Company Overview

HDFC Life Insurance Company is a leading player in the Indian life insurance sector, offering a diverse portfolio of insurance and investment products including Protection, Pension, and Savings. Its products cater to individual and group customers and are distributed through an extensive network of agents, banks, corporate partners, and digital platforms.

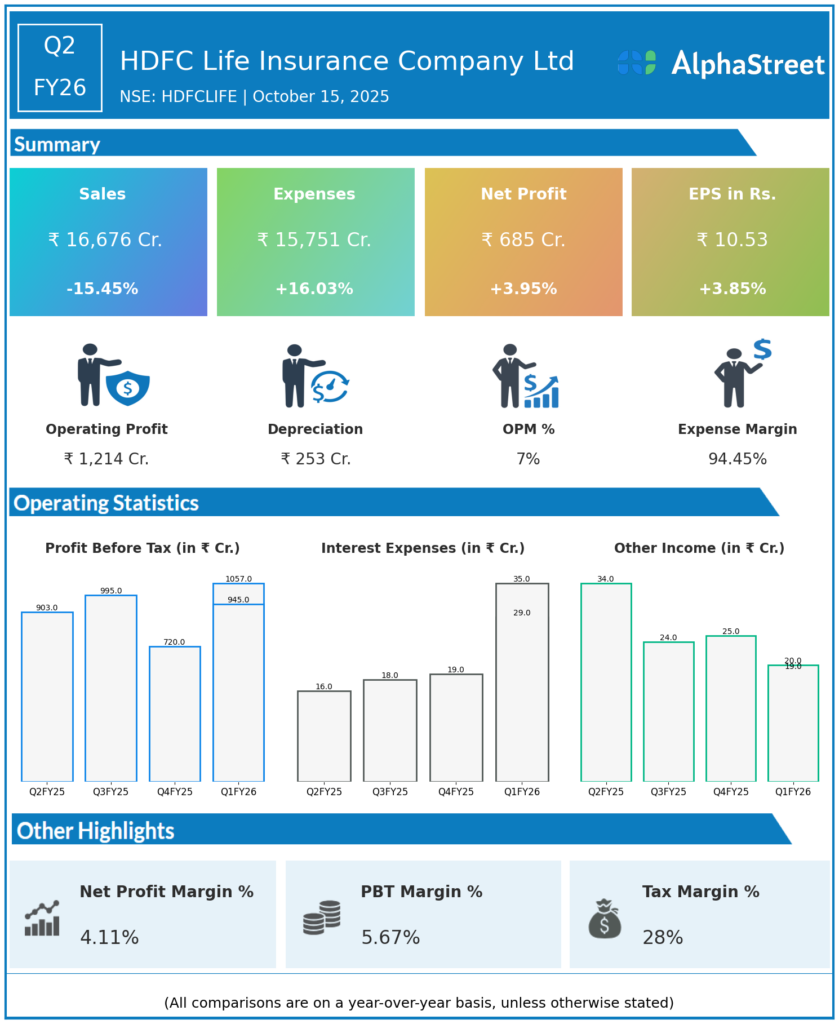

Q2 FY26 Earnings Results

HDFC Life reported consolidated revenues of ₹16,676 crore for Q1 FY26, marking a decline of 15.45% year-on-year from ₹28,497 crore. Total expenses increased by 16.03% to ₹15,751 crore compared to ₹13,575 crore in the same quarter last year. The company posted a consolidated net profit of ₹685 crore, representing a 3.95% rise from ₹659 crore year-on-year. Earnings per share rose 3.85% to ₹10.53 from ₹10.14 during the same period.

Operational & Strategic Update

- The company reported a 12.5% growth in Annualized Premium Equivalent (APE), underpinned by strong demand in retail insurance segments.

- Value of New Business (VNB) was ₹809 crore for the quarter, up 12.7%, with improved margins reflecting a favorable product mix and growth in high-margin segments.

- Assets under Management (AUM) increased 15% year-on-year to ₹3,55,897 crore, highlighting strong fund inflows and investment performance.

- Persistency metrics remained healthy with 13th and 61st month rates at 86% and 64%, respectively, supporting long-term business sustainability.

- The company’s market share increased 70 basis points overall to 12.1%, with the private sector share growing to 17.5%.

- Focus on digital transformation, product innovation, and customer-centric initiatives continue to drive growth.

Outlook

HDFC Life is well-positioned to sustain growth through continued innovation, expanded distribution, and superior operational efficiencies. Strategic investments in technology and an emphasis on high-margin product segments are expected to underpin profitability and market leadership going forward.

Explore the company’s past earnings and latest concall transcripts click here to visit the AlphaStreet India News Channel.