GR Infraprojects Limited (NSE: GRINFRA) has emerged as one of the leading infrastructure companies in India, with a diverse range of services including design, engineering, procurement, construction, and project management. The company has executed projects in over 15 states across the country, and its client list includes various government agencies, private companies, and international organizations. One of the company’s primary focus areas is the construction of highways and expressways, where it has built a reputation for delivering high-quality projects on time and within budget. GR Infraprojects has also diversified into other sectors such as water supply, irrigation, and urban development, leveraging its expertise in civil engineering and construction. The company is committed to sustainable development and has implemented several initiatives like installing solar panels & implemented water harvesting to reduce its environmental impact.

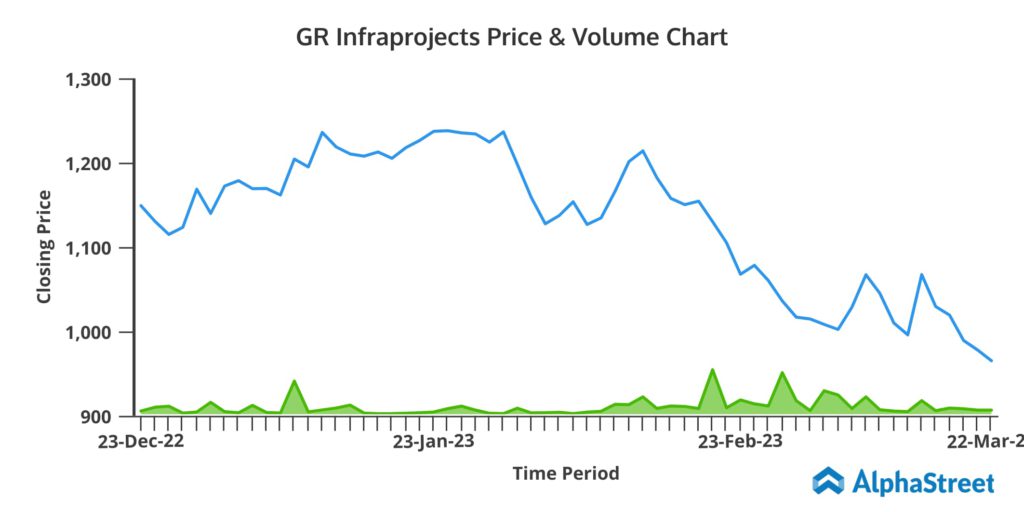

GR Infraprojects’ Share Price Performance

GR Infraprojects Limited announced the results for Q3 FY23 on February 13, 2022. The company’s share price dipped by more than 19% following the results.

