Greenpanel Industries Limited is a prominent manufacturer of plywood, medium density fibre boards (MDF), and allied wood-based products. The company is recognized for its focus on quality, innovation, and sustainable wood processing solutions that cater to the building and furniture sectors.

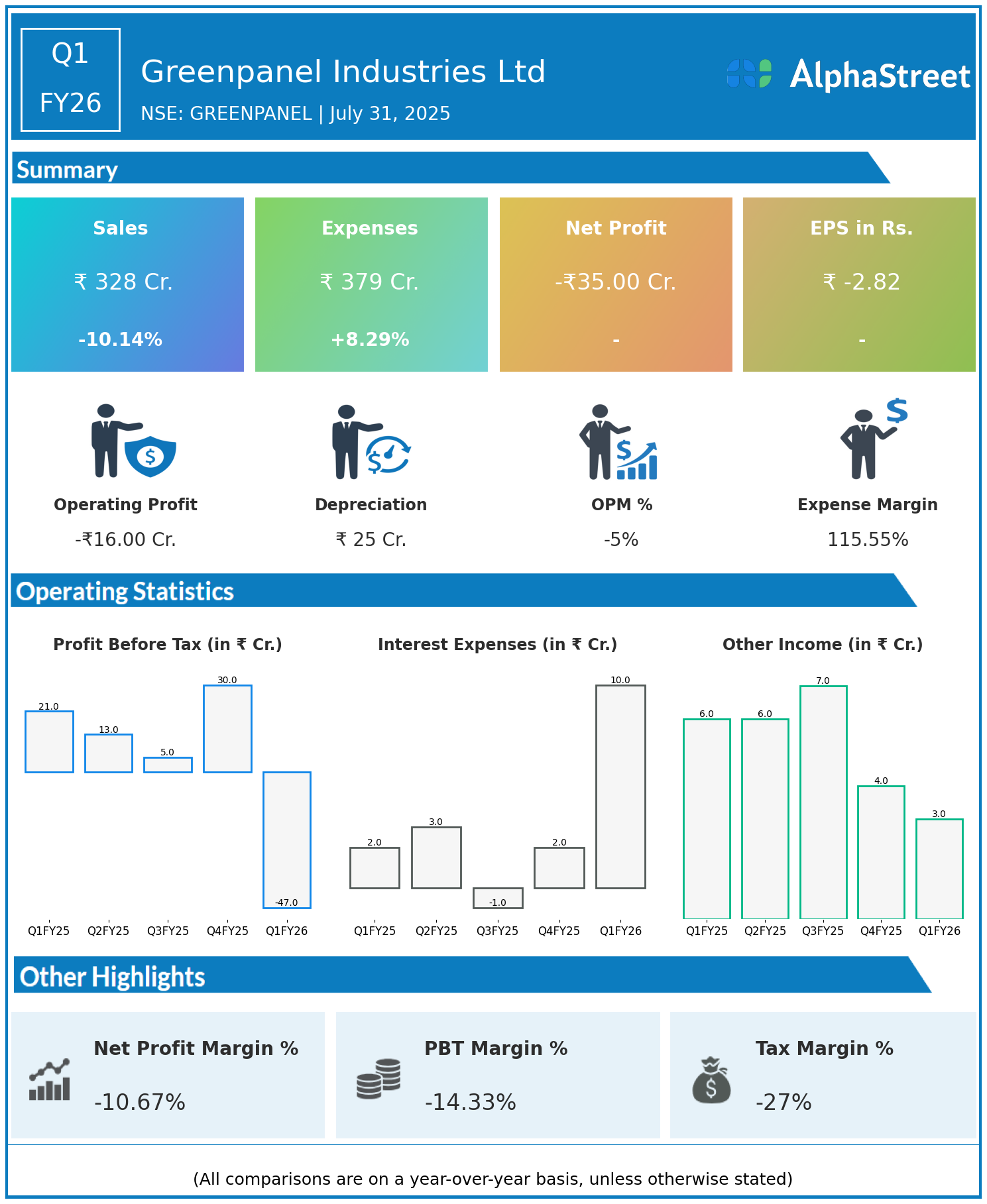

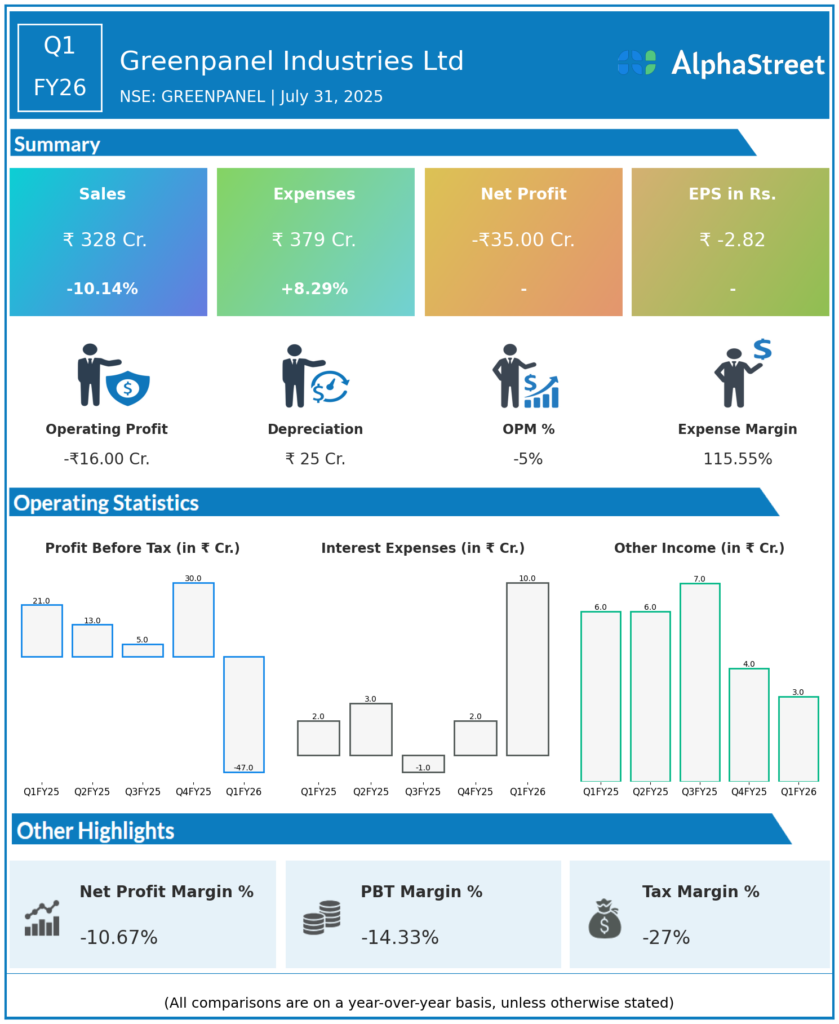

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹328 crore, down 10.14% year-on-year (YoY) from ₹365 crore in Q1 FY25.

- Total Expenses: ₹379 crore, up 8.29% YoY from ₹350 crore.

- Consolidated Net Profit (PAT): -₹35 crore, compared to a profit of ₹16 crore in the same quarter last year, marking a swing to loss.

- Earnings Per Share (EPS): -₹2.82, down from ₹1.28 YoY.

Operational & Strategic Update

- Revenue Decline: The decrease in revenue reflects softer demand conditions in the plywood and MDF markets, pricing pressures, and possible supply chain disruptions.

- Rising Expenses: Despite the fall in revenue, total expenses increased due to higher raw material costs, energy prices, and operational overheads impacting profitability.

- Profitability Impact: The company posted a net loss in Q1 FY26, indicating margin compression and challenging market dynamics in the wood panel segment.

- Product & Market Focus: Greenpanel continues to serve both residential and commercial segments with a diverse product range, while pushing for enhanced operational efficiencies and sustainable sourcing.

- Sustainability Initiatives: The company maintains commitment to green manufacturing practices, including responsible forestry management and reducing environmental impact.

Corporate Developments

Q1 FY26 was a difficult quarter for Greenpanel Industries, with significant revenue contraction coupled with rising costs causing losses. The company is likely focusing on cost optimization and operational improvements to navigate these headwinds.

Looking Ahead

Greenpanel Industries Ltd is working to stabilize its top line through renewed market engagement and product innovation, while controlling costs to restore profitability. Strategic emphasis on efficiency, quality upgrades, and expanding sustainable product offerings will be important to drive recovery and long-term growth in FY26 and beyond.