GR Infraprojects has diversified its portfolio, secured substantial projects, and ventured into new sectors, all while delivering impressive financial performance. With a robust order book, strategic bidding initiatives, and an ambitious Infrastructure Investment Trust (InvIT) fundraising plan, the company is poised to contribute significantly to India’s infrastructure boom. Dive into the dynamic world of GR Infraprojects and witness its role in shaping India’s economic growth through innovative construction and development projects.

Stock Data

| Ticker | GRINFRA |

| Industry | Infrastructure |

| Exchange | NSE |

Share Price

| Last 5 Days | -0.5% |

| Last 1 Month | -3.6% |

| Last 6 Months | 19.4% |

Business Basics

GR Infraprojects Limited has established itself as one of India’s leading infrastructure companies, offering a wide range of services such as design, engineering, procurement, construction, and project management. The company has completed projects in more than 15 states across the nation, and its clientele includes a range of public and private sector organizations as well as international ones. Highway and expressway construction is one of the company’s main focus areas, and it has established a reputation for completing high-quality projects on schedule and on budget. GR Infraprojects has expanded into other industries by utilizing its knowledge of civil engineering and construction, such as water supply, irrigation, and urban development. The company is committed to sustainable development and has implemented several initiatives like installing solar panels & implemented water harvesting to reduce its environmental impact.

Q1 FY24 Financial Performance

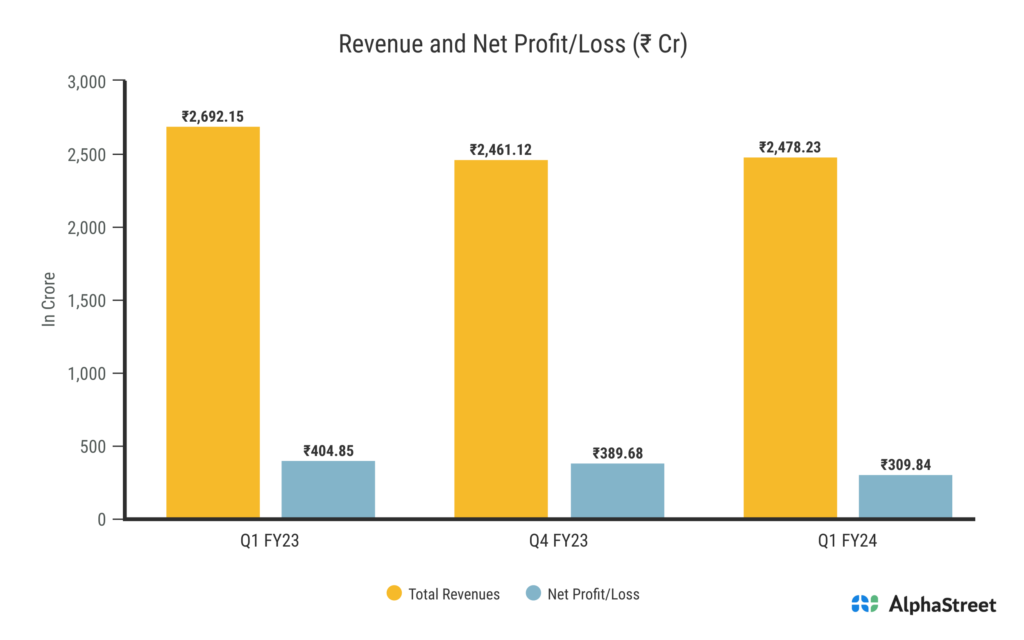

GR Infraprojects reported Revenue from operations for Q1 FY24 of ₹2,478.23 Crores down from ₹2,692.15 Crore year on year, a fall of 8%. The consolidated Net Profit of ₹309.84 Crores down 23.5% from ₹404.85 Crores in the same quarter of the previous year. The Earnings per Share is ₹32.05, down 23.45% from ₹41.87 in the same quarter of the previous year.

In Q1 FY24, the company invested approximately ₹20 crores in acquiring additional fixed assets. As of the end of the current quarter, the net value of the acquired property, plant, and equipment, including work in progress, stands at ₹1,452 crores. GR Infraprojects also increased its investment in subsidiary companies through loans and equities to ₹2,156 crores by the end of Q1 FY24, compared to ₹1,950 crores at the end of Q4 FY23. To support the ongoing and upcoming home projects, the company have a balanced promoter contribution requirement of ₹2,378 crores. The management anticipates receiving contributions totaling around ₹650 crores during the current fiscal year.

