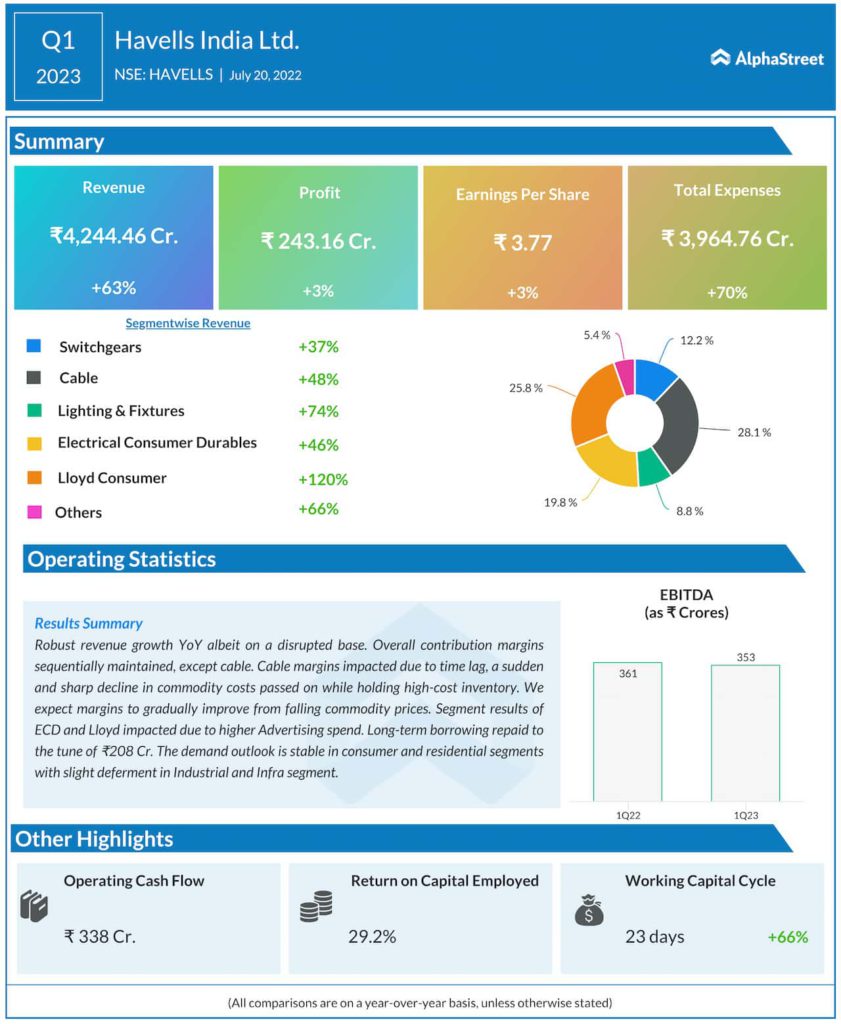

Revenue for Q1 FY23 has increased by 63% YoY to ₹4,244.46 crores. Long Term Borrowings repaid to the tune of ₹208 crores. Profit increased by 3% YoY to ₹243.16 crores for Q1 FY 2023. Total Expenses rose by 70% YoY to ₹3,964.76 crores. The management believes that the company will be benefited by commodity prices cooling down.

ROCE fell to 29.2% YoY but the Working Capital Cycle improved from 68 days a quarter ago to 23 days. Operating Cash Flow fell to ₹338 crores. The management has shared that the firm saw robust growth. However, margin pressures in the Cable Segment and advertising spending on ECD and Lloyd are the reasons for the little growth in profits this quarter. In this quarter’s results, management suggested that the demand outlook seems stable in consumer and residential segments but the industrial and infra segment demand may seem bleak.

To further compare this quarter’s results to the past, check out this link.