Godrej Properties Limited (GPL) is the real estate development arm of the Godrej Group, one of India’s most respected conglomerates established in 1897. Synonymous with innovation, sustainability, and excellence, Godrej Properties extends the strong legacy of the group by developing landmark residential, commercial, and township projects across India.

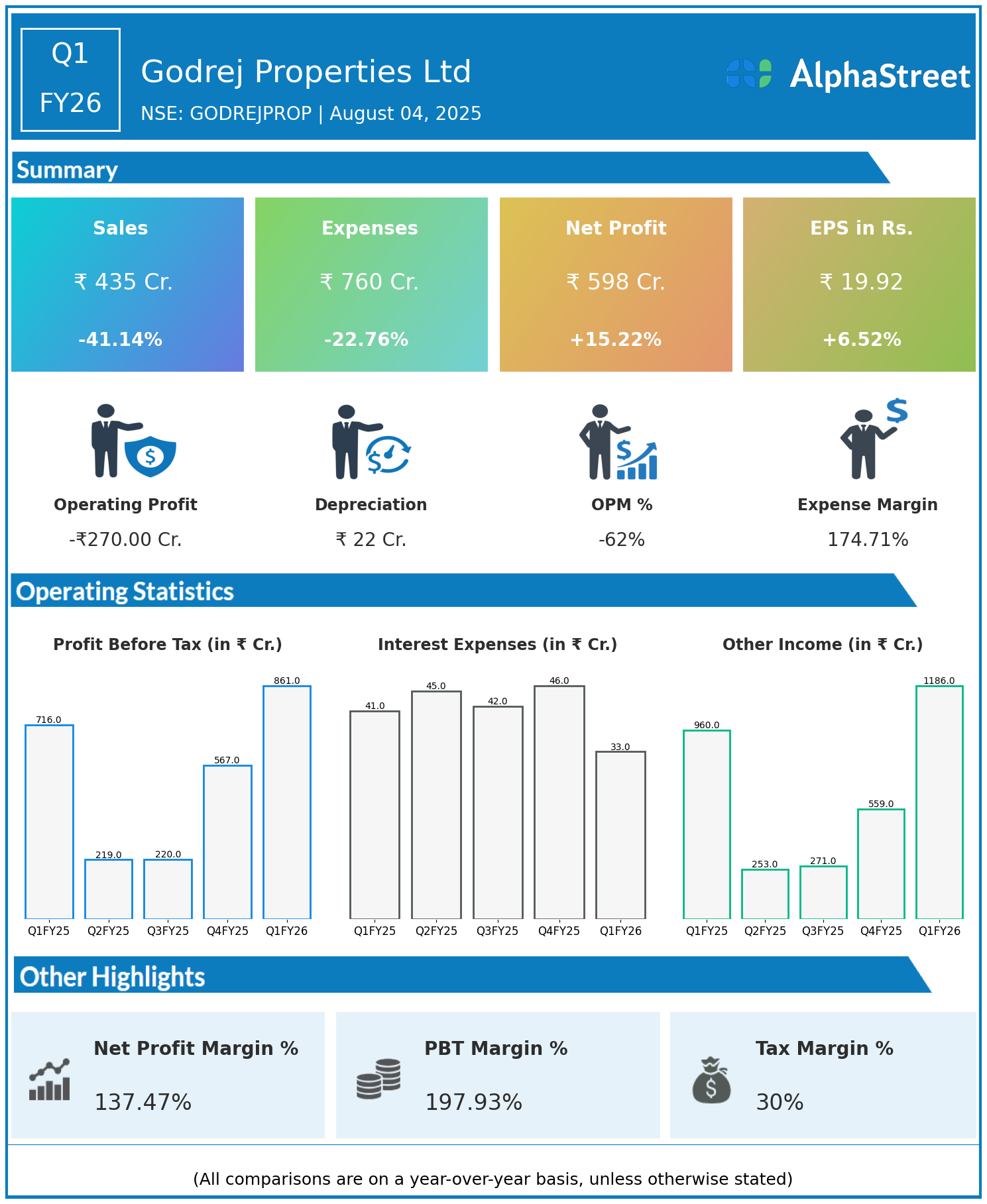

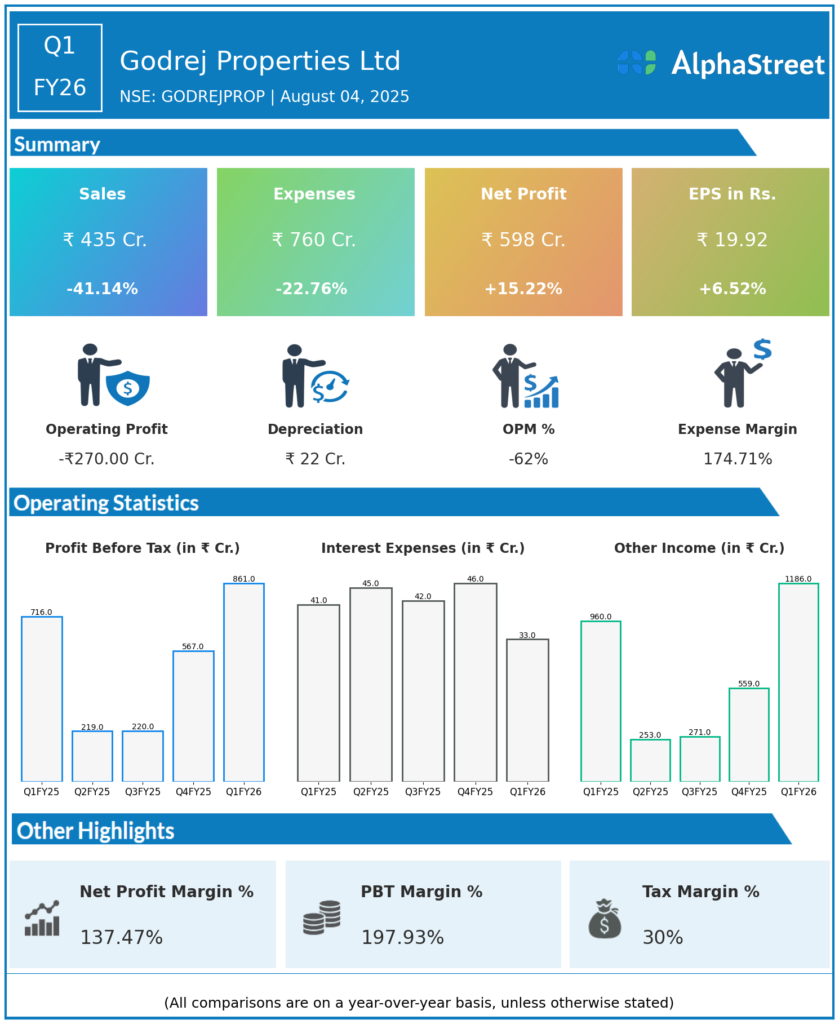

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹435 crore, down 41.14% year-on-year (YoY) from ₹739 crore in Q1 FY25.

- Total Expenses: ₹760 crore, down 22.76% YoY from ₹984 crore.

- Consolidated Net Profit (PAT): ₹598 crore, up 15.22% from ₹519 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹19.92, up 6.52% from ₹18.70 YoY.

Operational & Strategic Update

- Revenue Dynamics: The sharp revenue decline is primarily due to revenue recognition cycles in real estate, which depend on project completion milestones and handovers during the quarter.

- Expense Management: Despite the drop in expenses outpacing revenue decline, margins expanded, reflecting a more favorable mix, efficient project execution, and potentially increased contribution from high-margin projects or one-time gains.

- Robust Profitability: Net profit and EPS rose significantly even as revenues fell, highlighting successful cost controls, possibly the monetization of completed projects, or other income sources impacting the bottom line.

- Strategic Initiatives: Godrej Properties remains focused on building a scalable development pipeline, leveraging brand equity for sales velocity, and embedding sustainability and innovation in new projects.

- Market Position: The company continues to launch new projects in high-demand locations and maintains a solid reputation for timely delivery and quality, supporting customer trust and growth.

- Capital Efficiency: Strong profit expansion despite revenue volatility demonstrates robust financial discipline and effective management of working capital and financing costs.

Corporate Developments

Q1 FY26 was a unique quarter for Godrej Properties, with lower reported revenue but substantial growth in net profit, driven by favorable project mix, disciplined execution, and strategic monetization. The company’s consistent focus on operational efficiency, value-driven development, and project pipeline strength underpins its resilience.

Looking Ahead

Godrej Properties Ltd is poised to benefit from continued urbanization, strong housing demand in major cities, and increasing preference for branded, sustainable real estate. The company’s strategic land acquisitions, innovative project launches, and continued focus on cost management are expected to support sustained value creation and profitability momentum through FY26 and beyond.