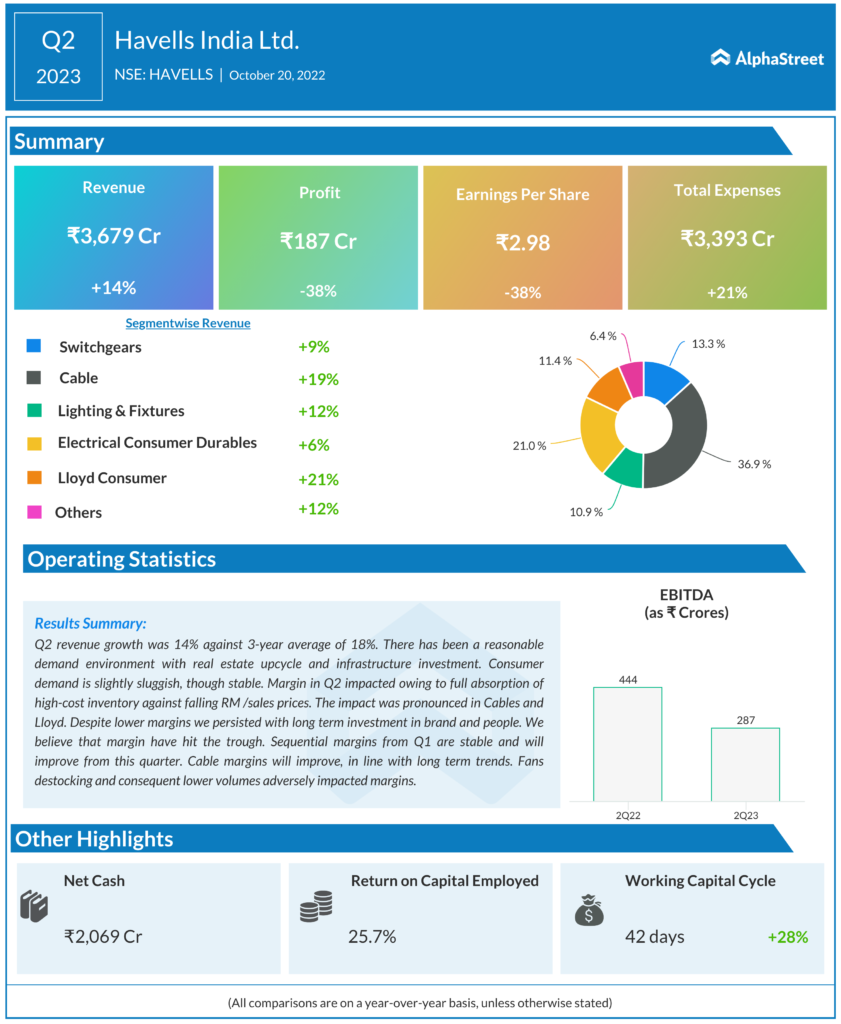

On Wednesday, the consumer electrical goods maker – Havells reported its earnings for the quarter ended September 30. The company reported a 38.15 per cent decline in its consolidated net profit to INR 187.01 crore as commodity inflation hit its margins. Meanwhile, Revenue from operations rose by 13.63 per cent to INR 3,679.49 crore during the period under review as against INR 3,238.04 crore in the corresponding period last fiscal.

Its total expenses were at INR 3,471.57 crore, up 21.10 per cent during the second quarter of FY 2022-23 as against INR 2,866.54 crore. Havells India Chairman and Managing Director Anil Rai Gupta said: “Decent revenue growth considering the inflationary environment. Margins adversely impacted due to commodity cost fluctuation.” “We believe that margins have hit the trough and are expected to improve hereon. The demand outlook remains positive, he added.

Revenue from the Switchgears segment was INR 487.90 crore and INR 1,359.39 crore from the cables segment. While revenue from lighting and fixtures in the second quarter of FY23 was at INR 401.75 crore. Its revenue from Electrical Consumer Durables was at INR 773.47 crore.

Revenue from Lloyd Consumer, a company which Havells had acquired in 2017, was at INR 419.79 crore. Shares of Havells India Ltd on Wednesday settled at INR 1,248.35 a piece on BSE, down 0.69 per cent.