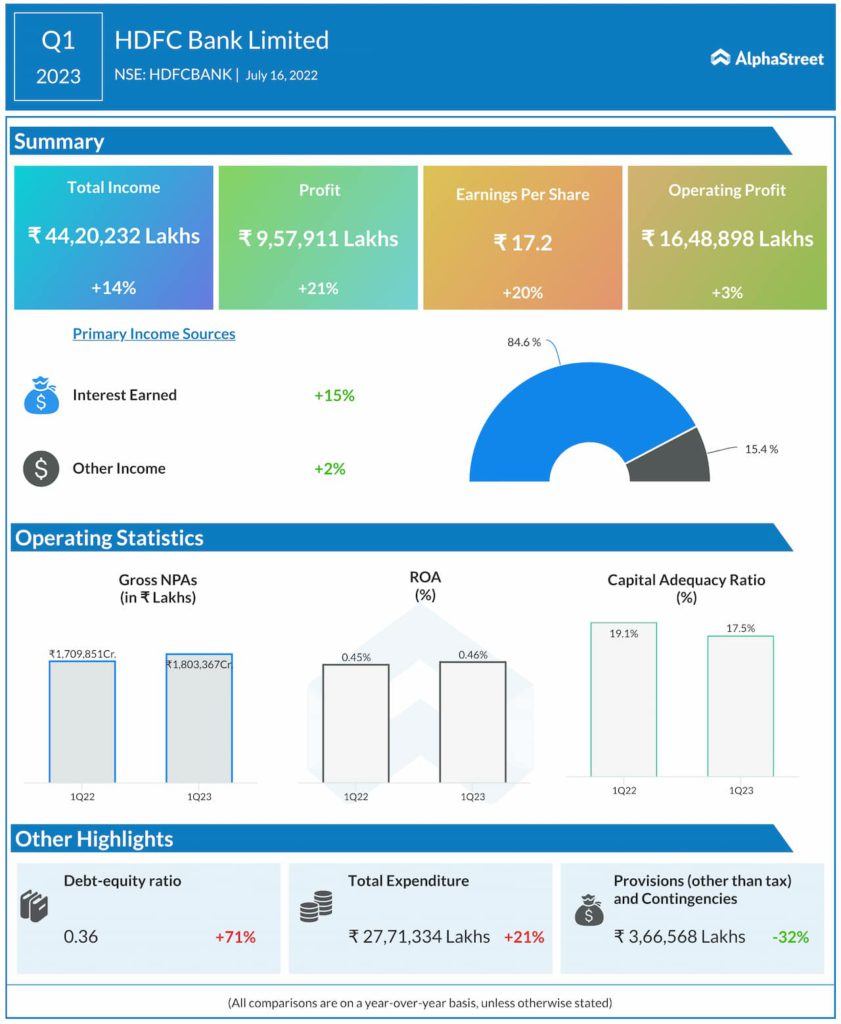

Total Income for Q1 FY23 has increased by 14% YoY to ₹44,20,232 lakhs. Profits rose by 21% YoY to ₹9,57,911 lakhs. Total Expenditure grew by 21% YoY for Q1 FY 2023.

Return on Average Assets grew to 0.46% from 0.45% a year ago. In this quarter’s results, it is clearly visible that provisions and contingencies are the major drivers of growth in profitabilty. Provisions and Contigencies decrease by 32% YoY is the reason as to why there is an 3% jump in Operating Profits but a 21% jump in Profits.

To further read this quarter’s research sheet, check out this link.