Greenlam Industries Limited is engaged in the manufacturing of laminates, decorative veneers, and allied products. Presenting below are its Q1 FY26 Earnings Results

Q1 FY26 Earnings Results

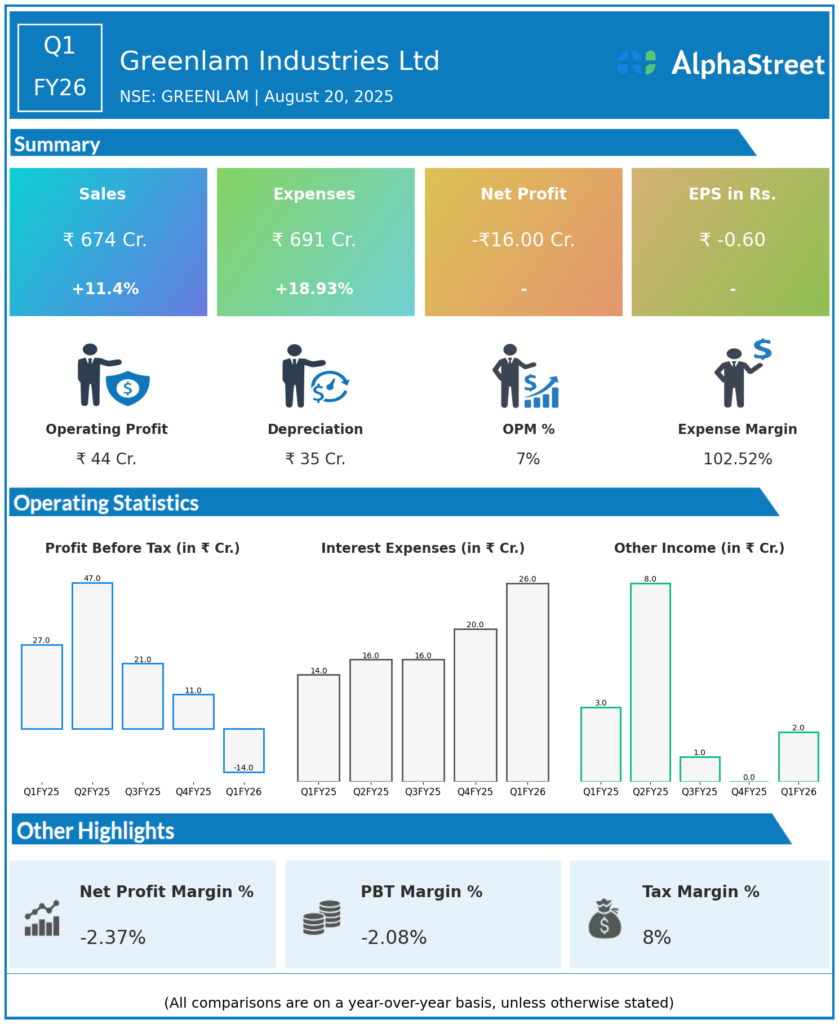

- Revenue: ₹674 crore, up 11.4% year-on-year (YoY) from ₹605 crore in Q1 FY25.

- Total Expenses: ₹691 crore, up 18.93% YoY from ₹581 crore.

- Consolidated Net Profit (PAT): Loss of ₹16 crore compared to a profit of ₹20 crore in the same quarter last year.

- Earnings Per Share (EPS): Negative ₹0.60, down from ₹0.79 in Q1 FY25.

Operational & Strategic Update

- Revenue Growth: Revenues increased by over 11%, driven by higher sales volumes and improved market demand in laminates and decorative veneers.

- Rising Expenses: Expenses rose sharply by nearly 19%, outpacing revenue growth due to increased raw material costs, fuel, logistics, and operational expenses.

- Profitability Pressure: The company swung to a net loss of ₹16 crore from a profit of ₹20 crore last year, largely due to significant margin compression and elevated costs.

- Market Position: Greenlam Industries remains a key player in the laminates and decorative surface segment with a strong brand presence.

- Strategic Focus: Focus areas include cost optimization, enhancing operational efficiencies, and product innovation to restore profitability.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results indicate a challenging operating environment for Greenlam Industries, with cost inflation significantly impacting margins despite revenue growth.

Looking Ahead

Greenlam Industries Ltd aims to return to profitability through stringent cost controls, process improvements, and broadening its product portfolio. Recovery initiatives and sustained demand are expected to support positive performance in the coming quarters.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.