Stock Data

Ticker: GULFOILLUB

Exchange :NSE and BSE

Industry: Lubricants

The share price of Gulf Oil India is Rs 448.20 as on 22 Aug, 2022, 04:03 PM IST. The price has declined by 2.44% based on previous share price of Rs. 465.8. In last 1 Month, Gulf Oil India share price moved up by 4.85%. The share has achieved 52 week high of Rs 625.85 and 52 week low of Rs 377.60. The share price is analyzed based on a few key parameters. The company has achieved PE Ratio of Gulf Oil India is 9.54. The Price/Sales ratio is 0.97 and Price to Book ratio 2.19.

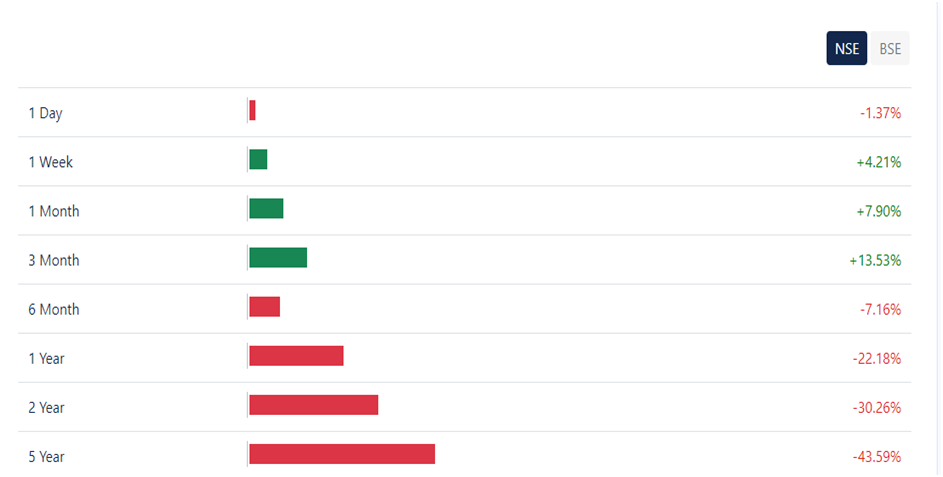

Price Performance– On the basis of the below chart it has been observed that Gulf Oil Lubricant share price moved up by 7.90 %. In last 3 months share price moved up by 13.53 %. However there is a sharp decline in price by -22.18 % in last 1 year. There is a sharp decline by -43.59 % in last 5 years.

Performance Analysis– Thecompany performance declined in last 1 year. The sales grew 0.49% in last 1 year. This is poor in relation to its growth and performance. The profit declined by -1.2% in last 1 year. However it was 8.06% in last 3 years. The ROE has declined to 24.83% in last 1 year compared to 30.04% in last 3 years. The ROCE for last 1 year is 25.97%. The Gulf Oil Lubricant has ROA of 13.26 % which is a bad indicator for future performance. The current year dividend is Rs 16 and the dividend yield is 1.09 %.

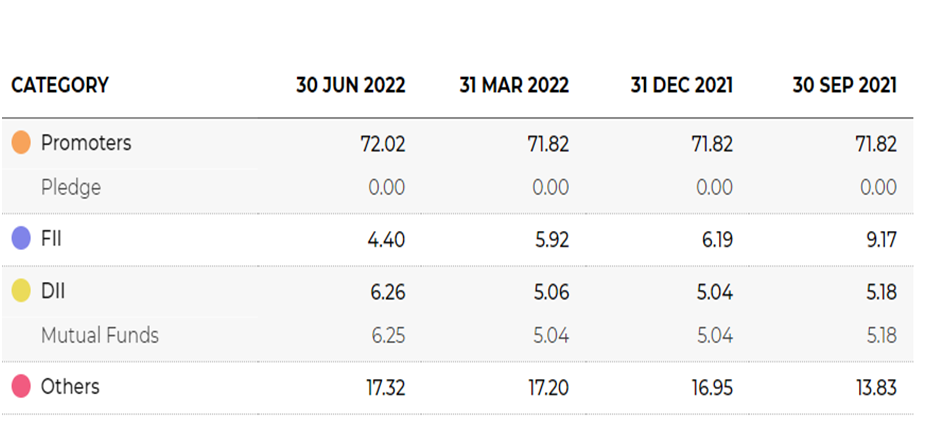

Shareholding

The Promoter holding is increased to 72.02%. The promoters’ pledge is zero. The FII holding has decreased to 4.40% as on 30th June 2022. DII increased by 6.26%. For others holding increased to 17.32%.

Financial Snapshots-The Revenue grew 69.26 % YoY to Rs 706.45 crore. EBITDA stood at Rs. 85.03 crore, increased 101.83% YoY. PBT increased to 82.86% YoY to Rs. 74.37 Crore. PAT increased by 82.31% YoY at Rs. 55.33 crore. EPS stood at Rs 11.20.

Company Description– Gulf Oil Lubricant is a part of the Hinduja Group. It is one of the major players in the Indian Lubricants Industry.Gulf Oil has its presence in over 25 countries for both fuel retailing and lubricants. The product portfolio includes Automotive Lubricants, Industrial Lubricants, Batteries and Marine. They have strong R&D bases with two plants in Silvassa and Ennore, Chennai. Recently the company tied up with Indra Technologies- UK based charger/mobility company and ElectreeFi, an EV SaaS provider to drive the change.The management includes Sanjay G HindujaChairman & Non-Exe.Director and Ravi Chawla, Managing Director & CEO.

Growth Strategies-The major factors which contribute to the growth is demand of lubricants in Commercial Vehicles (CVs), Passenger Vehicles (PVs) and two-wheeler segments. Recently it has been observed that demand increased due to increasing consumer awareness towards utilising better-quality lubricant. Moreover Gulf Oil has entered in a partnership with ElectreeFi to develop solutions and play a role in the fast-charging e-mobility space for 2 and 3-wheelers.

Industry Analysis– According to different statistics lubricants market in India is expected to grow by 809.93 thousand tons from 2021 to 2026.It is expected that market will progress at a CAGR of 5.58%. The main factor which contributes to the growth is increasing demand. The industry is mainly hindered by fluctuations in crude oil prices. Light-duty vehicles like two-wheelers and passenger cars widely use lubricants in their automobiles.

Inherent Strengths-The Company has recorded a strong growth in margin. It has a strong market leadership position in the Oil & Gas Operations industry.The company has a Low Debt. The Book Value per share has improved in last 2 years. The company has maintained zero promoters pledge.

Peer Comparison-

| Company Name | MCap(Cr) | TTM PE | P/B | ROE(%) | Debt to Equity |

| Gulf Oil Lubricant | 2,196.95 | 9.31 | 2.11 | 20.24 | 0.34 |

| Castrol | 11,266.10 | 13.92 | 6.92 | 46.07 | 0 |

| Savita Oil Tech | 2,090.29 | 8.03 | 1.64 | 19.56 | 0 |

| Tide Water Oil | 1,980.76 | 14.81 | 2.69 | 17.07 | 0.02 |

| Panama Petro | 1,840.22 | 7.77 | 2.4 | 29.98 | 0.04 |

If we make a comparison based on the above parameters Castrol will be most preferable with market Cap of 11,266.10 Cr and ROE of 46.07%. The debt equity ratio also stood at zero. Gulf Oil needs to improve the ROE compared to its peers.