Stock Data

Ticker: HCLTECH

Exchange :NSE and BSE

Industry: Information technology Consulting Outsourcing

The share price of HCL Tech is Rs 973.85 as on 19 Aug, 2022, 02:59 PM IST. The share price increased by 0.04% based on previous share price of Rs. 980.6. In last 1 month, HCL Tech share price increased by 9.35%.The company has a market capitalization of Rs 2,65,356 Crores and it ranks third in IT Sector for its Market Cap. It is trading at a High PE ratio that is 19.53.The 12 month trail of EPS is 50.03. Hence from an analyst point of view HCL Technologies Ltd has a “Buy” rating for the long term.

HCL Tech, one of the IT giants, has also wiped away a quarter of its value and touched its 52-week low on 5 July 2022. The major factors contributing to such a fall are the attrition rate increased to 23.8% in the June 2022 quarterand weak margin due to increase in employee cost. Therefore we can conclude that all Indian IT stocks have fallen. The BSE IT index has fallen 28% in 2022.

Investment Thesis

Financial Snapshot- The Revenue for Q1 FY 23 stood at Rs 23,464 crores; increased 3.8% QoQ & up 16.9% YoY. The Net income stood at Rs 3,283 crores; declined 8.6% QoQ & up 2.4% YoY. EBITDA stood at Rs 4,975, declined 1.5%QoQ and 1.7% YOY. EBIT stood at Rs 3,992 increased 1.5% YOY and declined -1.8% QOQ.

Performance Analysis

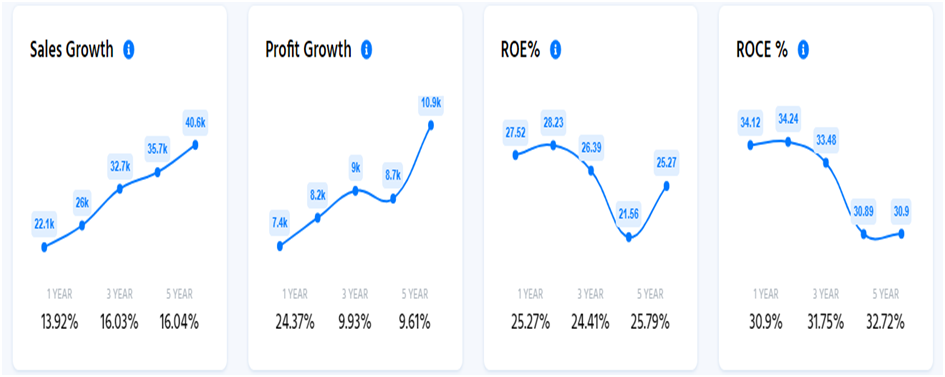

The company has achieved sales growth of 16.03% in last 3 years. However it has declined to 13.92% in last 1 year. The profit has grown to 24.73% in last 1 year compared 9.93% in last 3 years. The ROE has improved 25.27% in last 1 year. But ROCE declined to 30.9% in last 1 year compared to 31.75% in last 3 years.

Shareholding Pattern

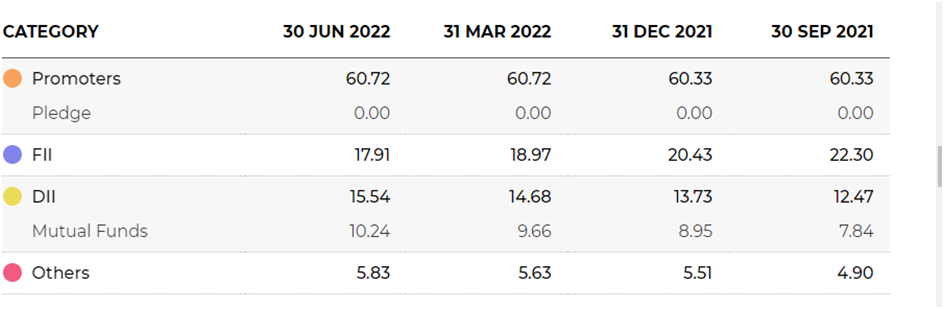

The Promoters holding remained constant at 60.72% and there is zero Promoter’s pledge. The Mutual fund holding has increased to 10.24%. The FII holding declined to 17.91%.

Business Outlook– The company expects revenue to grow between 12% to 14% in constant currency. EBIT margin is expected to be between 18% to 20%.

Geographical Segment Analysis– The geographical presence can broadly be classified into Americas, Europe and ROW. For America the revenue increased 2.8% QoQ and 17.5% YoY. For Europe the revenue increased 1.6% QoQ and 22.5% YoY. For ROW the revenue has increased 1.1% QoQ and 18.2% YoY.

