Graphite India Limited is a leading manufacturer and seller of graphite and carbon products, catering to industries like steel, metallurgy, automotive, and electrical. With an established presence and global market footprint, the company plays a pivotal role in supplying key raw materials for high-temperature industrial processes.

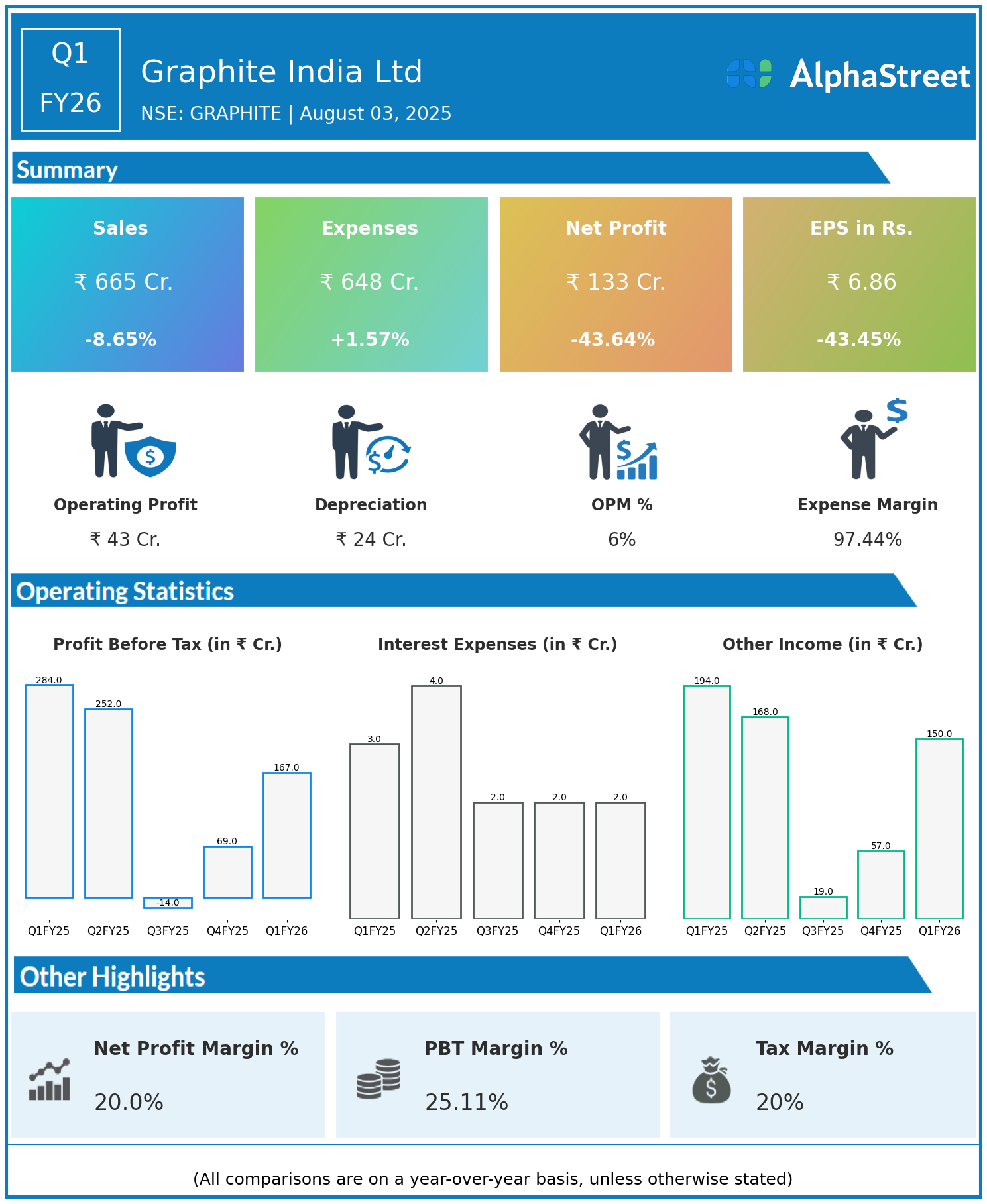

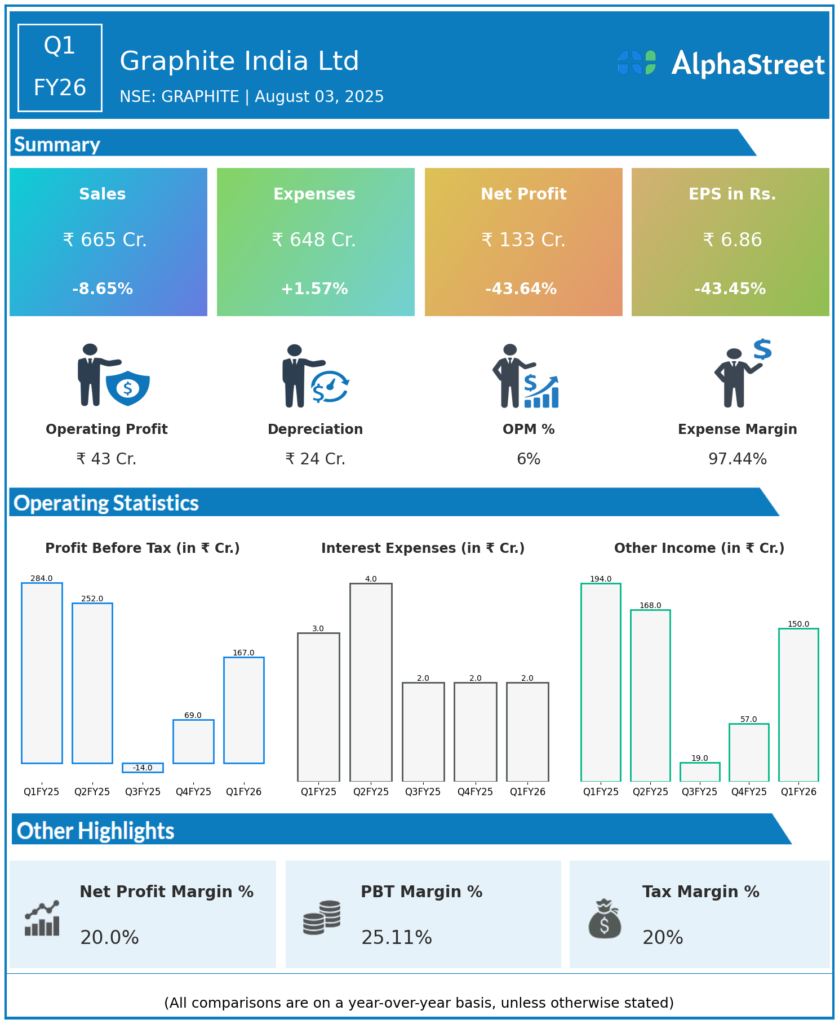

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹665 crore, down 8.65% year-on-year (YoY) from ₹728 crore in Q1 FY25.

- Total Expenses: ₹648 crore, up 1.57% YoY from ₹638 crore.

- Consolidated Net Profit (PAT): ₹133 crore, down 43.64% from ₹236 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹6.86, down 43.45% from ₹12.13 YoY.

Operational & Strategic Update

- Revenue Decline: The substantial drop in revenue reflects ongoing demand headwinds, price pressures in global graphite markets, and possible delays in large steel and metallurgical projects.

- Rising Cost Pressures: Despite the decline in revenue, total expenses rose slightly, led by inflationary input costs, higher power and fuel prices, and increased operational outlays.

- Profitability Contraction: The steep fall in net profit and EPS highlights significant margin compression as fixed costs and input inflation outpaced a shrinking topline.

- Business Segment Dynamics: Demand softness in export and domestic markets, along with tight pricing competition, affected performance across major graphite and carbon segments.

- Operational Focus: The company continues to focus on product quality, process optimization, and cost discipline to safeguard margins in a tough operating environment.

- Market Initiatives: Efforts are underway to diversify the customer base, upgrade technology, and enhance the value-added portfolio to drive future growth and resilience.

- Sustainability & Innovation: Ongoing investments in R&D and environmentally-efficient operations remain a priority, aligning with global trends toward sustainable manufacturing.

Corporate Developments

Q1 FY26 was a challenging period for Graphite India Ltd, marked by lower revenues and sharply reduced profits. Margin pressures from weak demand and rising costs underscore the need for stringent cost management and strategic diversification.

Looking Ahead

Graphite India Ltd aims to navigate market headwinds by intensifying operational improvements, targeting new growth segments, and strengthening cost efficiency initiatives. As demand dynamics stabilize and raw material costs are better managed, the company is positioned to pursue recovery and long-term value creation in FY26 and beyond.