“During the quarter, MDF business clocked sales of INR18.1 crores with a net loss of INR14.8 crores. Since these are our first few days of operations, the financial performance does not reflect to the true potential of the business. We expect the financial performance to subsequently improve from here on. For the full year, we are confident on achieving INR275 crores to INR300 crores of sale. As a product category, we are foreseeing the market expansion due to cost effectiveness, innovative product usage and rapidly gaining acceptance by consumers.”

-Sanidhya Mittal, Joint Managing Director

Stock Data

| Ticker | GREENPLY |

| Industry | Wood Products |

| Exchange | NSE |

Share Price

| Last 5 Days | 0.4% |

| Last 1 Month | -1.5% |

| Last 6 Months | 17.2% |

Business Basics

Greenply Industries Limited, a leading name in the Indian interior infrastructure industry, operates with a strong emphasis on quality, innovation, and sustainable growth. The company’s business fundamentals are deeply rooted in its diversified portfolio of interior and exterior building products, catering to residential, commercial, and industrial sectors. Central to Greenply’s business strategy is its extensive range of plywood and allied products. The company is renowned for its plywood, which is known for its durability, strength, and adherence to global quality standards. Greenply’s plywood finds application in furniture, interior decoration, cabinetry, and construction, making it an integral part of India’s building and furnishing ecosystem.

The company invests significantly in research and development to create technologically advanced and environmentally sustainable products. Innovations such as termite-resistant plywood and eco-friendly laminates exemplify Greenply’s commitment to providing solutions that meet evolving consumer needs and sustainability goals. Greenply Industries places a strong emphasis on sustainability and responsible business practices. The company’s commitment to the environment is evident in its use of sustainable timber sources and eco-friendly manufacturing processes. Additionally, Greenply actively engages in afforestation initiatives, contributing to environmental conservation.

The company’s customer-centric approach is reflected in its diverse customer base, which includes builders, architects, interior designers, and homeowners. Greenply provides value-added services such as design consultancy and technical support, ensuring that customers receive tailored solutions and expert guidance. Greenply Industries demonstrates prudent management by balancing profitability and growth. The company’s strategies include cost optimization, strategic expansion, and diversification into complementary product categories to meet the evolving needs of the construction and interior design industries.

Q1 FY24 Financial Performance

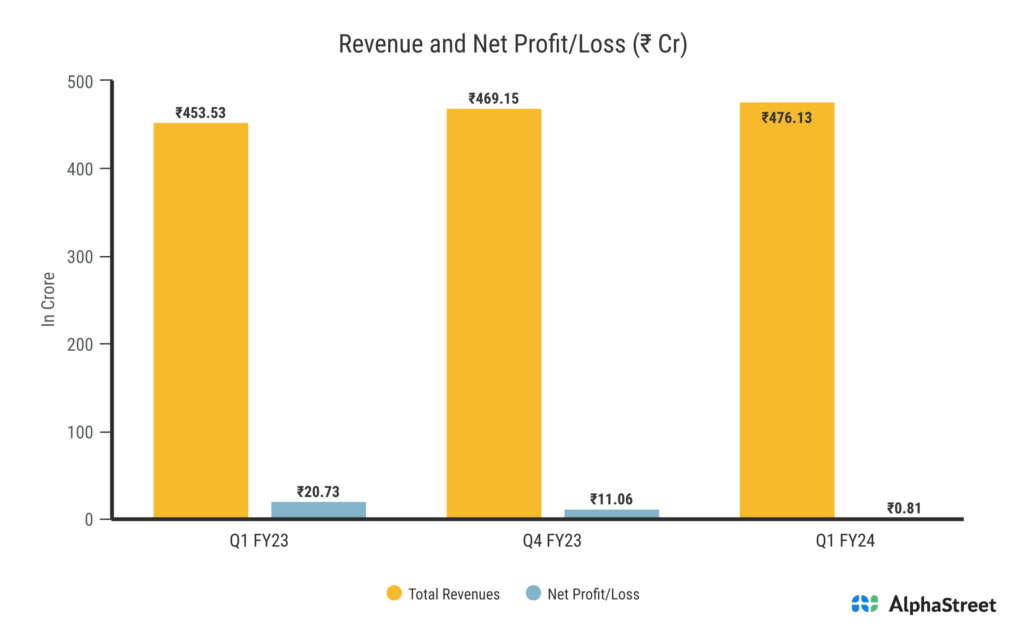

Greenply Industries reported Revenues for Q1 FY24 of ₹476.14 Crores up from ₹453.54 Crore year on year, a rise of 4.98%. Consolidated Net Profit of ₹0.82 Crores down 96.04% from ₹20.73 Crores in the same quarter of the previous year. The Earnings per Share is ₹0.07, down 95.86% from ₹1.69 in the same quarter of the previous year.

Greenply’s Segment Revenue

Plywood and Allied Products: The Plywood and Allied Products segment is at the heart of Greenply’s business. The company is widely recognized for its plywood, which is used in a wide range of applications, including furniture, interior decoration, cabinetry, and construction. This segment encompasses various types of plywood, including structural plywood, decorative plywood, and special-purpose plywood. Greenply’s plywood is renowned for its quality, strength, and durability, making it an essential choice for architects, interior designers, and homeowners seeking reliable and high-quality building materials.

Medium Density Fibreboards (MDF) and Allied Products: The Medium Density Fibreboards and Allied Products segment includes a variety of engineered wood products, with MDF as a prominent offering. MDF is a versatile and environmentally friendly wood composite material used in furniture manufacturing, interior paneling, cabinetry, and other applications. Greenply’s MDF products are known for their smooth finish, consistency, and suitability for a range of surface finishes, including veneers, laminates, and paints. This segment also includes complementary products such as laminates, veneers, and doors that complement the MDF and plywood categories.

Company’s Investments and Sustainability

Greenply Industries continues to invest in its brand, people, processes, and technology to achieve higher scale and operational excellence. The company has undertaken large-scale plantation activities by planting over 27.8 million saplings in more than 34,700 acres of land across the country as part of its sustainability efforts. Greenply Industries has also voluntarily published its first sustainability report, becoming the first in the Indian wood panel industry to do so.

The company also mentioned challenges in its Gabon business due to demand-side issues, although there has been some improvement compared to the previous quarter. Greenply Industries’ debt levels have risen due to investments in its MDF business and related working capital requirements, but the company expects these levels to decrease as the MDF business generates cash flows.

Management’s Outlook for FY24

For the full fiscal year, Greenply Industries aims to achieve a 10% volume growth target. The company’s gross contribution in the last quarter improved to 39.5% from 36.3% in the corresponding quarter, primarily driven by better realizations and cost efficiencies in manufacturing. However, the adjusted core EBITDA margin in the plywood business declined by 50 basis points to 8.7% in the last quarter due to increased spending on branding and marketing activities. Advertisement and promotion expenses reached 4.8% during the quarter, higher than the normalized spend of 3% to 3.5% of sales for the year.

Greenply Industries is facing challenges related to cost escalations and timber prices, and to protect its margins, the company plans to implement price hikes in the current quarter, with the full impact expected to be realized in the second half of the year. The company anticipates that, assuming no further cost escalations and successful price hikes, it can improve its margins to a double-digit level for the full fiscal year.