“Our mission and purpose of empowering millions of lives and livelihoods through sustainable mobility solutions continue. Thanks to our talented team and continued investments, our focus continues and Q1 FY24 demonstrates some of these aspects. A quick strategic recap: over the last quarter, we are glad to report that the integration of Greaves Cotton along with Excel Control Linkages, which was 60% and announced in the previous quarter, is on track. The integration is going well. This has driven both growth and profitability; more importantly, it has expanded our reach to new markets, customers, and products across the automotive value chain and several other value chains.”

– Nagesh Basavanhalli – Non – Executive Vice Chairman

Stock Data

| Ticker | GREAVESCOT |

| Industry | Automotive |

| Exchange | NSE |

Share Price

| Last 5 Days | -1.4% |

| Last 1 Month | -8% |

| Last 6 Months | 6.3% |

Business Basics

Greaves Cotton Limited, a well-established engineering company in India, operates with a rich legacy of innovation, diversification, and a commitment to powering mobility and infrastructure. The company’s business fundamentals are rooted in its core competencies, which include manufacturing engines, power generation solutions, and aftermarket services. One of the central pillars of Greaves Cotton’s business strategy is its expertise in internal combustion engines. The company has a legacy of manufacturing engines for a variety of applications, including automotive, construction equipment, agricultural machinery, and more. Greaves’ engines are known for their reliability and efficiency, and it power a wide range of vehicles and equipment, contributing to India’s mobility and industrial growth.

Greaves Cotton is not just about engines; it also plays a significant role in the power generation sector. The company offers a range of generators and power solutions that cater to various industries, including manufacturing, healthcare, and infrastructure. These power generation solutions provide essential backup and uninterrupted power supply, ensuring business continuity for its customers. Financially, Greaves Cotton demonstrates prudent management by balancing profitability and growth. The company’s strategies encompass efficient cost management, strategic diversification, and a focus on customer relationships.

Q1 FY24 Financial Performance

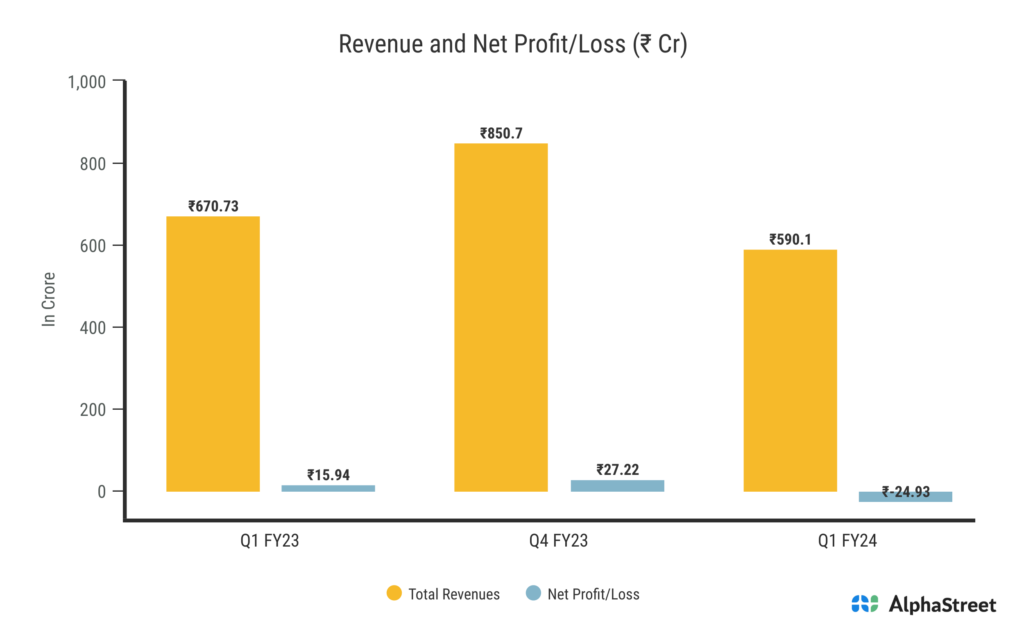

Greaves Cotton Ltd reported Revenues for Q1FY24 of ₹569.00 Crores down from ₹660.00 Crore year on year, a fall of 13.79%. Consolidated Net Profit of -₹25.00 Crores from ₹16.00 Crores in the same quarter of the previous year. The Earnings per Share is -₹0.22, from ₹0.69 in the same quarter of the previous year.

