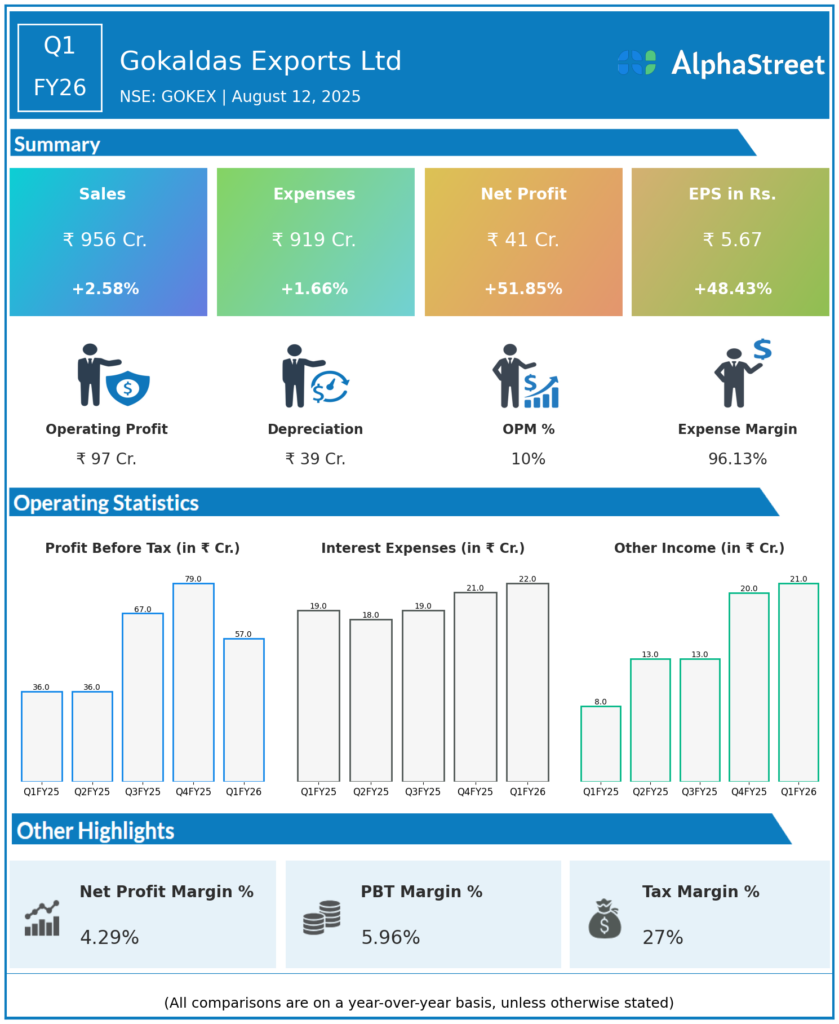

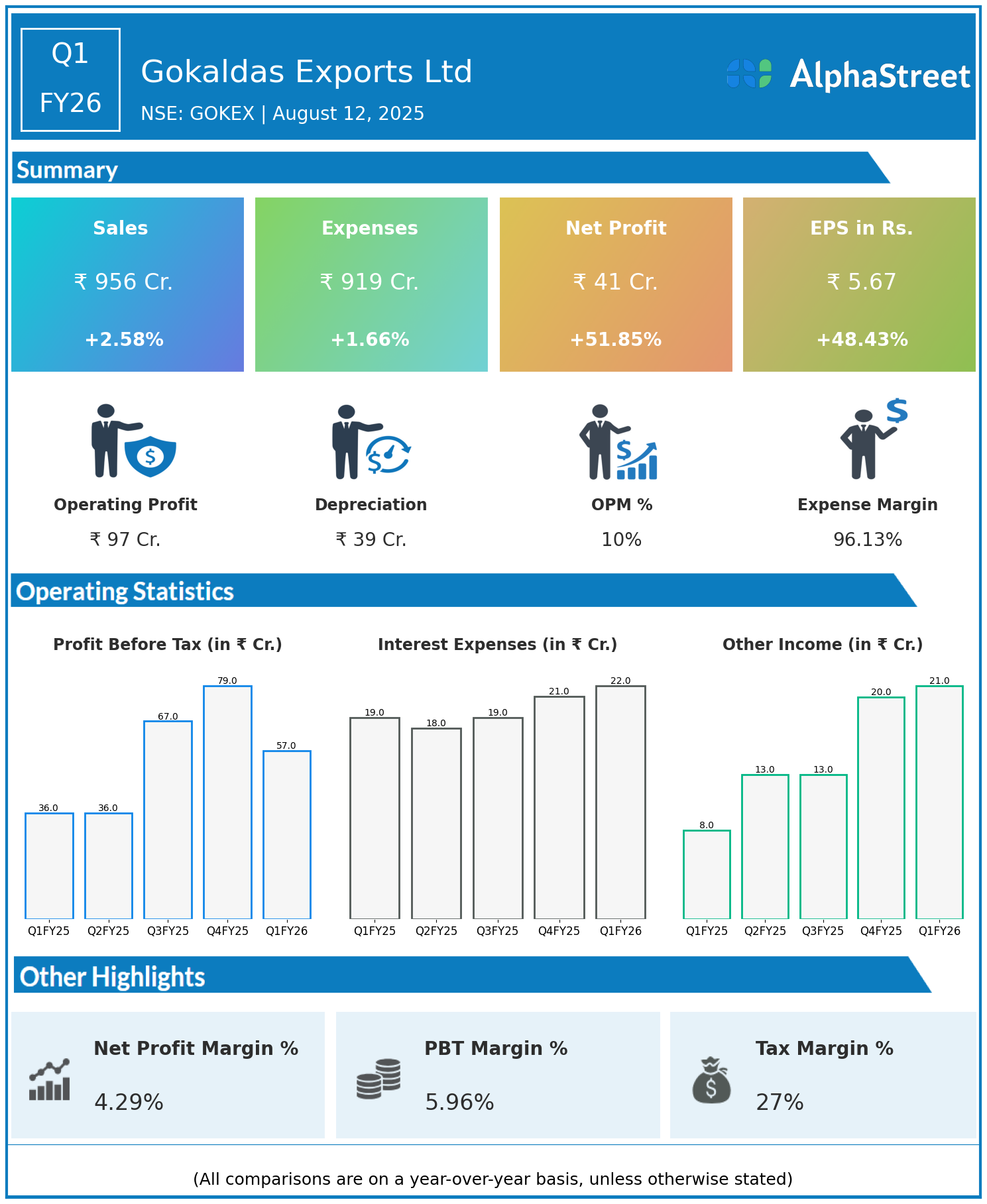

Gokaldas Exports Limited is engaged in the business of design, manufacture, and sale of a wide range of garments for men, women, and children, catering to several leading international fashion brands and retailers. Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

- Revenue: ₹956 crore, up 2.58% year-on-year (YoY) from ₹932 crore in Q1 FY25.

- Total Expenses: ₹919 crore, up 1.66% YoY from ₹904 crore.

- Consolidated Net Profit (PAT): ₹41 crore, up 51.85% from ₹27 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹5.67, up 48.43% from ₹3.82 YoY.

Operational & Strategic Update

- Modest Revenue Growth: The 2.6% rise in revenue reflects stable sales volumes and continued demand from global apparel clients, albeit in a challenging international market environment.

- Tight Cost Control: Expenses increased at a slower pace than revenue, indicating effective cost management and operational efficiency gains.

- Strong Profitability Surge: Net profit jumped nearly 52%, supported by improved margins, better capacity utilization, and an optimized product mix catering to higher-value segments.

- Global Market Position: The company continues to strengthen its relationships with large international brands, leveraging its design-to-delivery capabilities and sustainable manufacturing practices.

- Strategic Initiatives: Focus remains on diversifying the customer base, enhancing productivity through automation, and expanding value-added services to boost margins.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results highlight Gokaldas Exports Ltd’s ability to achieve significant profit growth despite modest top-line expansion. Margin improvement through operational efficiency and premium product offerings has been a key driver of performance.

Looking Ahead

Gokaldas Exports Ltd is well-positioned to benefit from global apparel outsourcing trends, supported by its strong client base, design expertise, and manufacturing scale. Strategic investments in technology, sustainability, and customer diversification are expected to drive long-term revenue growth, profitability, and shareholder value creation through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.