Gujarat Fluorochemicals Limited, incorporated in 2018 and formerly known as Inox Fluorochemicals Limited, is part of the INOX Group of Companies. It was demerged from GFL Ltd into a separate legal entity. The company is one of India’s leading producers of fluoropolymers, fluoro-specialities, chemicals, and refrigerants, and ranks among the top five global players in the fluoropolymers market, with exports to Europe, the Americas, Japan, and Asia. Presenting below are its Q1 FY26 Earnings Results.

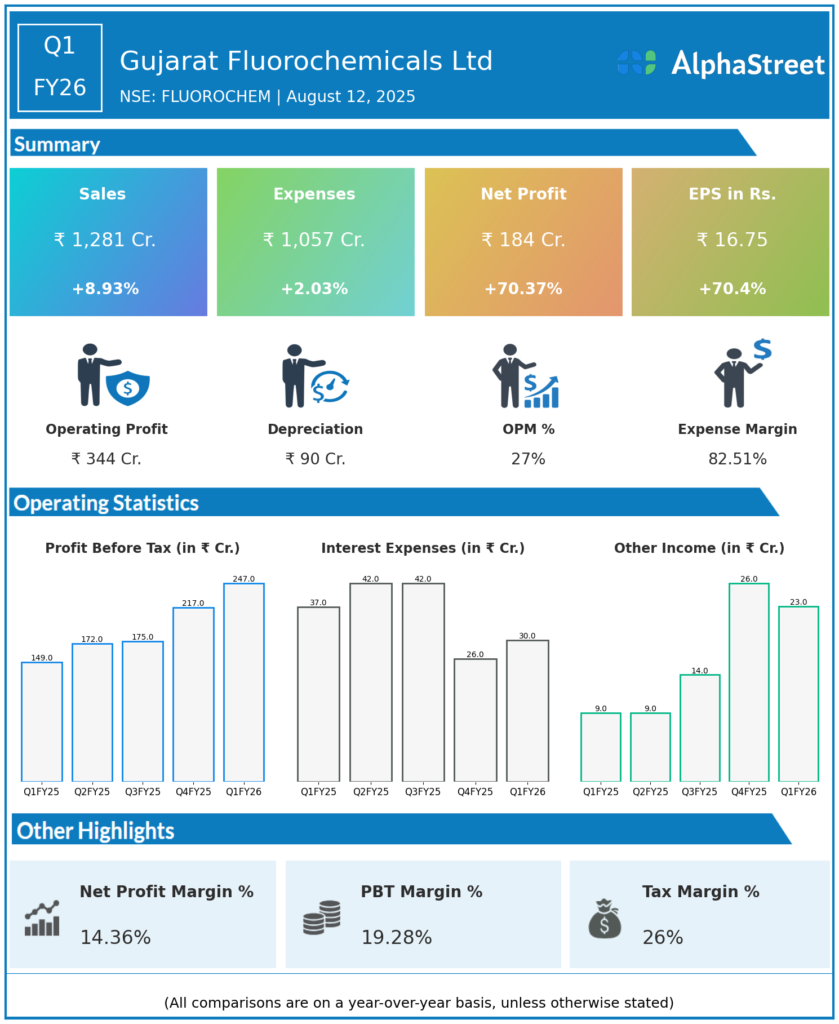

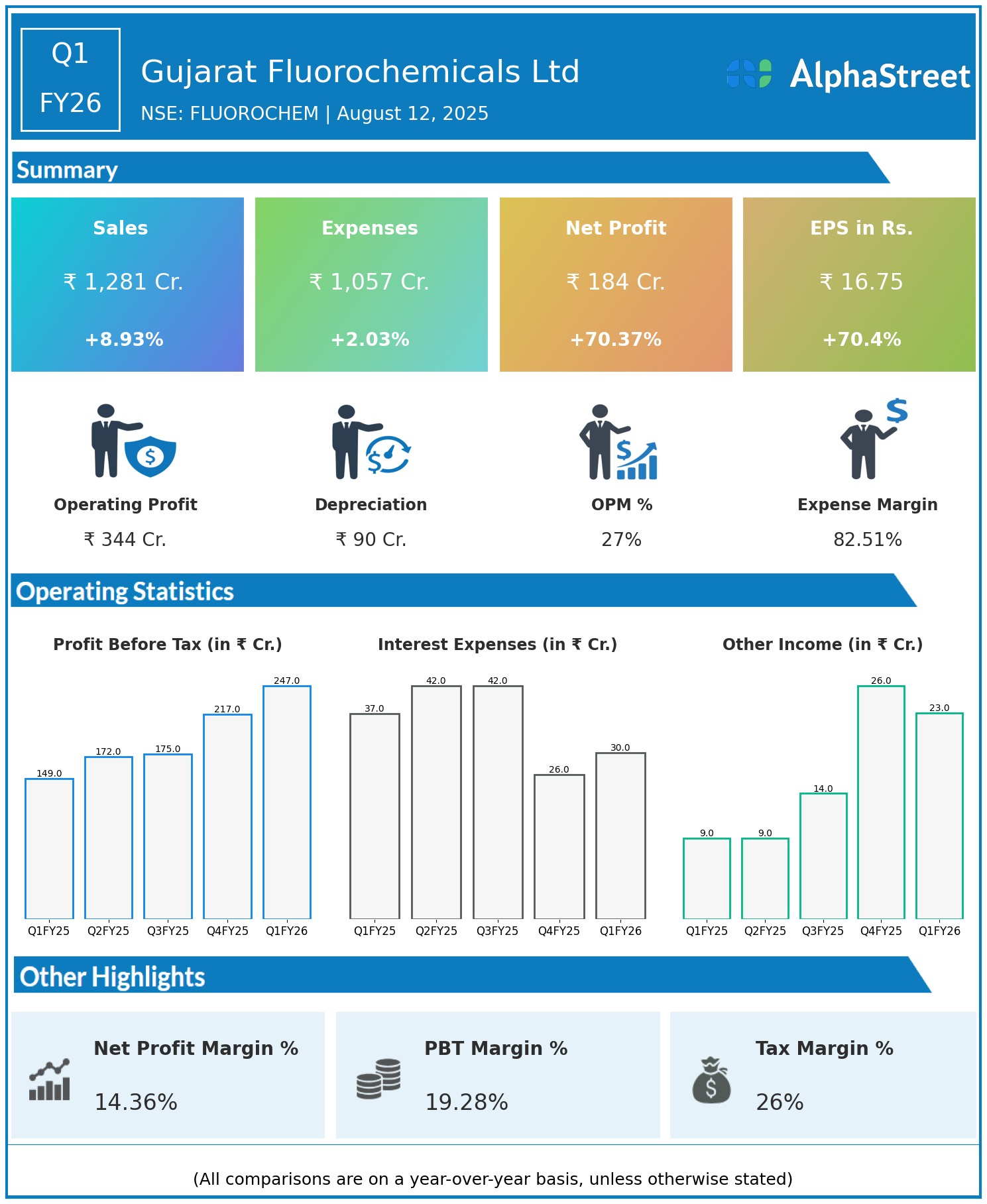

Q1 FY26 Earnings Results

- Revenue: ₹1,281 crore, up 8.93% year-on-year (YoY) from ₹1,176 crore in Q1 FY25.

- Total Expenses: ₹1,057 crore, up 2.03% YoY from ₹1,036 crore.

- Consolidated Net Profit (PAT): ₹184 crore, up 70.37% from ₹108 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹16.75, up 70.40% from ₹9.83 YoY.

Operational & Strategic Update

- Healthy Revenue Growth: The nearly 9% increase in revenue was driven by robust demand for fluoropolymers and specialty chemicals both in domestic and global markets, coupled with favourable pricing in high-value segments.

- Strong Cost Control: Total expenses grew by only 2%, significantly slower than revenue growth, reflecting operational efficiencies, improved raw material sourcing, and process optimization.

- Sharp Profitability Expansion: Net profit and EPS surged by over 70%, supported by margin expansion due to a superior product mix, higher export realisations, and disciplined expenditure.

- Global Market Positioning: As one of the top global players in fluoropolymers, the company continues to leverage its strong international presence, enhancing exports to Europe, the Americas, Japan, and Asia while diversifying its product portfolio.

- Strategic Initiatives: Ongoing capacity expansion in high-margin product lines, investments in innovation, and tapping into emerging high-performance materials markets position the company for sustained growth.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 highlights Gujarat Fluorochemicals Ltd’s ability to achieve significant profit growth through operational efficiency and strategic focus on high-value markets. The company reinforced its competitive edge with a combination of global outreach, premium product offerings, and efficient cost structures.

Looking Ahead

Gujarat Fluorochemicals Ltd aims to strengthen its global footprint by expanding capacity in key product segments, driving innovation in fluoro-specialties, and targeting high-growth industries such as EV batteries, renewable energy, and advanced manufacturing. Continued focus on operational excellence, cost optimisation, and market diversification is expected to support strong earnings momentum and long-term shareholder value creation through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.