine-month adjusted profit after tax was ₹216 million compared to ₹371 million previously. Pre-tax return on capital employed was 13.3%. Payor mix consisted of 55% from cash and insurance and 33% from government schemes. Medical oncology represented 38% of total revenue.

Business and Operations Update

The West cluster accounted for 45% of revenue and grew 17% on patient inflows in Gujarat and Maharashtra. South cluster revenue increased 9% to account for 39% of the total, despite disruptions to state-sponsored schemes in Andhra Pradesh. East cluster revenue rose 12% on penetration in Ranchi and Cuttack. Kenya operations reported 42% year-over-year growth to ₹157 million, while Milann fertility revenue increased 11%. Total capital expenditure was ₹2,227 million. Net debt, including capital leases, stood at ₹16,337 million.

Forward Outlook

The 120-bed North Bangalore Greenfield Hospital is scheduled to operationalize by the end of the fourth quarter of fiscal year 2026. This facility will introduce MR-LINAC technology to the region. Strategic priorities include brownfield expansions and developing asset-light adjacencies. The company has completed leadership recruitment across marketing and international business. New leaders for finance, technology, clinical strategy, and investor relations roles join by fiscal year 2027. No specific financial guidance was provided.

Performance Summary

Revenue and operating profit increased across all geographic clusters during the third quarter. Operating margins improved through leverage, although net profit was affected by exceptional items and growth-related costs. The company maintains a network of 25 hospitals and 38 LINACs. Network-wide growth was supported by simultaneous increases in patient volumes and average revenue per bed. Recent efforts focused on clinical technology differentiation and strengthening the management team.