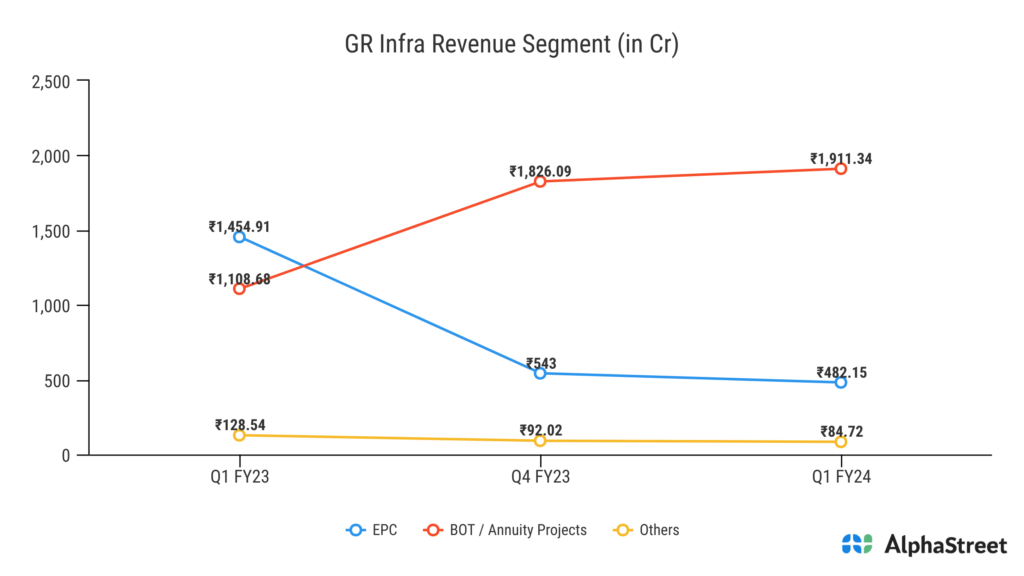

GR Infraprojects Segmental Revenue

In Q1 FY24, GR Infraprojects has reported substantial revenue figures in its key segments. In the Engineering Procurement and Construction (EPC) segment, generated ₹482.13 Crore in Q1 FY24, marking a significant decrease from the ₹1454.91 Crore reported in the same quarter previous year. This represents a reduction of 66.8% in Revenue compared to Q1 FY23. Conversely, in the Build, Operate, and Transfer (BOT)/ Annuity Projects segment has witnessed remarkable growth. During Q1 FY24, the company recorded revenue of ₹1911.34 Crore, which is a substantial increase of 72.5% compared to the ₹1108.68 Crore reported in Q1 FY23.