Electric Mobility, a key division, reported revenue of ₹135 crores. With the inclusion of Excel, the combined revenue from Greaves Cotton and Excel reached ₹435 crores, offering a strong base for diversifying the core product portfolio. Greaves Cotton achieved EBITDA margins of 11.3% on a standalone basis, and 13.5% when combined with Excel, aligning with historical trends of pre-COVID levels. The company maintains a strong cash position with consolidated net cash of ₹739 crores, supporting future investments and expansion.

Company’s Segment Revenue

Greaves Cotton Limited generates revenue through its three distinct revenue segments, reflecting its diversified portfolio and contributions to various industries:

Engines: The Engines segment is at the core of Greaves Cotton’s business. The company specializes in manufacturing a wide range of internal combustion engines that power diverse applications, including automotive vehicles, agricultural machinery, construction equipment, and more. These engines are known for their reliability, fuel efficiency, and compliance with stringent emissions standards. Greaves’ engines play a vital role in driving mobility and industrial applications, contributing significantly to India’s infrastructure and transportation sectors.

Electric Mobility: In response to the growing demand for sustainable and eco-friendly transportation solutions, Greaves Cotton has ventured into the Electric Mobility segment. This segment involves the development and manufacturing of electric three-wheelers, a rapidly expanding market in India. Greaves aims to provide clean and energy-efficient mobility options to address urban transportation challenges and reduce the environmental impact of traditional internal combustion engine vehicles.

Cables & Control Levers: The Cables & Control Levers segment encompasses the production of high-quality control cables and levers for a variety of applications, including automotive, construction, and industrial machinery. These components play a crucial role in ensuring the efficient operation of vehicles and equipment. Greaves Cotton’s expertise in this segment extends to design, manufacturing, and quality control, serving diverse industries where precise control mechanisms are essential.

Greaves Cotton’s Strategic Initiatives

Greaves Cotton emphasized its recent acquisition of a majority stake in MLR Auto, a three-wheeler company in Hyderabad, as a valuable opportunity to strengthen its presence in the three-wheeler segment. The acquisition allows Greaves Cotton to expand its value chain offerings, not only as a component supplier but also in terms of vehicle sales, service, and spares through Greaves Retail. Greaves Finance introduced “evfin,” an innovative EV financing platform to promote sustainable mobility adoption. The company’s strategy has evolved from a diesel engine mechanical company to mechatronics and electronic sensors, focusing on forward-looking technology areas.

Greaves Cotton’s Upcoming Developments

Greaves Cotton plans to launch a high-speed, fully connected scooter, NXG, before the end of the calendar year. The company is working on launching new electric cargo and passenger vehicles under the Greaves brand in the three-wheeler segment. Branding strategies, such as ‘powered by Greaves,’ are being applied to enhance brand visibility for specific vehicle categories.

In the electric mobility sector, Greaves Electric Mobility adapted to evolving regulatory requirements, ensuring compliance with AIS 156 Phase II standards and OBD-2 BS6 norms. Despite market challenges, Ampere, a subsidiary, achieved over 10% market share and double-digit growth in vehicle registrations in Q1 FY24. Greaves’ three-wheeler portfolio, spanning L3 and L5 formats, recorded a 140% volume growth YoY. Bestway and MLR, the company’s subsidiaries, have shown strong double-digit growth YoY.