Company Overview

Incorporated in 1999, HDFC Asset Management Company (HDFC AMC) is one of India’s leading asset management companies, providing fund management services across a broad range of mutual fund and portfolio management schemes for individual and institutional clients. Presenting below its Q2 FY26 Earnings Results.

Q2 FY26 Earnings Results

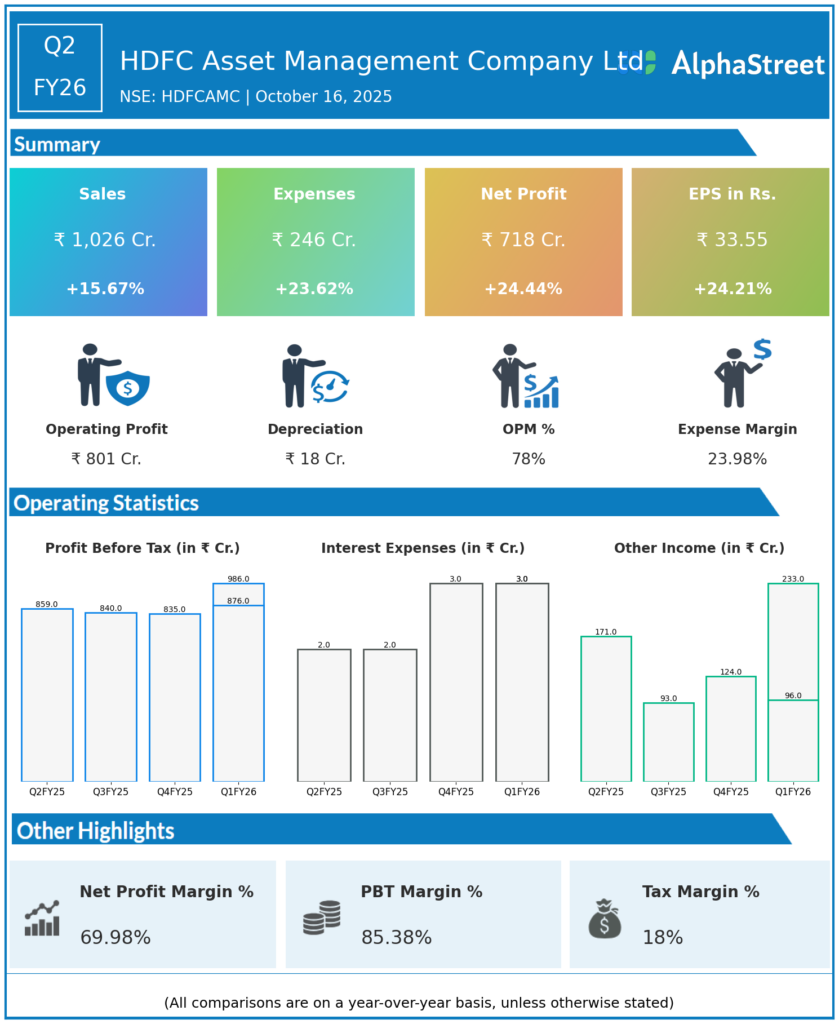

HDFC AMC reported revenues of ₹1,026 crore for Q2 FY26, up 15.67% year-on-year from ₹887 crore. Total expenses rose 23.62% to ₹246 crore. The company posted a consolidated net profit of ₹718 crore, jumping 24.44% year-on-year from ₹577 crore. Earnings per share climbed 24.21% to ₹33.55 from ₹27.01.

Operational & Strategic Update

- The company’s quarterly average assets under management (QAAUM) grew to ₹8.29 lakh crore, up 23% year-on-year, with individual investors accounting for 70% of AUM—underscoring retail demand and market leadership.

- Operating profit margins held strong, with profit before tax rising 31% year-on-year and sustained growth in consolidated PAT.

- HDFC AMC continued to outperform the industry in equity AUM market share and client acquisition, servicing over 24 million live accounts at the end of June 2025.

- The company’s distribution footprint and digital initiatives have further strengthened efficiency and reach.

Outlook

HDFC AMC aims to drive continued growth through digital transformation, retailer-centric products, and operational excellence. The company’s robust brand, large client base, and leading market position support confidence in sustained profitability and long-term value creation for shareholders.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.