Order Book and Project Portfolio Overview

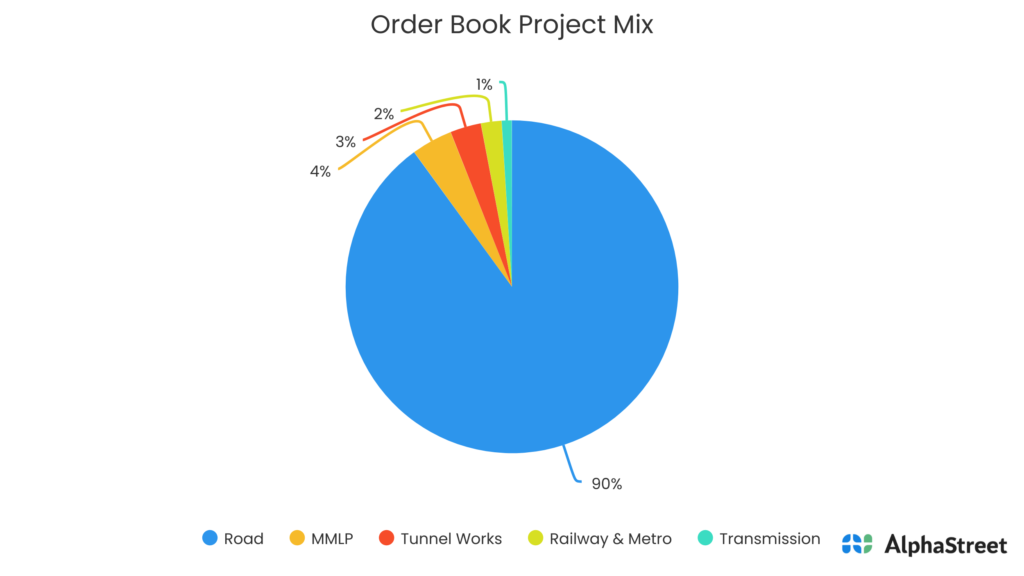

As of June 30, 2023, the company’s order book stands at ₹19,597.85 crores, encompassing a diverse range of projects. This includes three L1 projects collectively valued at ₹7,250 crores. Sector-wise, the allocation within the order book is as follows: a substantial 90% pertains to roads and highways, 4% to Multi-Modal Logistics Park (MMPL) projects, 3% to tunnel works, 2% to Railway & metro initiatives, and 1% to transmission projects.

In the current financial year, the company has signed three concession agreements for Hybrid Annuity Model (HEM) projects and securing one Multi-Modal Logistics Park (MMLP) project. Additionally, they have entered into an Engineering, Procurement, and Construction (EPC) agreement with East Coast Railway. These projects were awarded in the previous fiscal year, formal agreements have been executed in the current year. The company’s project portfolio is both extensive and dynamic, consisting of a total of 34 Build-Operate-Projects (BOPs). Of these, 10 projects are operational, 13 are actively under construction, and 11 await appointment. This diversified portfolio underscores the company’s commitment to growth and its ability to thrive across various sectors.

Diversification Efforts & Bidding Progress at the Company

GR Infraprojects has been actively expanding its business beyond road projects, entering various sectors and actively participating in project bids. In the current financial year, the company has submitted bids totaling ₹12,000 crores. These bids comprise ₹10,700 crores allocated for road projects, while the remaining ₹1,300 crores are dedicated to projects in different sectors. It’s worth noting that bids for projects amounting to ₹7,600 crores are still pending announcement.

The company’s bidding pipeline is robust, standing at ₹90,000 crores. Within this pipeline, the road sector accounts for ₹75,000 crores, with the remaining funds allocated to other sectors. This strategic diversification is aimed at not only expanding growth opportunities but also reducing dependency on specific clients and sectors. GR Infraprojects has achieved success in its bids, notably securing contracts in Ropey and Logistics Park. This demonstrates the company’s capability to diversify successfully and capitalize on opportunities beyond its traditional road projects.

GR Infraprojects InvIT Fundraising Update

In a recent update to its shareholders, GR Infraprojects has unveiled plans to raise a substantial amount of capital, ranging from ₹2500 to ₹3000 crore, through an Infrastructure Investment Trust (InvIT). The company has already secured approval from the NHAI (National Highways Authority of India) for this ambitious endeavor.

According to the management, the InvIT has received the final observation letter from SEBI (Securities and Exchange Board of India), marking a crucial milestone in the fundraising process. This progress underscores GR Infraprojects’ commitment to expanding its infrastructure projects and contributing to the nation’s economic growth. While most aspects of the plan are progressing smoothly, the company is still awaiting the change of ownership approval from the NHAI for one of its projects. However, the management remains optimistic about obtaining this approval and plans to launch this unit in September.

The Booming Infrastructure Industry in India

The infrastructure boom is expected to catalyze India’s economic growth, fostering an environment conducive to investment and business expansion. With the development of roads, railways, airports, and ports, the country is poised to improve logistics and trade facilitation, making it more competitive on the global stage. The government’s dedication to infrastructure development is palpable, as highlighted in the recent budget announcement for fiscal year 2023-24. A paramount focus on increasing infrastructure spending is evident, with a budget allocation of nearly ₹10,00,000 crores for capital expenditures. This represents a notable 33% surge over the previous year’s budget and constitutes 22% of the total budget. Notably, roads and railroads account for nearly half of this allocation, totaling ₹4,98,000 crores.

The government has allocated a substantial ₹2,58,000 crores for capital expenditures in fiscal year 2023-24, signifying a remarkable 37% increase compared to the previous year’s budget for the Ministry of Road, Transportation, and Highways. This significant investment underscores the government’s commitment to enhancing road connectivity and expanding the national railway network.