Last 1 month: -9.4%

Last 6 months: -22.5%

Last 12 months: -33%

GR Infraprojects Financial Performance

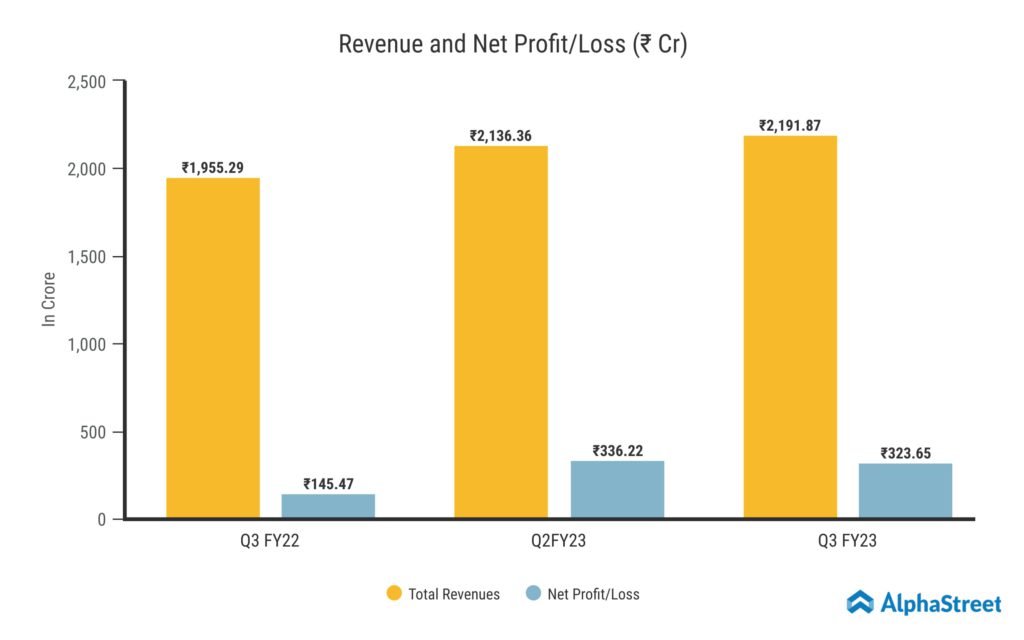

GR Infraprojects Limited reported Revenue from Operations for Q3 FY23 of ₹2,191.87 Crore up from ₹1,955.29 Crore year on year, a growth of 19%. The Revenue was driven by Build Operate Transfer/Annuity Projects segment which surged by 138% up to ₹1,301.29 Crore. Consolidated Net Profit of ₹323.65 Crore, up 122% from ₹145.47 Crore in the same quarter of the previous year. The Earnings per Share is ₹33.47 for this quarter.

The Net Profit Margin is 14.77% compared to the margin of 7.44% year on year. The margins have improved despite increase in prices of steel and cement. As per the management, the inflationary pressure should continue to exist in the near future. The Consolidated Net Worth was around ₹5,875 crores at the end of December 2022. Meanwhile, the Total Borrowing outstanding at the end of December 2022 is around Rs. 5,276 crores with debt-to-equity level of 0.91. At the end of December 2022, trade receivables were approximately ₹414 crores as opposed to ₹664 crores at the end of the fiscal year 2022. Coming to the inventories, it has been decreased down to ₹853 crores at the end of this quarter, as compared to ₹1,022 crores at the end of March 2022. In company’s Balance Sheet, cash and cash equivalent is around ₹886 crores at the end of December 2022, as compared to ₹1,095 crores in the Q4 FY22.

Order Book & Bids In Development

The order book value for the company as of December 31 was almost ₹14,000, with one project with an appointed date for ₹700 crores still pending. 90% or more of the shares in the order book are for projects to develop roads and highways. The Company has submitted bids totalling nearly ₹51,800 crores in FY23 to date, including ₹42,100 crores for highway projects, ₹2,500 crores for ropeway projects, ₹5,000 crores for railway and metro projects, and ₹2,200 crores for transmission projects. The outcomes of projects totalling almost ₹14,100 are still pending in these bids. The management’s current-year order target of ₹15,000 crores remains unchanged.

Strategic Partnership with Indigrid

GR Infraprojects’ management saw good opportunities in upcoming 7 power transmission projects with an approximate value of ₹10,000 Crores. As a result, the company identified certain projects worth ₹5,000 crores where it will be bidding jointly with IndiGrid Trust.

The management commented on this partnership, “So, with IndiGrid we have done some sort of partnership where we have identified certain projects where we will be having support both in terms of equity, as well as monitoring, as well as our guidance because IndiGrid is there into this business for last so many years where we will be continue to receive the guidance from or even capital also. So, such thing has been done, but it is not that we will do all the projects with IndiGrid only.”

Government’s Push For Infrastructure

The government has recently announced the budget for fiscal year 2023-24, with a continued emphasis on increasing infrastructure spending. These expenditures ought to accelerate India’s economic growth and open up new employment opportunities. The government has allocated nearly ₹10,00,000 crores for capital expenditures, a 33% increase over the budget from the previous year and 22% of the overall budget. With ₹4,98,000 crores, roads and railroads account for nearly 50% of this. The government has budgeted for capital expenditures totaling ₹2,58,000 crores for fiscal year 2023–24, a 37% increase over the previous year’s budget for the Ministry of Road, Transportation, and Highways. Along with roads, the Government is also fully committed to expand the railways network across the country.