Havells India Limited is a leading Fast Moving Electrical Goods (FMEG) Company and a major power distribution equipment manufacturer with a strong global presence.

It enjoys enviable market dominance across a wide spectrum of products, including Industrial & Domestic Circuit Protection Devices, Cables & Wires, Motors, Fans, Modular Switches, Home Appliances, Air Conditioners, Electric Water Heaters, Power Capacitors, Luminaires for Domestic, Commercial and Industrial Applications.

Financial Results:

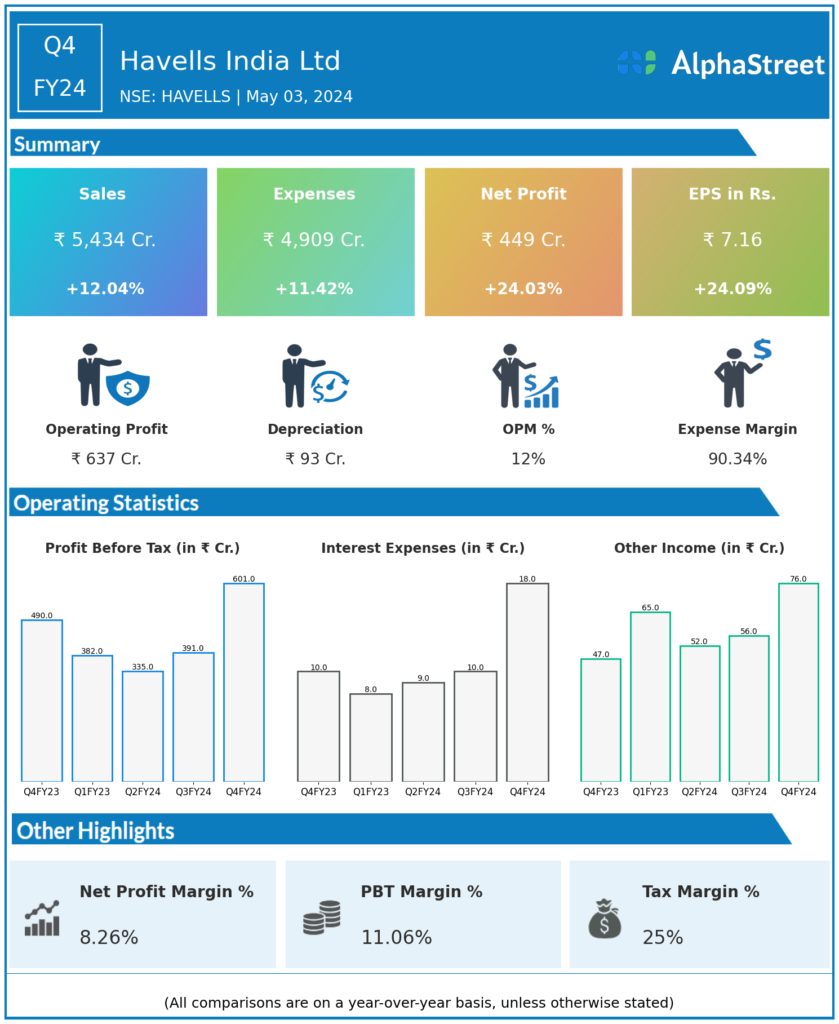

Havells India Ltd reported Revenues for Q4FY24 of ₹5,434.00 Crores up from ₹4,850.00 Crore year on year, a rise of 12.04%.

Total Expenses for Q4FY24 of ₹4,909.00 Crores up from ₹4,406.00 Crores year on year, a rise of 11.42%.

Consolidated Net Profit of ₹449.00 Crores up 24.03% from ₹362.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹7.16, up 24.09% from ₹5.77 in the sa

me quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.