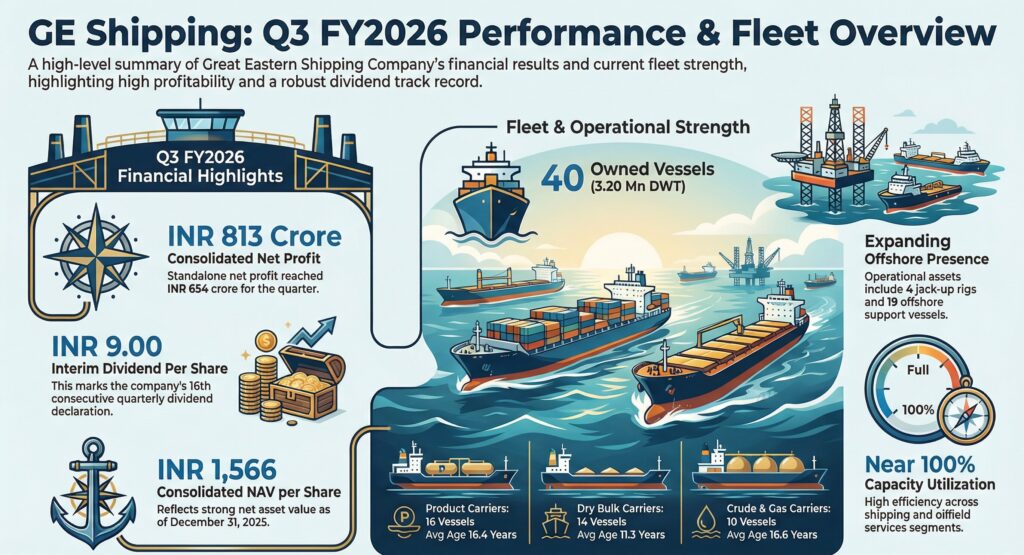

The Great Eastern Shipping Company Limited (NSE: GESHIP; BSE: 500620) reported a surge in its consolidated net profit to INR 813 crore for the third quarter ended December 31, 2025 (Q3FY26), according to its latest financial results released on Thursday.

The Mumbai-based shipping giant, India’s largest private sector shipping and oilfield services provider, saw its consolidated revenue reach INR 1,737 crore for the quarter, while EBITDA stood at INR 1,118 crore. On a standalone basis, the company reported a net profit of INR 654 crore.

Shareholder Returns and Valuation

In a move to maintain consistent shareholder returns, the board declared an interim dividend of INR 9.00 per share for Q3FY26. This marks the company’s 16th consecutive quarterly dividend payment.

The company’s Consolidated Net Asset Value (NAV) was reported at INR 1,566 per share as of December 31, 2025, while the Standalone NAV stood at INR 1,233 per share. Management highlighted that the consolidated NAV has grown at a compound annual growth rate (CAGR) of 25% since FY21.

Fleet Expansion and Strategy

GE Shipping continues to actively manage its fleet, which currently comprises 40 vessels aggregating 3.20 million deadweight tons (dwt). The fleet is diversified across 26 tankers (including crude, product, and LPG carriers) and 14 dry bulk carriers.

Recent operational highlights include:

• New Delivery: On January 28, 2026, the company took delivery of the “Jag Riddhi,” a 2019 Japanese-built Ultramax dry bulk carrier, financed entirely through internal accruals.

• Future Transactions: The company has contracted to purchase a secondhand Medium Range (MR) tanker and sell the Very Large Gas Carrier (VLGC) “Jag Vishnu,” with both transactions expected to close in Q4FY26.

• Asset Utilization: The company reported that its current capacity utilization is close to 100%.

Market Conditions

The company’s performance was bolstered by varied trends in the global shipping markets. Global dirty tanker trade witnessed a 7% year-on-year volume increase in Q3FY26, driven by a surge in exports from South America and the Middle East. In the dry bulk sector, iron ore trade grew by 10% as China continued to restock supplies from Brazil and Australia. However, the product tanker market saw a slight 1% decline in seaborne trade volumes during the same period.

Financial Health

GE Shipping maintains a robust balance sheet with a Net Debt/Equity ratio of (0.39)x on a normalized basis, indicating a strong net cash position. The company’s credit rating remains at “AAA”. For the nine months ended December 31, 2025, the company reported a consolidated Return on Equity (ROE) of 16%.