Company description– HCL Technologies (Hindustan Computers Limited) is an Indian multinational company. It mainly deals with information technology and consulting. It was founded on 11th August 1976. The founder is Shiv Nadar. It is headquartered in Noida, Uttar Pradesh, India. It mainly deals with IT and Business Services (ITBS), Engineering and R&D Services (ERS), and Products and Platforms (P&P). It has global delivery capabilities, and over 211,000 ‘Ideapreneurs’ across 52 countries. The major services include IT & Business Services, Engineering & R&D Services. The product platform includes Industry Software Division, Actian Avalanche Hybrid Cloud Data Platform and Nippon – Workforce Analytics Solution.

Stock Analysis– The Stock has underperformed the Indian IT industry which returned -8.3% over the past year. P/E ratio in terms of industry average – HCLTECH has good value based on its Price-To-Earnings Ratio (19.53) compared to the Indian IT industry average (26.2). The stock is expected to be high in 3 years time (25.8%). HCLTECH has more cash than its total debt and is well covered by operating cash flow.

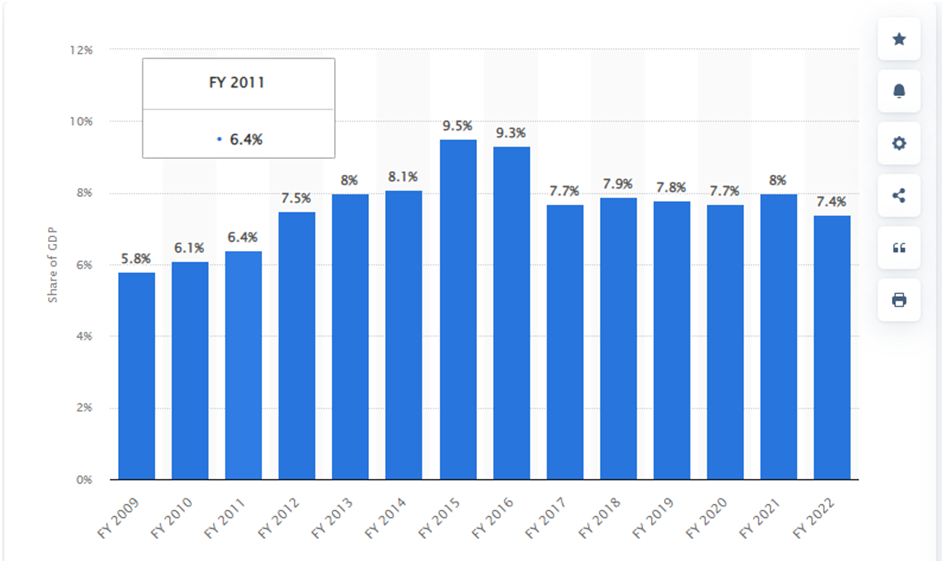

Industry Analysis– According to Statista,India’s IT industry contributes 7.7% to GDP. Revenue from digital is expected to contribute 38% of all IT & ITES revenue by FY25. If we analyse the IT industry, we can see Opportunity-wise, the IT sector is growing. But on the other hand there is a huge shortage of talented employees. The employees have multiple job opportunities.

Information technology/business process management sector in the GDP of India

Inherent Strengths- HCL Technology is a growing global technology company. The company continuously focuses on innovation and R&D. It has a digital partner ecosystem. It concentrates on core technologies like Analytics, Digitization, Cloud, Automation etc.

Peer Analysis

| Company Name | MCap(Cr) | TTM PE | P/B | ROE(%) | Debt to Equity |

| HCL Tech | 2,66,102.00 | 19.6 | 4.29 | 21.8 | 0.06 |

| TCS | 12,44,479.96 | 32.08 | 13.85 | 42.99 | 0 |

| Infosys | 6,75,864.71 | 30.34 | 8.92 | 29.34 | 0 |

| Wipro | 2,42,960.01 | 21.04 | 3.71 | 18.69 | 0.23 |

| Tech Mahindra | 1,07,447.79 | 20.1 | 4.23 | 20.7 | 0.06 |

If we make a peer analysis from investor prespective, TCS will be the first selection by any investor based on the Market Cap, ROE and Debt to Equity ratio. The next preferable stock for investment will be Infosys and HCL Tech.

Strategic Deals– HCL Technologies has acquired Confinale AG, a Switzerland-based digital banking and wealth management consulting specialist, and Avaloq Premium Implementation Partner. The company has even decided to acquire Quest Informatics Private Limited – an aftermarket, Industry 4.0, and IoT company, in a cash deal. HCL Technologies has entered into a strategic deal with the largest healthcare services to manage end-to-end technology operations. An European bank has chosen HCL Technologies for cloud transformation and hybrid cloud operations. A life sciences company based out of Europe entered into a strategic deal with HCL Technologies to enable end-to-end security operations for the entire digital, IT and OT landscape.