Gujarat Ambuja Exports Limited (GAEL) is a prominent manufacturer specializing in corn starch derivatives, soya derivatives, feed ingredients, cotton yarn, and edible oils. Since its inception in 1991, the company has focused on serving the food, pharmaceutical, feed, and various other industries with a long-term strategy centered around growth in the agro-processing sector. (Source: Company Website)

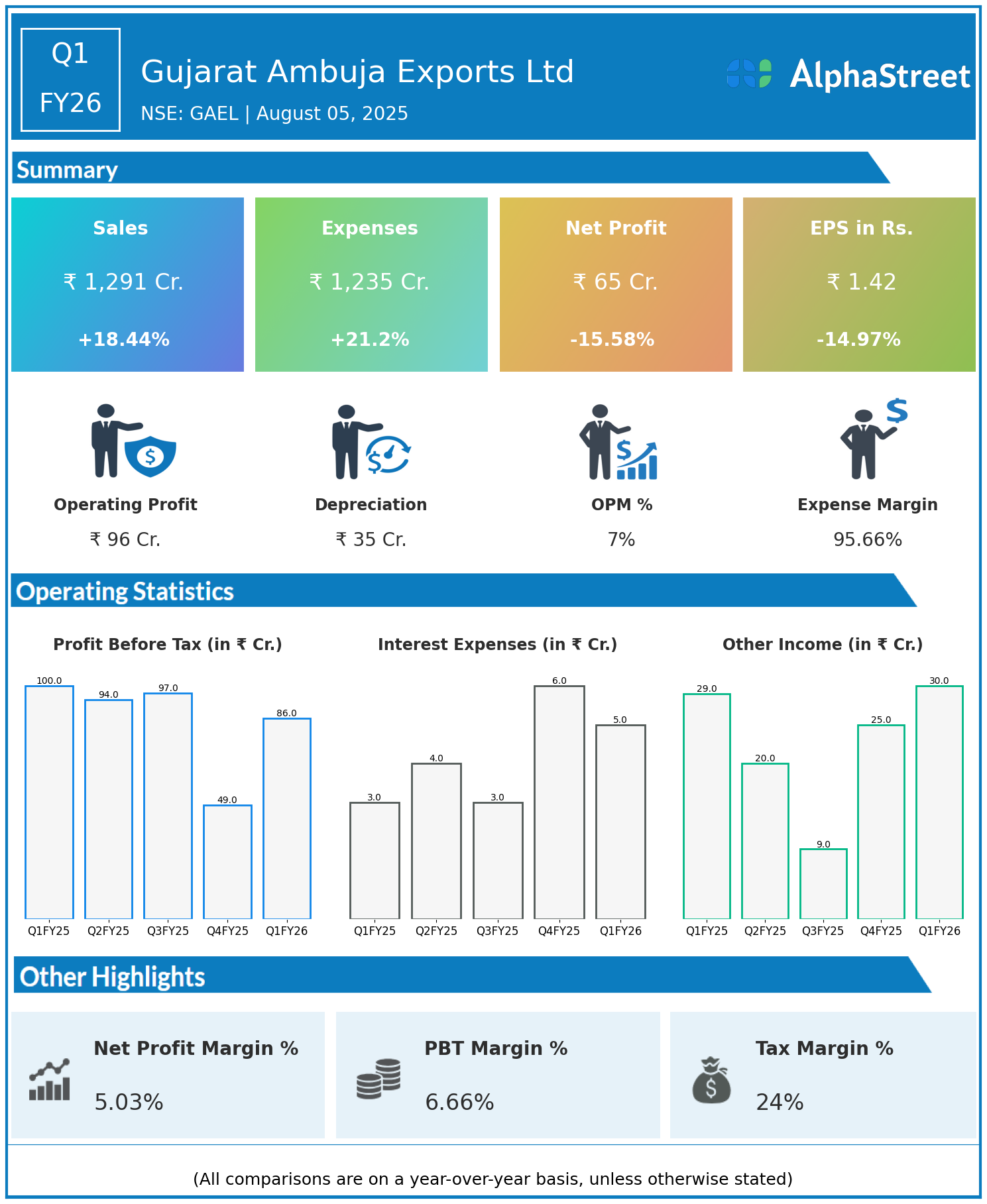

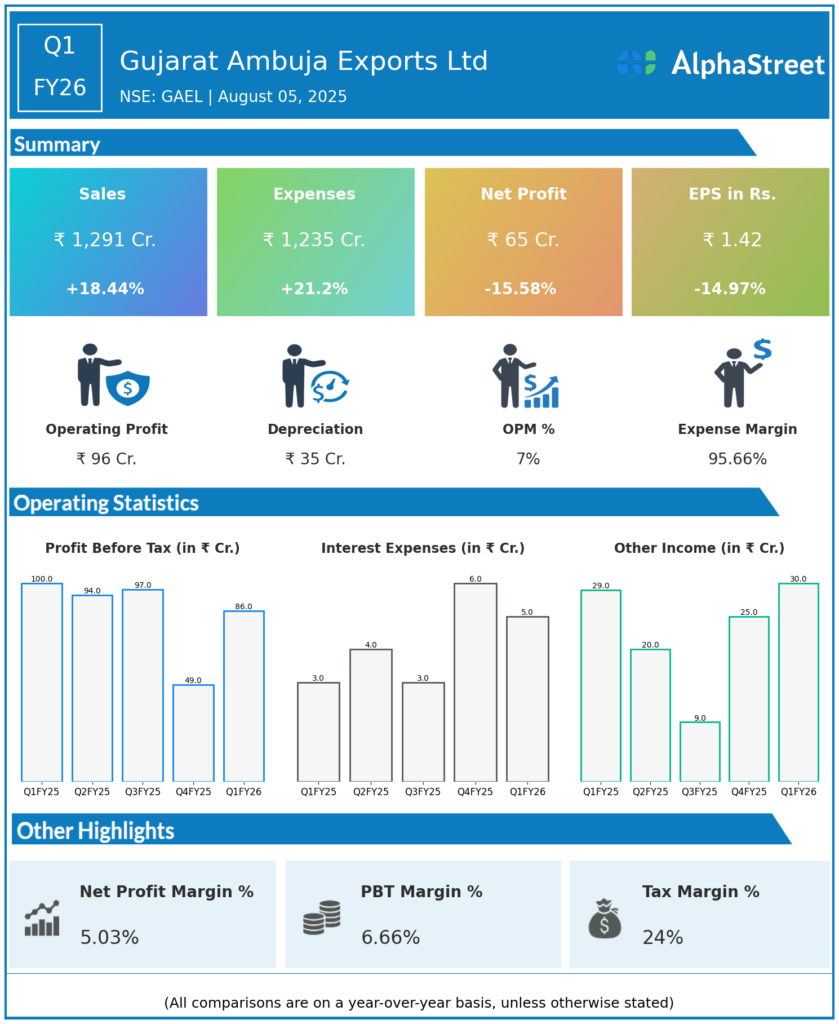

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹1,291 crore, up 18.44% year-on-year (YoY) from ₹1,090 crore in Q1 FY25.

- Total Expenses: ₹1,235 crore, up 21.2% YoY from ₹1,019 crore.

- Consolidated Net Profit (PAT): ₹65 crore, down 15.58% from ₹77 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹1.42, down 14.97% from ₹1.67 YoY.

Operational & Strategic Update

- Revenue Growth: GAEL reported strong revenue growth driven by increased volumes and improved realizations, reflecting healthy demand across its diversified product segments.

- Rising Expenses: Total expenses increased at a faster rate than revenues, mainly due to higher raw material costs, input inflation, and increased operational expenses, which put pressure on profitability.

- Profitability Decline: Despite higher topline, net profit and EPS declined significantly due to margin compression from rising costs and competitive pricing dynamics.

- Product & Market Focus: The company continues to strengthen its foothold in corn starch and soya derivatives, expanding feed ingredient and edible oil offerings, while exploring new markets and value-added products.

- Strategic Initiatives: Efforts are underway to optimize the supply chain, improve cost efficiency, and enhance product portfolio depth to achieve sustainable profitability.

- Industry Environment: The agro-processing sector remains sensitive to commodity price fluctuations, input cost volatility, and changing demand conditions globally and domestically.

Corporate Developments

Q1 FY26 was a mix of solid revenue growth and margin challenges for Gujarat Ambuja Exports Ltd. The company’s strategic focus on product diversification and market expansion remains central to navigating the challenging cost environment.

Looking Ahead

Gujarat Ambuja Exports Ltd aims to mitigate cost pressures through operational efficiencies and strategic sourcing. Continued innovation in product development and expanding presence in feed and pharmaceutical ingredients are expected to bolster growth and profitability through FY26 and beyond.