Established in 1992, Gravita India Limited is one of India’s largest lead producers, with a diversified business model spanning four specialized verticals: Lead Recycling (its flagship segment), Aluminum Recycling, Plastic Recycling, and Turnkey Projects. The company is also highly experienced in recycling used batteries, cable scrap and other lead scrap, aluminum scrap, plastic scrap, and related materials, reinforcing its leadership position in the sustainable materials management industry.

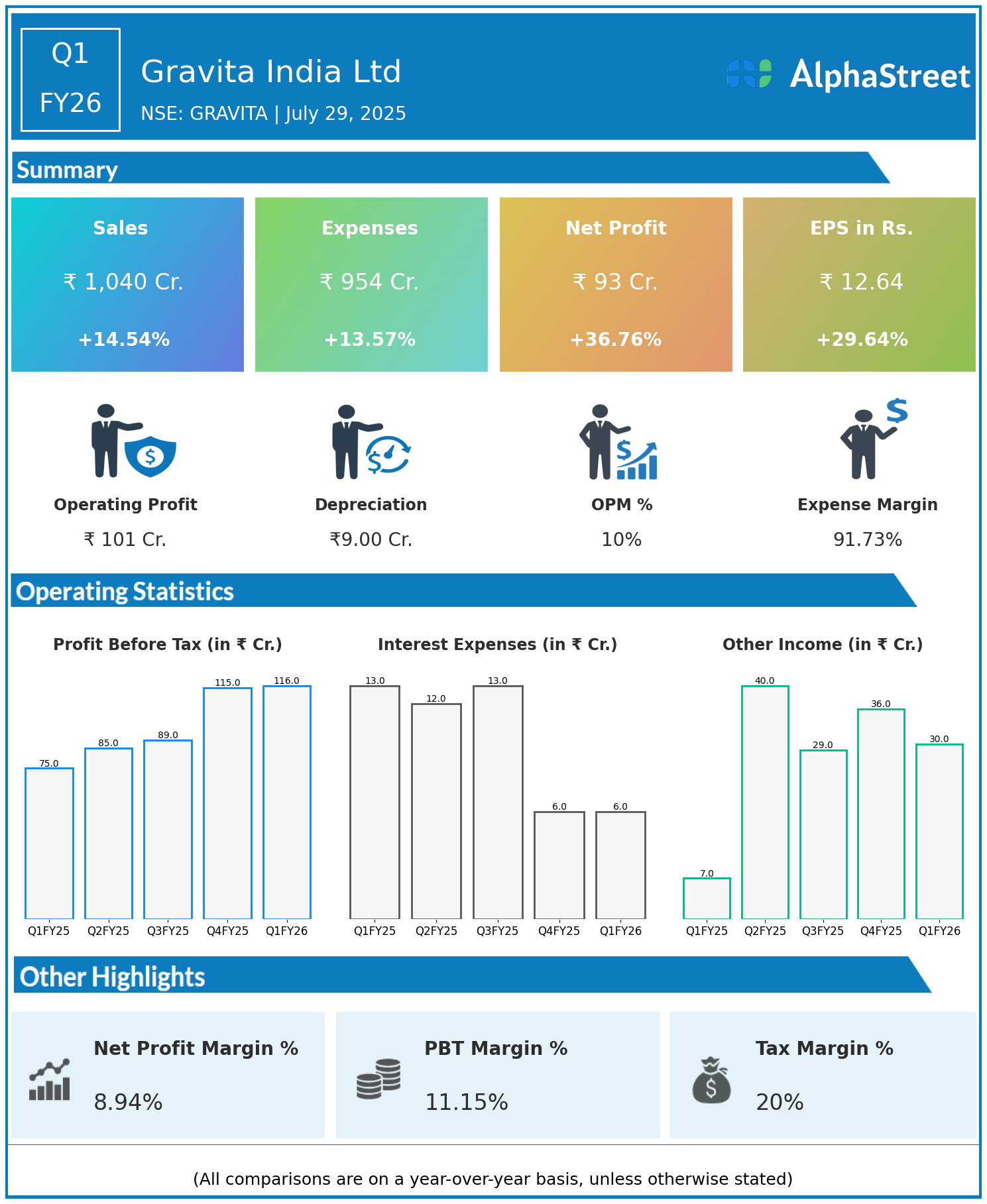

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹1,040 crore, up 14.54% year-on-year (YoY) from ₹908 crore in Q1 FY25.

- Total Expenses: ₹954 crore, up 13.57% YoY from ₹840 crore.

- Consolidated Net Profit (PAT): ₹93 crore, up 36.76% from ₹68 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹12.64, up 29.64% from ₹9.75 YoY.

Operational & Strategic Update

- Revenue Growth: The healthy increase in revenue reflects strong demand across all verticals, particularly in lead and aluminum recycling segments, supported by operational scale-up and favorable market conditions.

- Controlled Expense Growth: Expenses increased moderately, aligned closely with revenue growth, demonstrating effective cost management and operational discipline.

- Profitability Surge: The significantly higher net profit and EPS growth indicate improved operational efficiency, better margins, and optimized resource utilization.

- Diversified Business Model: Gravita’s multi-segment approach provides resilience, leveraging specialized expertise in lead, aluminum, plastic recycling, and turnkey solutions.

- Sustainability Focus: The company’s core recycling business aligns with global environmental goals, helping promote circular economy principles and reducing industrial waste.

- Operational Excellence: Continued investments in technology and process enhancements have strengthened productivity and product quality.

- Market Position: Gravita remains a key supplier to battery manufacturers and other industrial customers, capitalizing on expanding demand for recycled metals.

Corporate Developments

Gravita India posted a strong Q1 FY26 performance marked by robust revenue growth and a remarkable profit increase, driven by operational leverage and cost efficiencies. The company’s commitment to sustainable recycling solutions and expanding capacities underpins its competitive edge in the industry.

Looking Ahead

With increasing global emphasis on sustainability and resource efficiency, Gravita India Ltd is well-positioned to benefit from growing recycling needs and regulatory support. Continued focus on capacity expansion, process innovation, and market diversification will drive sustained growth and value creation in FY26 and beyond.